Instantly total your Shopify data to enter on your existing Paper + Spark Seller Spreadsheet with our Shopify import add-on spreadsheet.

With this add-on, you can easily import your Shopify info and enter it over onto your main Seller Spreadsheet. Here's how the tool works:

- Import your Shopify CSV file into the import add-on spreadsheet file to instantly total your Shopify sales, refunds, shipping received, and sales tax collected

- Follow the step-by-step instructions to quickly find all the Shopify fees you need to record each month

- After tabulating these amounts, enter the totals over on your existing main Seller Spreadsheet. Now you can easily have ALL your business sales in one place, without having to manually figure out how to get your Shopify data.

The Shopify import add-on is designed to be used in conjunction with one of our Seller Spreadsheets.

A note before purchasing:

📌 If you currently use the PayPal Seller Spreadsheet, I generally don't recommend you use this import add on alongside it (or the PayPal import add on). You will end up importing in your Shopify PayPal sales twice.

The Shopify import add-on is NOT made to be used by itself. If you're a Shopify seller looking for a bookkeeping spreadsheet, see our Shopify Seller Spreadsheet. You do not need the Shopify import add-on if you already own or plan to buy the Shopify Seller Spreadsheet!

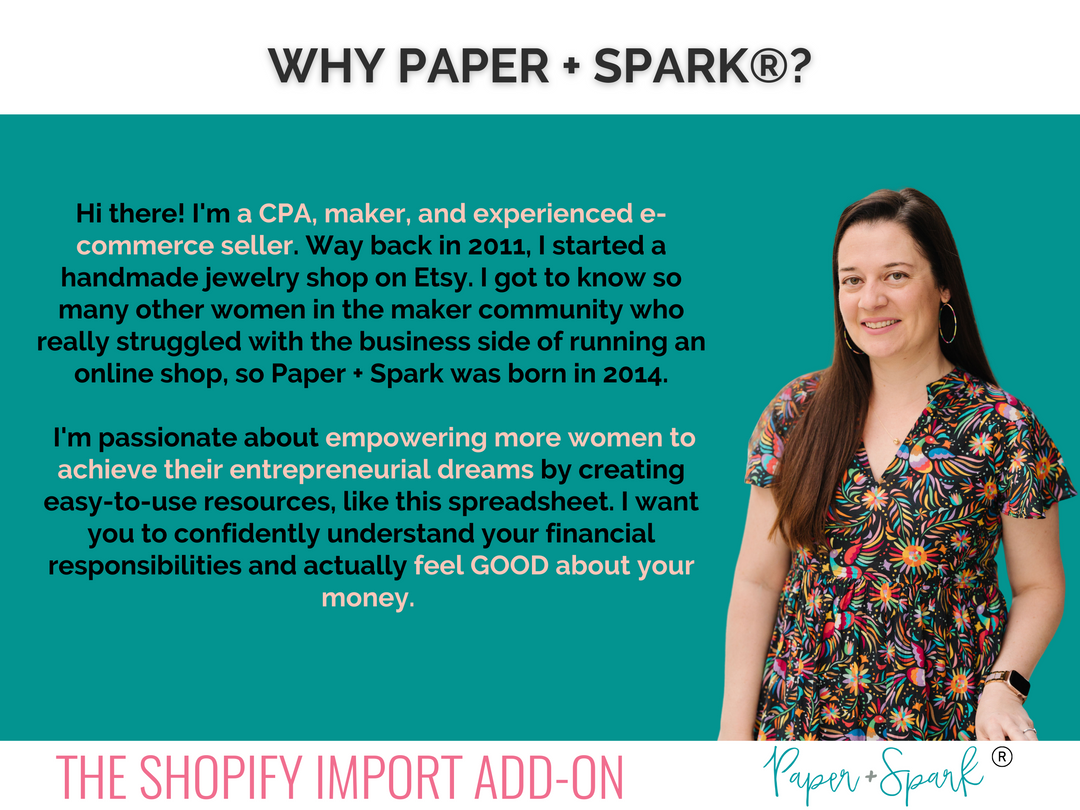

Why A Paper + Spark Spreadsheet?

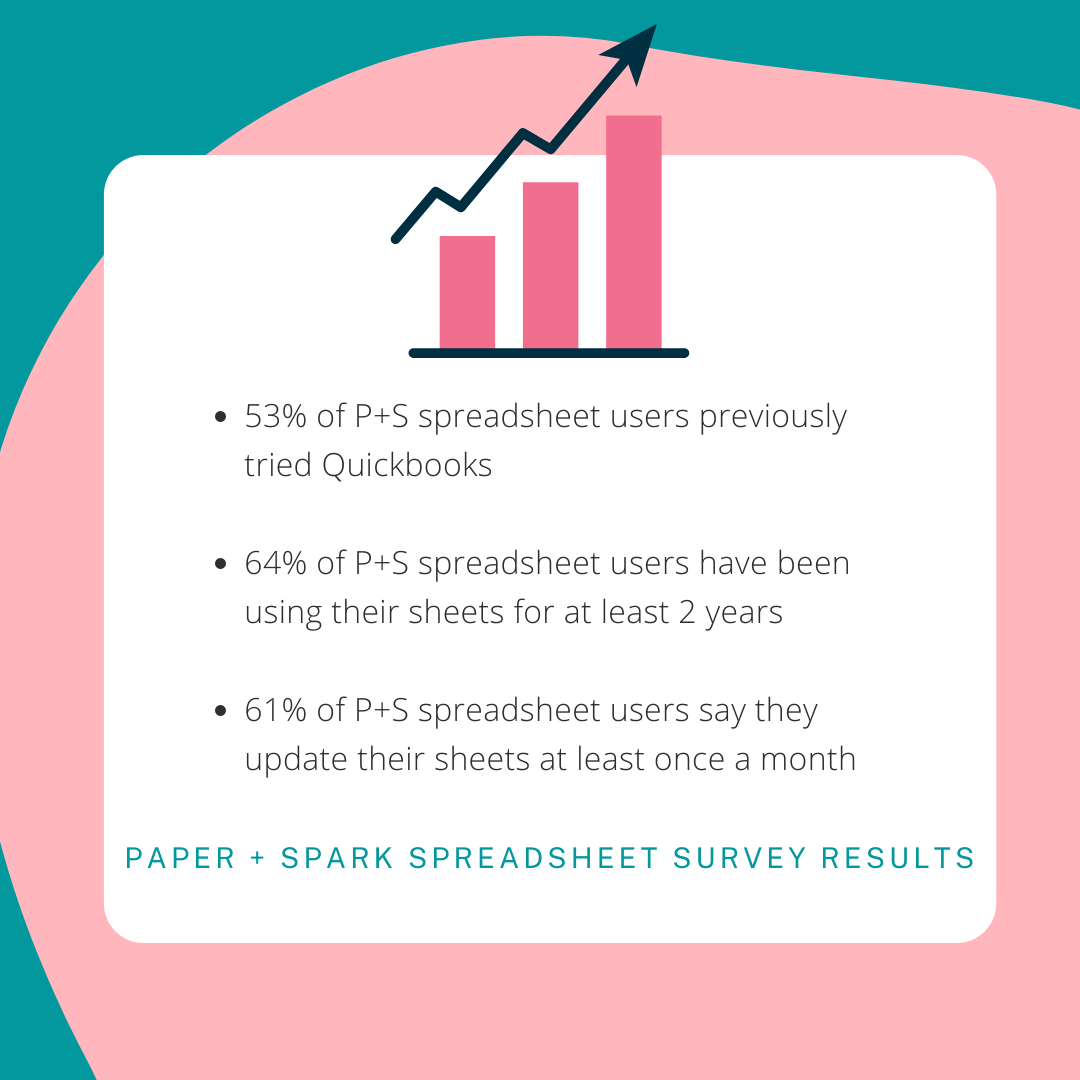

Traditional bookkeeping software is made with accountants in mind. It’s expensive (and generally requires a monthly subscription payment), bulky, and oftentimes more complicated than a micro business like yours needs. It’s made for any and all types of small businesses, and not specific to YOUR business needs as a handmade biz owner or e-commerce seller. When your bookkeeping software is too complicated, too vague, and support or in-plain-English instruction is lacking, you tend to procrastinate on using it. Not updating your books consistently means severe stress once year end or tax deadlines hit.

Spreadsheets are powerful but simple tools. Partner a well-crafted spreadsheet file designed by an accountant intimately acquainted with e-commerce with clear, understandable instructions and you’ve got a formula for bookkeeping success. You get everything you need to feel empowered by your numbers, and nothing you don’t need.

Paper + Spark has been selling spreadsheets since 2015. We currently support thousands of makers and creative entrepreneurs in doing their books and understanding their money. Our spreadsheets have received countless rave reviews from shop owners. No other bookkeeping solution out there offers our level of step-by-step guidance & support. We also stay up-to-date on e-commerce reporting and platform changes.

With a Paper + Spark spreadsheet, you’ll pay a one-time fee for lifetime access to your files and support. We provide any future year files and updates for free, forever, via the account you create at checkout. You can always reach out in the Accounting Accountability Club, or via DM or email, and get answers to your spreadsheet & bookkeeping questions.