Let’s discuss something I’ve seen lots of confusion about on the Etsy forums and out on the inter webs – your tax ID number…and what exactly it is.

Going into business and being a small biz owner opens up the door to a whole new confusing world. There are taxes. There are forms. To make things more complex, there might be federal taxes, state taxes, and local taxes. Sales taxes and income taxes. Sales tax permits, business licenses, DBA licenses, tax return forms, applications…the list goes on and on. (Speaking of lists, if you’re looking for a definitive one of what all you need to be doing to get your financial ducks in a row, check my free get legit checklist! ⬇️)

Often when you are registering for your business somewhere, filling out an application for a bank account, or doing some kind of business-related paperwork, you might be asked for your Business’ “tax number” or “tax ID”. Unfortunately, your “tax number” can be defined as several different things, and it’s important that you know what’s what before you 1) answer the form incorrectly, or 2) think you need to apply for some tax ID number or status when you don’t really need to.

Let me preface this discussion by saying that a lot of the answers here might vary based on the state you’re located in. This is especially true anytime we’re dealing with sales taxes, since those are levied on a state-by-state basis. Read more here.

Usually the answer is either your EIN or your sales tax ID number, so let’s cover those two items.

WHAT’S AN EIN?

An EIN, or “Employer Identification Number”, is an identification number assigned by the IRS to your business. Its original purpose is to assign ID numbers to employers. Lots of types of businesses can apply for and receive an EIN – huge corporations, partnerships, sole proprietorships, and also little tiny Etsy businesses. You can think of an EIN as the equivalent of a social security number, but for a non-living entity like a business.

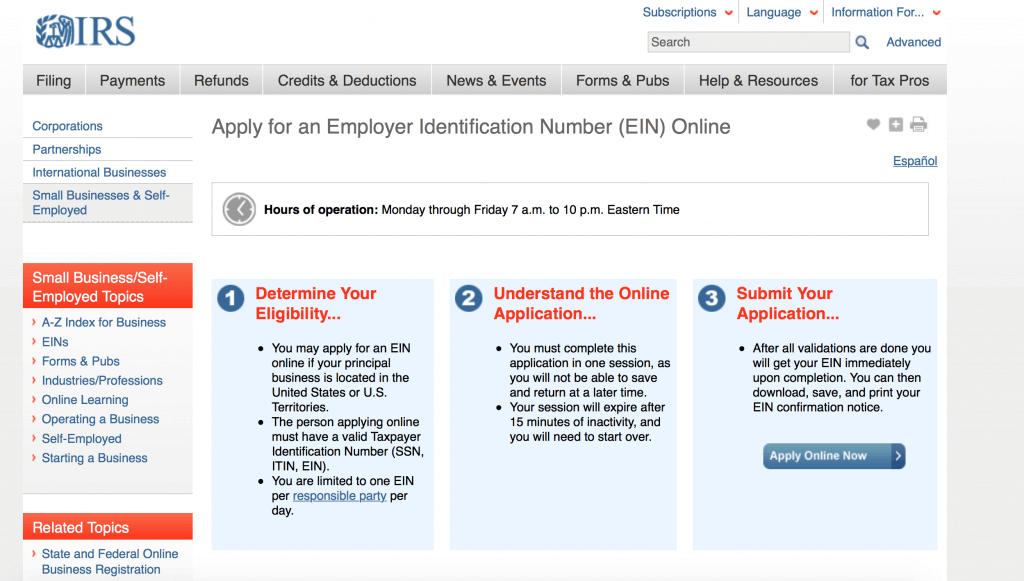

It’s super easy these days to apply for an EIN. You can do it via the IRS website here, and you’ll be issued your EIN immediately online.

why do i need an ein?

If you are operating your small biz as anything other than a sole proprietor or a partnership, as in, your business is a legally separate entity from you, then you need an EIN. Also, regardless of your business entity type, if you have employee, you need an EIN. See this handy questionnaire by the IRS to determine if you need an EIN.

If you are a sole proprietor or partnership, you report your business’ income taxes on your own personal business tax return. That means you are basically filing your business income under your social security number, since you = your business.

That being said, even if you are not required to get an EIN, you still have the option to get one. In today’s age of identity theft, a lot of sole proprietors and entrepreneurs will voluntarily apply for an EIN. In circumstances where they’re required to give a tax ID number (for paperwork or whatever other documentation), they can “protect” their social security number and use their business’ EIN instead.

Getting an EIN is free and can be done quickly online via the IRS website, so there’s really no downside to getting one, even if you don’t need one.

WHAT’S A SALES TAX ID NUMBER?

Before you start selling online (or begin any new business), you should apply for a sales tax permit in your state (assuming your state has sales tax, of course). Each state has their own rules and regulations regarding the collection and payment of sales taxes. In most states, you can apply online and the process is free and painless. Once you receive your permit, you should have it on display in your place of business, and always bring it with you to any craft shows or fairs.

why do i need a sales tax permit?

You can read more about how sales tax works here, but in general terms & depending on what you sell, getting a sales tax permit with your state is a requirement for doing business. Anytime you make a sale to a customer in your same state, you should be collecting sales tax. You then periodically remit this money to your state and/or local government.

Fortunately, being known to your state government has also got it’s perks. If you purchase business goods or supplies from a wholesale seller, you can usually provide your sales tax ID (to prove that you are a retailer), and you don’t have to pay sales taxes on your purchase. If you want to attend a trade show or shop at certain wholesale supply websites online, you might be asked for your sales tax ID number or to show your sales tax permit.

Your sales tax ID number can sometimes be referred to as your resale or reseller number. I live in Texas and have used my sales tax ID number from my sales tax permit for every craft show I’ve sold at, every trade show I’ve purchased supplies at, and every wholesale website I’ve purchased from for my business. However, another state-by-state caveat – some states issue separate wholesale account numbers that you might use in similar situations instead.

SO, WHY ALL THE CONFUSION?

A lot of times creative biz owners get confused when they’re filling out paperwork and asked for a tax ID number. For some reason, many people incorrectly assume this means EIN and frantically research how to apply for one. But in most situations, the paperwork is requesting your sales tax ID number from your sales tax permit. This ID number is usually needed to buy from wholesale suppliers, apply for craft shows, or apply for a DBA or business license.

I will add that in a few states, the state will issue you a sales tax ID number that is identical to your EIN, thus causing conflicting answers and confusion for everyone.

Just make sure to pay attention to what the paperwork or agency is actually asking you for. When in doubt, just ask!

All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

[…] handy to have on hand for saving money at wholesale shows and shopping for supplies. Check out our previous post about your tax ID for more info about […]

This was so super helpful, thank you!

Thank you so much for this post! It was very informative. I also live in Texas (just moved a couple of months ago) and have both my sales tax ID and EIN. I read a lot of articles that said sole proprietors don’t need an EIN but I don’t like using my SSN so I applied for one. I feel more at ease knowing that lots of sole proprietors have also applied for EIN.

Hi there!

Do you have a link to apply for a sales tax ID? Also I’m assuming you have to have an EIN before you can apply for sales tax is that correct?

Hi Molle, the link would be dependent on your state. I’d start by visiting your state’s department of revenue site and/or the state’s comptroller site. Some states require an EIN as well, and some do not.

I would like to get a tax ein

We don’t have sales tax in Oregon and no state sales tax ID is given when you register your business with the state. I have an EIN. How do I provide a state tax id number for purchasing wholesale or registering to go to market …. when they ask for state tax ID and EIN? I only have the EIN. Thanks for your help.

I need a sale Tex is number so I can open a paint and body shop

Thank You! This was very helpful.

Which states use a businesses federal id number and tax is number as the same number?

Excellent info given here…I was wondering if a Sales tax number or EIN number was needed in order to buy wholesale and attend trade shows…..thank you thank you thank you

Hello,

I had a similar question as someone else below. I grew up in Oregon and now live in Montana – neither state having a sales tax so I also was wondering what to do in regards to purchasing wholesale. I have tried to do so from a few different wholesalers and they say they can’t help me without a sales tax ID. I’m not sure where to turn now and could benefit from purchasing wholesale. Your help with this would be much appreciated. Thanks!

Great content! I was so confused over these terms, thanks for sharing:)

This was great information. Thank you

I don’t know if I still have a sale tax number

Very helpful information shared. I am looking for such content for so long. Well described with lots of information. Thanks for sharing this!

I’m so glad you found it helpful Lily!

Gracias!! this helped me a lot.

This article was very good

This is the most informative article I found on the web that answered all my daunting questions for the past week.

I just received my received my Sales Tax License and the number is the same as my EIN and really confused me. Thank you for clearing this up.

This is great info!! I have two questions I’m wondering if you can answer.

I sell only online. I live in Alabama but just moved here from Texas. A lot of my customers are in Texas. Is it true they I don’t need to charge sales tax unless they live in my current state?

The other question is, if you buy things tax free for your business, don’t you have to go back and pay that later anyway? I have never understood the point in doing that!

Hello, I live in Colorado, I started A small online business( dropshipping) ,please do I have to collect taxes?

To apply for sales tax ID number do I need to open a business account first?

Thank you, this was very helpful.

What is the big difference between a sales tax License Or ID number and an EIN number?

Sales tax license & tax ID – something given to you by your state when you register for your sales tax permit

EIN – something given to you by the IRS if you sign up for an EIN, use it in place of your SSN

You use these numbers for different purposes.

In some states, your EIN will be used on your sales tax license so the numbers are the same.

Thank you for clearing EIN an Sales and use tax permit up!!!