I previously discussed income taxes and how they relate to your e-commerce biz. Today, let’s talk about that other tax biggie – sales taxes. Getting sales tax set up for your shop is often one of the first “must dos” of setting up your biz. But a lot has changed over the past few years, making tackling sales tax complicated in 2025!

WHAT ARE SALES TAXES?

Sales tax is a tax that retailers charge to their customers (or the end user of a product) when they sell any product subject to sales tax to customers in any state in which their business has a “nexus”. (We’ll talk about what nexus means in a sec.) The retailer then holds onto that money and eventually pays (or “remits”) it over to their state government when due.

Let that marinate a minute. If you think about it, sales taxes don’t really need to be nearly as painful for you as your income taxes. Why? Because – if you’re doing it correctly- it’s just money in, money out. It’s not money out of your own pocket (or your business’ pocket) like income taxes. It’s money from your customer, that you hold onto for a little while, and then hand over to your state.

When I say “if you’re doing it correctly”, I mean “if you’re charging the proper customers the proper sales tax”. If you’re NOT charging your in-state customers sales taxes on their purchases from you when you should be, then you still owe those taxes to the government. The money just will come out of your pocket now. So make sure when you set up your online shop that you are charging sales tax to those in-state customers!

Remember that sales taxes are a state and/or local level tax, not a federal tax. There is no federal sales tax. Your rate will vary depending on what state, and even what town or county, you live in. For example, you might have a sales tax rate 6% for your state, and 2.5% for your county. A good place to start researching this info is to simply Google your state name + “sales tax”, or visit your state’s Department of Revenue website.

WHAT THE HECK IS “NEXUS”?

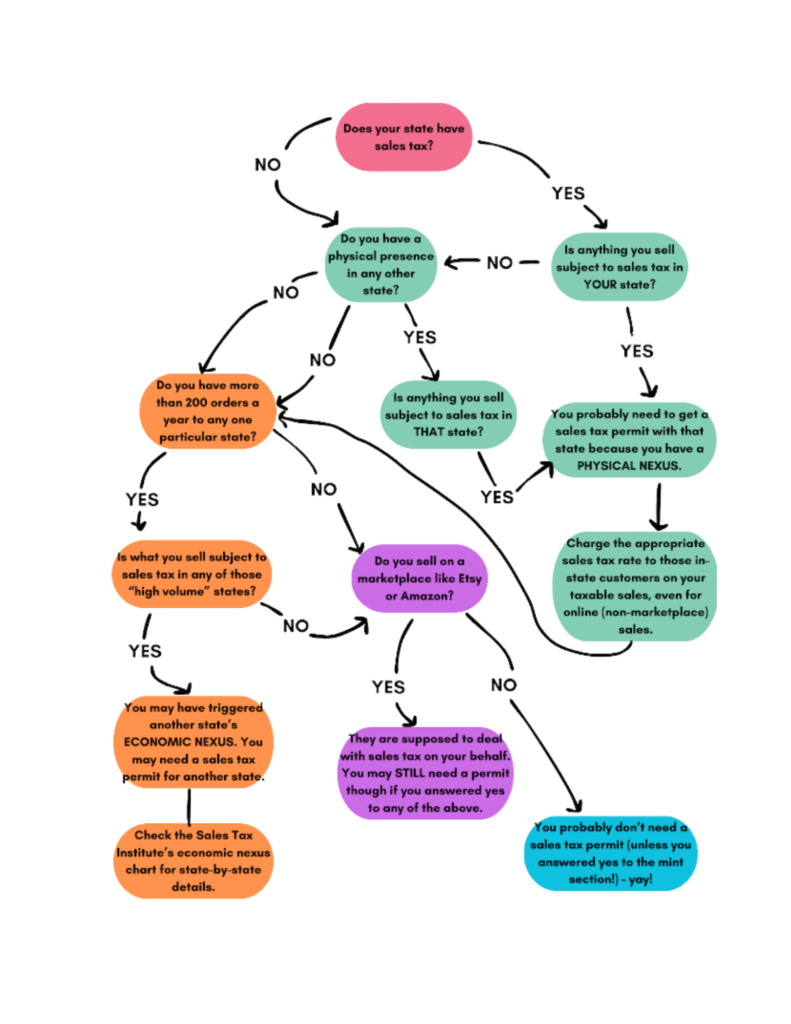

Sales tax rules basically all boil down to the nifty concept of “nexus”. Nexus means your little retail shop has a significant presence in a state, so much so that that state should get some revenue from the sales you make there. You are required to collect and then pay over sales taxes for any state in which you have a nexus.

First and foremost, you have a nexus in the state that you live in, because that’s where you work and you have a significant physical presence there. So it’s often safe to say that you should be charging and collecting sales taxes to all your in-state customers. How do you determine who an in-state customer is if you sell online? It’s usually based on their shipping address.

Now, things can get confusing with nexus. It IS possible to have nexus in other states, not just the one you live in. If you ever have a physical presence in another state, like maybe selling at a craft show out-of-state, you may have nexus there for those sales. If you have an out-of-state employee that does a lot of work for you in that other state, you might have nexus there as well. This whole “nexus” concept can lead to a state of confusion (haha, get it? my lame tax joke), so this is where I advise you to consult with a tax professional to make sure you’re doing things correctly.

MORE DEFINITIONS OF NEXUS

States have been working to get ecomm retailers on a level playing ground with brick & mortar retail shops, so in the past several years we’ve gotten updated definitions of nexus. One being a significant economic presence in another state. In general terms, each state now has an economic threshold and once you trigger it, you may need to deal with sales tax in that state as well, even without a physical presence. I have a whole blog post on this concept here.

There are also now marketplace facilitators that have to deal with sales tax on sellers’ behalves, and this sort of “overrides” your sales tax obligations, further muddying the waters. This is why you see platforms like Etsy dealing with sales tax for you. Again, I have an in-depth explanation of this in this blog post.

I have this (sort of?) handy flow chart that summarizes this to the best that such things can be summarized… 👇

I’M JUST AN ONLINE SHOP. DO I REALLY NEED TO DEAL WITH SALES TAX?

Yes! Don’t think that just because you don’t have a brick & mortar retail shop in your state or you aren’t selling at craft fairs that you aren’t subject to sales tax rules. Again, it varies by state, but generally it’s safe to assume that if you sell anything online, whether it be a mailed physical product or even a digital download, you are subject to sales tax rules.

If you’re an Etsy seller (or selling on any marketplace like eBay or Amazon), then know that that marketplace is required to deal with sales tax on your behalf.

→ I have more info on how marketplaces deal with sales tax online here.

→ And more info on how non-marketplace website platforms, like Shopify, deal with sales tax here.

If you are selling on your own non-marketplace website, like Shopify, you will need to set up your ecomm shop to properly charge the right customers the right sales tax rate. Google instructions for how to do that (start with “set up sales tax on ‘platform name'”).

Remember, whether your sales tax charge is “activated” usually depends on the shipping address of your customer. This is the data that will determine whether that customer is charged sales tax on the sale.

WHAT ELSE DO I NEED TO KNOW ABOUT SALES TAX?

Like I’ve said, sales taxes are a state issue, and every state has their own rules and regulations regarding sales tax. So, it’s difficult for me to sum everything up about sales tax in one nifty article because so much varies from state to state. It is your responsibility to determine what your state requires for your sales tax return. Here are some good questions to get you started:

- What sales tax rate(s) should you be charging your in-state customers? Once you know this number, you can set up your online shop to charge customers accordingly.

- Is your state a destination-based or origin-based state when it comes to charging sales tax? A simple Google search will answer this question for you.

- Are all of the goods you sell subject to sales tax? Make sure to check your state’s policy on services and digital goods if these items apply to you.

- Does your state charge sales tax on shipping? This is important to know and often overlooked!

- How often are you required to remit sales taxes? Each state has different requirementsfor filing monthly, quarterly, semiannually, or annually.

HOW DO I PAY MY SALES TAXES?

One of the first things you should do when you open up a retail business is get your state sales tax permit. This process is usually easy and painless, and in most states, free.

Having a sales tax permit is not only the legal thing to do, but it’s handy to have on hand for saving money at wholesale shows and shopping for supplies. Check out our previous post about your tax ID for more info about this.

The requirements for filing and reporting your sales taxes will again vary by state. Generally, you will owe sales taxes to your state government on a monthly, quarterly, or annual basis. Most states require you to file a return even if you have no sales tax to pay.

The forms usually require only a minimum of information, such as your total revenue and your total in-state revenue for the applicable time range. Your total in-state revenue will be the number that you should’ve already collected sales tax on and that you now owe to the government.

You should track the amount of sales tax you collect over the course of the month, quarter, or year (depending on how often you have to file). In your head at least, you need to set this money aside. It’s in your bank account, but when it’s time to file, you are remitting it over to the government, so it’s not really yours to spend!

IS THERE AN EASY WAY TO TRACK MY SALES TAXES?

Our best-selling Seller Spreadsheets have special areas dedicated to tabulating the sales taxes you collect on your sales. More importantly, they also totals your in-state sales each month, giving you exactly what you need to fill out your state’s sales tax form when the time comes. They will total your sales both with and without shipping, so regardless of what your state requires, you have the total you need on hand!

NEED A MORE IN-DEPTH GUIDE TO SALES TAX? CHECK OUT THE Get Legit Toolkit®

I share more details about this program in the free workshop below 👇

All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

[…] Let me preface this discussion by saying that a lot of the answers here might vary based on the state you’re located in. This is especially true anytime we’re dealing with sales taxes, since those are levied on a state-by-state basis. Read more here. […]

[…] offices and call your county or town clerk to see if you need a business license and obtain a resale tax number. If you’re planning on selling at out-of-state shows, contact the state and find out what you […]

Sales tax, rates, rules, and product taxability change frequently at the state, and in some cases local, level. Though tax authorities do their best to disseminate information to taxpayers, the burden of keeping informed and complying with new rates and regulations falls squarely on the shoulders of the seller. If you make a mistake, even due to ignorance, you’ll likely pay the price.

If I am selling on Etsy, do I need to add the sales tax for all 50 states? Or just the ones where I have economic nexus (my own state and the state that I’m manufacturing from)?

Hi! I love the info you offer shop owners like me! Can you help me understand sales tax exemptions and wholesale orders? Is there ever a a time when I would not charge sales tax on a wholesale order?

Ms. LeBlanc,

Can you “reactivate” a sales tax accpunt? I had a craft business a couple of years ago. Naturally, life got in the way and I wasn’t making any sales but I didn’t close my business. I knew this was a temporary setback and I wanted to get back up and running as soon as I could. Anyway, my sales tax account was closed due to inactivity for a year. I want to get back to working my business in a couple of weeks so can I reopen my account?

Janet, I sell exclusively on Etsy and really love the Etsy seller spreadsheet. 100% of my sales are online. I’m confused about this, though. Isn’t Etsy collecting and remitting taxes for all of the United States now? Why do I need to manually adjust it? And if I adjust it, do I adjust it to match only the zip code I’m in? I’m not understanding. Will you please clarify? Thank you.

[…] Let me preface this discussion by saying that a lot of the answers here might vary based on the state you’re located in. This is especially true anytime we’re dealing with sales taxes, since those are levied on a state-by-state basis. Read more here. […]

[…] offices and call your county or town clerk to see if you need a business license and obtain a resale tax number. If you’re planning on selling at out-of-state shows, contact the state and find out what you […]

Sales tax, rates, rules, and product taxability change frequently at the state, and in some cases local, level. Though tax authorities do their best to disseminate information to taxpayers, the burden of keeping informed and complying with new rates and regulations falls squarely on the shoulders of the seller. If you make a mistake, even due to ignorance, you’ll likely pay the price.

If I am selling on Etsy, do I need to add the sales tax for all 50 states? Or just the ones where I have economic nexus (my own state and the state that I’m manufacturing from)?

Hi! I love the info you offer shop owners like me! Can you help me understand sales tax exemptions and wholesale orders? Is there ever a a time when I would not charge sales tax on a wholesale order?

Ms. LeBlanc,

Can you “reactivate” a sales tax accpunt? I had a craft business a couple of years ago. Naturally, life got in the way and I wasn’t making any sales but I didn’t close my business. I knew this was a temporary setback and I wanted to get back up and running as soon as I could. Anyway, my sales tax account was closed due to inactivity for a year. I want to get back to working my business in a couple of weeks so can I reopen my account?