In this guide, I’m walking through the various fees Etsy charges sellers.

I’m not trying to express any *judgement* on these fees (there’s enough of that elsewhere on the interwebs). As a financial educator that works with many Etsy sellers, I see a lot of shop owners (both new and experienced) who are not fully aware of ALL the fees they are subject to when selling on Etsy.

Not knowing all the fees you’re paying is an issue for two reasons. First, I’ve seen some sellers miss out on claiming all these fees as deductions at tax time! I don’t want you to miss out on these valuable tax deductions – so make sure you understand all the fees and where to find them.

Second, it’s vital you understand all the fees Etsy charges you so you can price your products appropriately. Otherwise, these fees will quickly eat up a big chunk of your profit margin.

an explanation of etsy fees

1. listing fees

These are the most self-explanatory fees Etsy charges you. You’ll pay $.20 (USD) when you list an item in your shop, and $.20 every time you renew it (including if it auto-renews after selling).

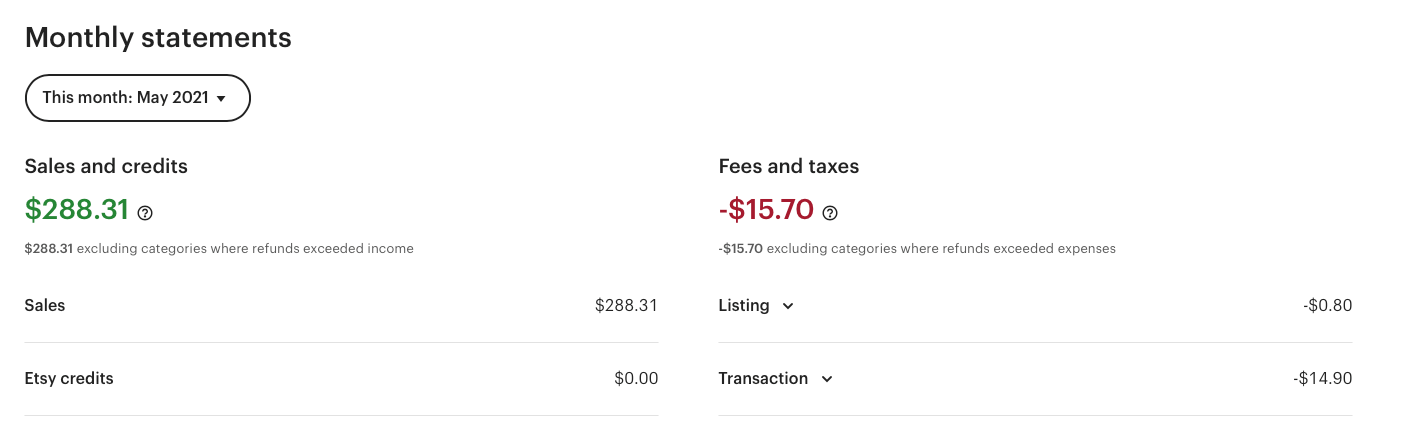

🔎 Where you can find them: On your payment account screen, under Finances > Payment Account > Monthly Statements. You can also find them on the CSV that you can only download on this screen – the payment fees CSV, which you can download from the monthly statement area of your Finance section.

2. transaction fees

I like to think of this as Etsy’s commission on your sale. It’s the cut they take for the honor of selling on their platform. 😁 The transaction fee is 6.5% of your gross sale (recently increased from 5% in April 2022), meaning it’s 6.5% of the item’s sales price plus any shipping & gift wrap you charge your customer. The 6.5% is not applied to any marketplace sales tax your customer is charged.

I see a lot of sellers get tripped up on that last bit – Etsy will charge a 6.5% transaction fee on any shipping your customer pays you. When looking at your payment account activity, this often shows up as a separate transaction fee than the 6.5% of the sales price.

🔎 Where you can find them: On your payment account screen, under Finances > Payment Account > Monthly Statements. The only CSV you will find them on is the payment fees CSV you can download from the monthly statement area of your Finance section.

3. credit card processing fees

This is the fee Etsy charges you for processing your customer payments. It’s pretty standard for all third party payment processors (PayPal, Stripe, Square, etc.) to charge you a processing fee, and Etsy is no different. US sellers will pay 3% + $.25 per transaction; international sellers have similar rates. This rate is also applied to your gross sale total, including any shipping & sales tax collected.

This fee seems to be the one that Etsy sellers miss the most; I assume it’s because Etsy makes it rather difficult to find. It’s missing from the “Fees and Taxes” section of your Payment Account screen (the red number in my screenshot above). In fact, the green amount showing as your total sales under “Sales & Credits” is actually with your CC processing fees subtracted out of it already (so be careful with that number – it’s not actually your gross sales!). Note that Etsy finally changed this in early 2022! You should now be able to see this fee broken out separately on your fees screen.

🔎 Where you can find them: The best place to find your CC processing fees is on your Orders CSV, which is found under Settings > Options > Download Data. You can also see it as the “sales fee” on your fees CSV, which can only be downloaded from your Payment Account screen. 🤯🤯🤯

I connected my Square account to Etsy to accept my credit card payments. I didn’t realize that my in-person sales would count towards my shop sales, which is amazing! I also didn’t realize I would be charged a .20 listing fee for every sale either. I’m deciding if the trade-off of paying a .20 listing fee is worth the extra exposer that Etsy seems to be giving me for having an active shop. I’m telling myself it’s probably equivalent to buying etsy ads.

This was very helpful. Explaining the gross sales in green was a great advice item. Do you have any example sales to show a break down of these fees and end profit vs beginning price. To show how fees affect profit?