All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. Please read my full disclaimer regarding this topic.

If you’re setting up shop (or even if you’ve been selling for a while), you’ve probably found yourself wondering about separating your personal funds from your business funds (getting a business bank account!). This is a frequently repeated “must do” on the generic checklist of setting up a business – but a lot of us still skip over it or avoid it because we don’t really understand why it’s even necessary. So today, we’re going to discuss just that – why you should separate and your business stuff from your personal stuff, and how to actually go about doing it.

“Open up a business bank account,” they say. “Make sure to keep your business money separate from your personal money,” they say.

And you’re like…Open up a business bank account…sure, with what money?!

When you’re just getting settled with the whole “creative entrepreneur” thing, chances are you feel like you can’t afford opening up an entirely separate business checking account (minimums, fees… my shop’s not even making sales yet?!). So you tell yourself you’ll just keep really good track of things for now, and when the funds materialize, maybe you’ll switch over.

I’m hoping today I can convince you why it’s a “best business practice” to separate your business funds from your personal funds ASAP, and that it doesn’t have to be hard or expensive (with the help of a trusty little bank account cheat sheet freebie I’ve got for you!).

BETTER FOR BOOKKEEPING & TAXES

The first step in setting up a solid financial foundation (and a decent bookkeeping system) for your creative business is to separate your business funds from your personal funds.

Assuming you’re operating as a sole proprietor (and you aren’t an LLC!), there actually isn’t really anything against the “rules” about using your personal checking account for your business. However, having a separate bank account will make things a lot easier for record-keeping purposes and reduce your chances of making costly errors, not to mention it’s pretty much a no-brainer for tax purposes.

Keeping your business separate from your personal basically keeps your funds from being “commingled” for tax and bookkeeping purposes. Commingled is a fancy way of saying “mixed up all together”.

If you have everything coming in and out of one account, that’s a bookkeeping nightmare. Each month (assuming you are actually doing your bookkeeping *wink wink*), you will need to go through each and every transaction and ask yourself – business or personal? – before recording it in your business books. That’s time-consuming and using up energy you’d be better off using elsewhere!

Commingled funds are an even bigger headache for tax purposes. If you are ever lucky enough to be audited, the tax man then gets to go through each and every transaction and ask YOU – business or personal? – and it’s going to be a lot of fun to convince them that your Hobby Lobby run was indeed business.

GETTING A BUSINESS BANK ACCOUNT KEEPS YOUR PERSONAL FUNDS OUT OF THE PICTURE AND LEGITIMIZES YOUR BUSINESS.

Having a separate bank account designated for your business prevents these problems. It also shows the IRS (or applicable government body) that you are indeed treating your business as a business and taking it seriously – which always helps in case of an audit.

ACCEPTING CHECKS IN YOUR BUSINESS NAME

Another perk of having a separate bank account (and specifically, a business bank account) is that you can accept checks made out to your business name. If you do most of your business online this may not be relevant, but if you sell at local shows or via consignment shops, you might get checks made out to your business from time to time. Nothing is more frustrating than getting PAID but not being able to cash a check since it’s not made out to your legal name!

Having a separate account also allows you to have a debit and/or credit card linked to just your business. This is great for going on supply or post office runs when you want to pay an expense directly out of your business funds.

EASY TO CHECK IN ON THE FINANCIAL HEALTH OF YOUR BIZ

You can also keep easier tabs on the overall financial health of your business simply by checking your business bank account balance. If everything is lumped together, it’s really hard to know if your business is really profitable since you can’t see a positive bank account balance at a glance. Plus you may unintentionally start dipping into your personal money to fund your business.

How to find a business bank account that fits your needs

Opening a new bank account can require some research on your part. Some banks require minimum balances, fees to open the account, and/or transaction limits. Proper planning can eliminate many of the unnecessary costs.

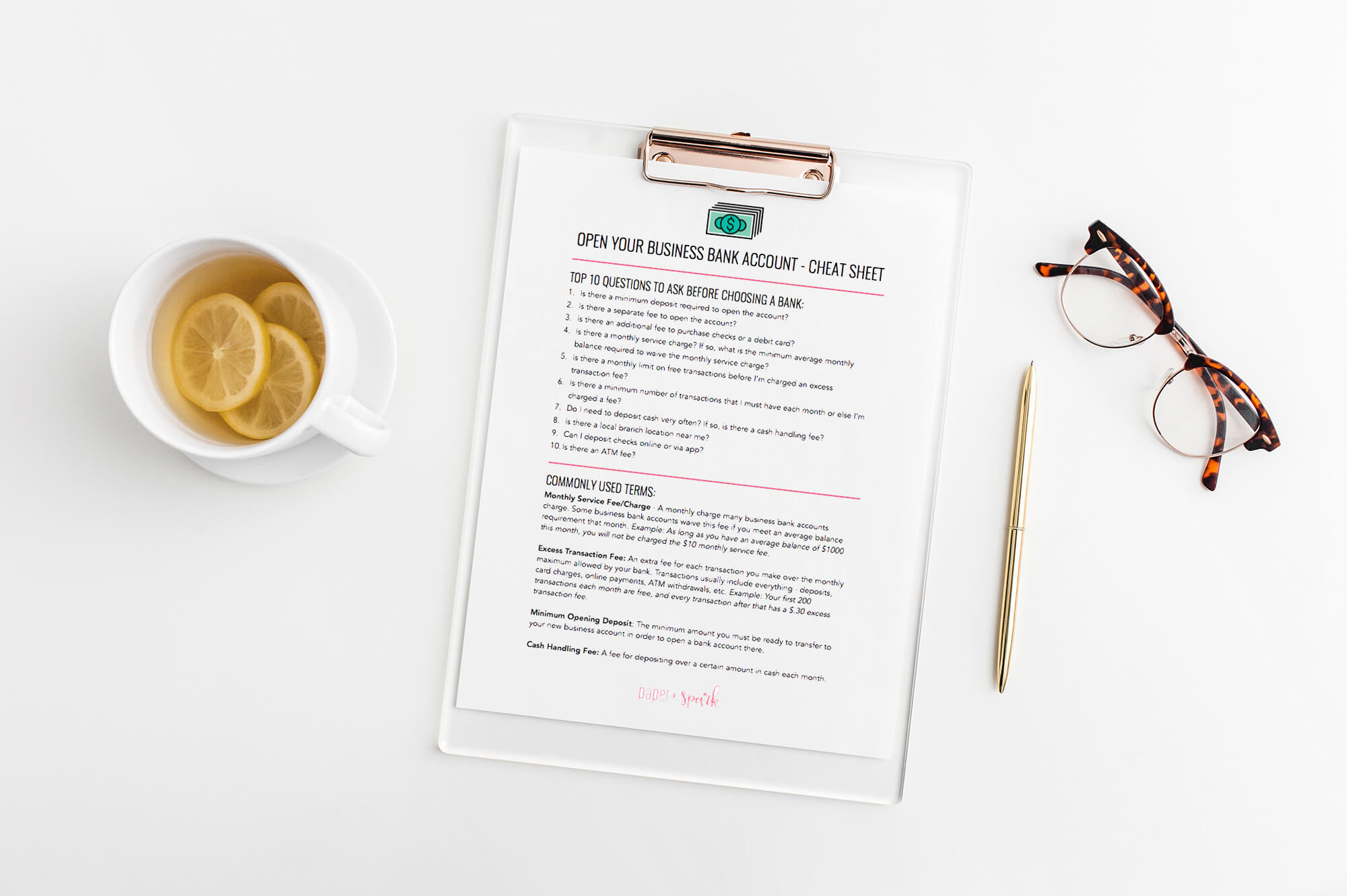

First you need to get to know the playing field. It’s hard to compare pros and cons of different banks if you don’t understand the terminology. That’s why I’ve got a handy one-page cheat sheet for you. This cheat sheet defines commonly used terms in the bank industry so you can know what’s what while you do your research.

To help you find a bank home that best fits your needs, the cheat sheet also includes the top 10 questions you should ask before choosing a bank for your biz. This questionnaire guides you through ALL the issues you should consider so you don’t end up any unexpected expenses or issues later on.

[…] Set up a business bank account, and, if you can do it, a business credit card. Keep your business and personal information as separate as possible. You’ll even want to consider a business cell phone, although that means you might have to carry around two phones at times. […]

[…] I totally get that this is sometimes hard to do when you’re just setting up shop, but getting those funds separate as soon as you can afford to do so is essential for good bookkeeping practices. It’s also important in case you ever have a tax audit. I’ve got more info on how to go about setting up a separate bank account for your biz here. […]

[…] Get organized by setting up a separate bank account for your new business. If you do this from the beginning, it will truly make things easier in the long run when it comes to bookkeeping and taxes. It’s really easy to do – you can read more about this here and here. […]

If I am only going to be selling on Etsy, would it be okay to just open a separate personal bank account instead of a business bank account? I don’t need to receive checks in my business name, so I don’t need that ability. Is there another reason to open a business bank account rather than a separate personal bank account? Thanks!

I am wondering the same thing. Did you get a reply to your question? What did you decided to do?

The issue with doing things this way is that you still risk violating federal banking regulations. For the most part, it’s against banking regs to run a business activity out of a personal checking account. So some banks may let you do this (knowingly or unknowingly) but it could still put you at risk.

Good advise