If you just got a 1099 form in the mail and you’re not sure what to do with it, stay tuned – I’m gonna explain exactly what’s going on!

CHANGES TO 1099K FORMS IN 2022 & 2023….AND 2024

Let’s chat 1099 forms! You may have gotten this form in the mail or in your inbox recently. You might be seeing this form this year for the first time and be like – what the heck is this?!

You might’ve been hearing rumblings about the IRS changing some rules about who needs to receive a 1099 form this year.

I’ve seen frantic FB posts from people saying things like “now my eBay sales are reportable!” or “now my FB marketplace sales are taxable!” or “they’re taxing my PayPal stuff next year!” etc.

Real truth y’all – that stuff was always subject to tax. Let’s get to the facts behind this particular topic.

The rules regarding 1099s have recently changed, but before I dive into that – let me explain exactly just WHAT a 1099 form is.

There are different types of 1099 forms, and in this post I’m explaining the 1099K form specifically.

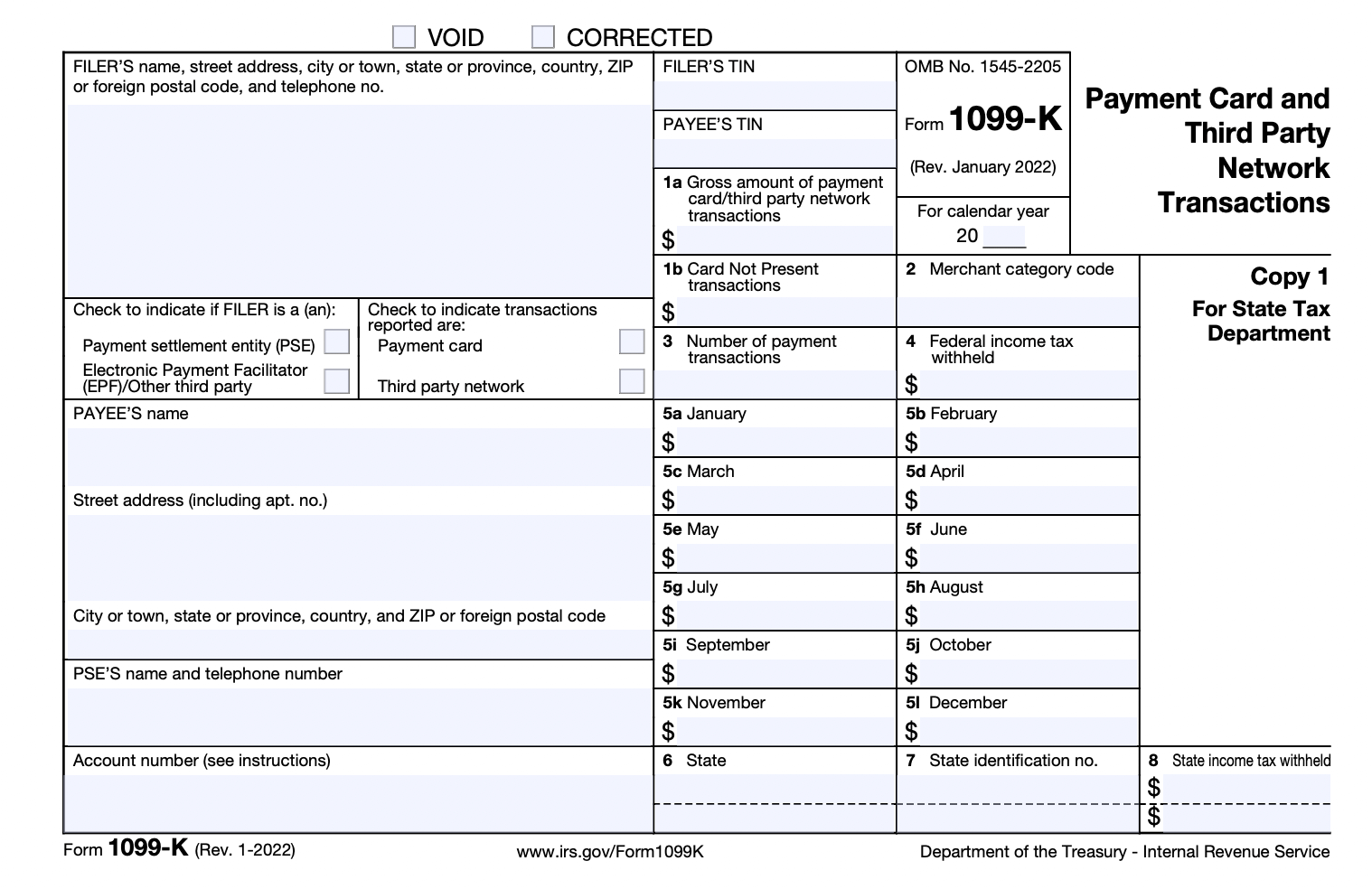

A 1099K is an informational form that third party payment processors are required to send to you if you received payments from them from processing payments on your behalf.

These are payment processors like Etsy, PayPal, Stripe, Shopify, Amazon, etc. All of these e-commerce platforms are payment processors accepting & processing payment on your behalf, then sending that payment over to you.

Read about 1099K forms directly from the IRS website here.

WHAT GOES ON A 1099K FORM?

The payment processor reports how much gross revenue (that means TOTAL sales before any fees are subtracted out) they processed on your behalf on this form. That’s literally all that’s on it – your total sales on that platform.

The payment processor ALSO sends a copy of your 1099K to the IRS. Like I said – it’s an informational form. It’s giving a heads’ up to the IRS (internal revenue service) that you (or really your business) should be reporting at least that much in revenue on your tax form somewhere.

So basically – It’s NOT a form that says, “hey now your stuff is subject to tax”. Instead, it’s just a form that says “Janet made $15,000 on Etsy this year. IRS – be on the lookout for Janet to report at least $15k on her taxes.”

So that’s all this form really is – your total sales from that platform. One for you, one for the IRS.

WHO RECEIVES A 1099K FORM?

Prior to 2024, the IRS only required payment processors to send you a 1099K if you made $20,000 or more on their platform.

For tax years 2024 and onward, the IRS has dramatically lowered that threshold to $5,000 in 2024 and $600 for years 2025 and on – meaning more people will be getting this form in the mail in early 2025 (for the 2024 tax year) and then tons more come early 2026 (for the 2025 tax year).

Now there’s been a lot of complications with these thresholds. The $600 one was supposed to go into effect for the 2022 tax year, then delayed to 2023, and then delayed again to 2024. So stay tuned!

Also I will note – it’s totally possible to receive one of these forms even with gross sales under the current threshold. One reason being that some states already have adopted the $600 threshold. If you receive one and didn’t hit the threshold, that’s not a big deal! Keep reading.

WHY DID THEY LOWER THE 1099 FORM THRESHOLD?

In our newer “gig economy” where freelancing and self-employment is dramatically on the rise, the IRS felt – probably correctly – that too many of us are not reporting all our income. So lowering the threshold to receive a 1099K means that more of us are getting notified of our revenue, and the IRS is getting notified to look out that we report it correctly.

WHAT DOES THIS CHANGE MEAN FOR YOU?

Now I want to make this clear – contrary to what some people on the internet are saying, the tax rules didn’t actually change. Things that were NOT previously subject to tax are not NOW suddenly taxable.

That money you were making online was ALWAYS subject to tax. You should’ve ALWAYS been reporting it somewhere on your tax forms – whether you made $600, $5000 or $25,000.

The only thing that changed was who would receive this informational form. The IRS is hoping that by reducing that threshold, tax compliance & reporting will improve (and thus they’ll get more tax money).

SO WHAT DO I ACTUALLY NEED TO DO, JANET?

The end goal to be compliant is to make sure the money reported on any 1099Ks you receive is included in your gross revenue on your taxes.

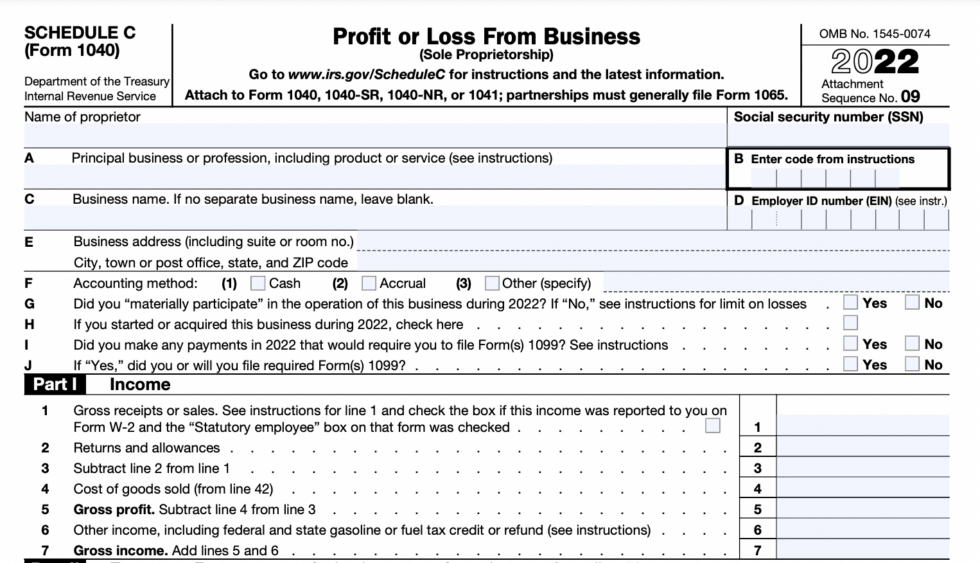

Most of us are probably filling out a Schedule C form for taxes (or should be) – this is where you report your business sales and expenses if you’re a sole proprietor or a single member LLC.

If you need to learn more about the Schedule C, this is a great place to start.

If you look at Line 1 of the Schedule C, this is where you report your gross revenue. Assuming your 1099Ks are all related to your business, the amount here should be equal to or greater than the sum of all the 1099Ks you receive this year. If this amount is LESS than your 1099Ks, that will be a red flag to the IRS that you aren’t reporting all of your revenue.

Now don’t be alarmed – this is you reporting your GROSS sales. That’s not what you pay taxes on. You still get to reduce your revenue by your business deductions or expenses to calculate your NET profit, which is the number that really matters when it comes to paying taxes!

KEEP UP WITH YOUR BOOKS

It’s important to make sure you are still recording your sales & expense transactions in a bookkeeping system. Don’t think that just because these platforms are sending you 1099K tax forms at year end that doesn’t mean you don’t have to keep track of your numbers yourself.

First – remember the 1099Ks will not include any of the fees or expenses you pay over to that platform all year. You need to be tracking those yourself so you know how much to deduct at year end. Those are things like shipping labels, sales tax paid, processing fees, advertising fees, transaction fees, etc.

Second – you want to make sure you’re recording your sales in your bookkeeping system so you can reconcile or MATCH to the 1099Ks you receive. 1099Ks aren’t always correct! There have been many instances where platforms send out inaccurate 1099Ks and they need to amend. The only way you’ll know is if you’re keeping track of your own books.

NEED HELP WITH THIS?

If you weren’t prepared to report those sales or file taxes for your online shop, now is the time to get to speed on those requirements. Receiving a 1099K for the first time will likely mean a lot of sellers are scrambling to figure out their bigger tax picture for the first time, to make sure they’re doing things properly.

I’ve got several resources to help you get settled!

💻 Bookkeeping templates to help you track your sales and expenses

💰 A free workshop all about your tax responsibilities as an online seller

📖 The Bite-Sized Bookkeeping Bootcamp course if you need step-by-step help getting caught up on your books & ready for the tax deadline (this course is seasonal and only available December through February each year)