Today we’re going to meet a very tricky guy (I feel like it’s safe to assume that all tax-related things are male, yes?), the Schedule C. The Schedule C seems to pop up around this time every year, and he can get a little confusing. So, let’s take things nice and slow, and I’m going to walk you through an easy introduction.

First, some links for you to bookmark:

- Here is the Schedule C in PDF form. Print it. Get friendly.

- Here are the PDF instructions for the Schedule C. He’s got a lot of baggage, but it’s very important baggage.

- Here’s a list of other helpful IRS publications relating to the finer points of the Schedule C. This list includes Pub 334 (Tax Guide for Small Businesses) and Pub 535 (Business Expenses); they cover most of the deductions you’ll find on the Schedule C. These are great resources if you have questions about specific transactions or situations that pop up as you’re filing your taxes.

Prefer to watch a video explanation of this? Check out my video here. If you’d rather read, keep scrolling!

If you operate as a sole proprietor, or another business entity type that is essentially taxed like a sole proprietor, then the Schedule C is basically your business’ tax return form. You will file it alongside you or your family’s personal 1040 tax return.

Whether or not you outsource your tax prep, it’s still super important to be familiar with this form. The better you understand it, the better you can keep track throughout the year of the things that will go on it, and being prepared is key.

Hello! A Schedule C Overview

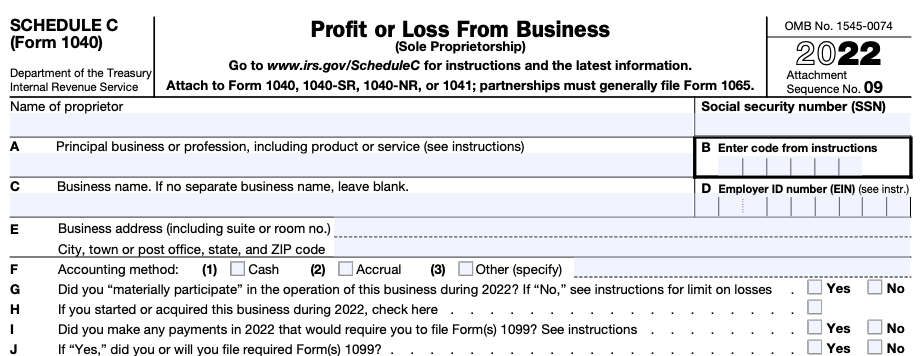

top of form

This is where you’ll enter general info about your business, like its name and address. If you have questions about accounting methods or Form 1099, refer to the Schedule C instructions and Publication 334 for more detailed help.

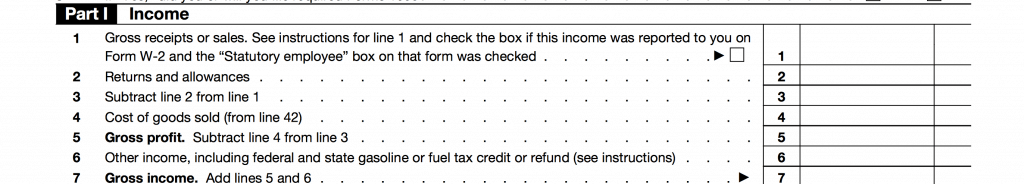

Part I – Income

This section is where you report all your business sales for the year. Line 1, gross receipts will be your total sales, including shipping received. Your refunds will go into line 2. The biggie here will be Cost of Goods Sold, which is calculated on page 2 of the Schedule C, and then flows back over here.

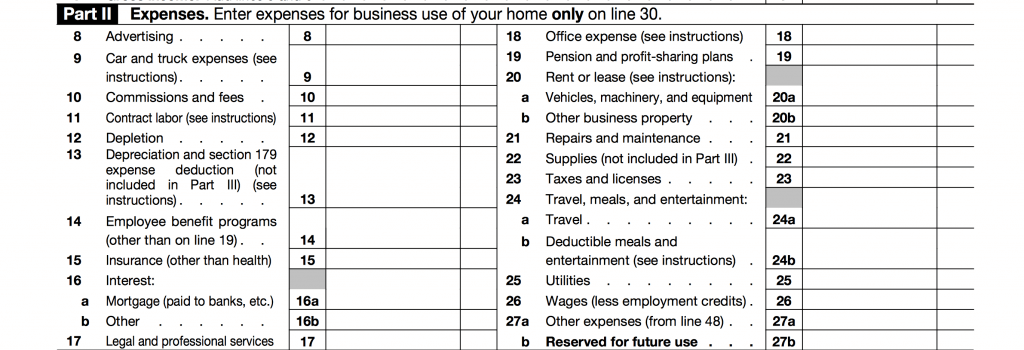

Part II – Expenses

Here we go! This is the part of Mr. Schedule C that we like. Here’s where you can enter ALL those deductions for your business. If you left this section blank and didn’t take any deductions, you’d basically be taxed on your entire revenue, which could mean steep taxes due if your business did well. So it’s GOOD to take deductions. In order to do that – it means you have to have recorded your expenses in the first place. If you never did any bookkeeping this year, you’ll likely forget a lot of the expenses your business paid.

Remember the IRS has some requirements regarding the paperwork you need to back up (or “substantiate”) any of the deductions you take for your business. More on that here.

Take a look at how the IRS categorizes your expense deductions in this section. This is helpful info for how you might choose to categorize your receipts throughout the year, or how you will categorize the entries in your bookkeeping system.

Some of the most common and biggest deductions are as follows:

- Advertising (line 8)

- Legal and professional services (line 17)

- Office expense (line 18)

- Supplies (line 22)

- Other expenses (line 27a)

…but of course this all depends on your specific business!

My personal advice to you is to not get too hung up on WHERE to enter a particular expense here. MOST of your expenses are going to end up somewhere in this section of your tax return. If you look closer, you’ll see that all of these expenses get totaled together and then subtracted from your total revenue. So in the end, most expenses end up as deductions on your tax return – whether you categorize them as office expenses or advertising – it all gets subtracted from your revenue.

The important things to remember if you get stressed about “where” an expense goes…

- Categorize your expenses in a way that makes reasonable sense, and

- Be consistent about it. Don’t change how you categorize things from year to year.

However, if you still have questions, the IRS has some rules and offers some examples of what belongs (or doesn’t belong) on each of these lines. Again, I highly recommend browsing Publication 334 (start with this one) and then, if necessary, Publication 535 on Business Expenses to get more educated about these deductions. I know these are lengthy documents, but you can easily search (CTRL + F) for the expense type you’ve got a question about.

Finally, I encourage you to consult an expert about your exact situation. A professionally trained and licensed tax preparer or accountant specialized in your niche is your best bet when you’re feeling uncertain about where to enter something on your tax return.

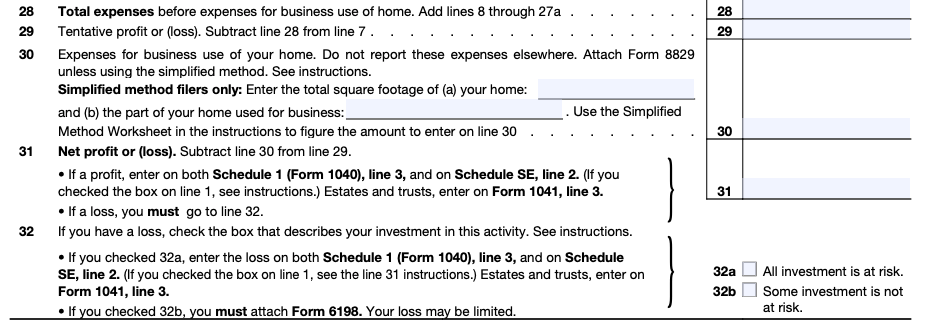

Bottom of Page 1

This no man’s land is basically where you’re re-entering amounts you calculated elsewhere and adding or subtracting them together.

Note that if you have a home office that qualifies, this is where you’ll enter your home office square footage and your total home square footage, if you’re opting to use the simplified method for the home office deduction. Otherwise, your home office deduction will be separately calculated on Form 8829, and then entered here.

Your business total net profit or loss is calculated on Line 31. If you have a profit (positive amount), this total will travel to Schedule SE, where you will calculate your self-employment tax (so much fun!).

Whew! That was like a whirlwind, right? Rushing things with Mr. Schedule C might leave your head spinning. Take a breather.

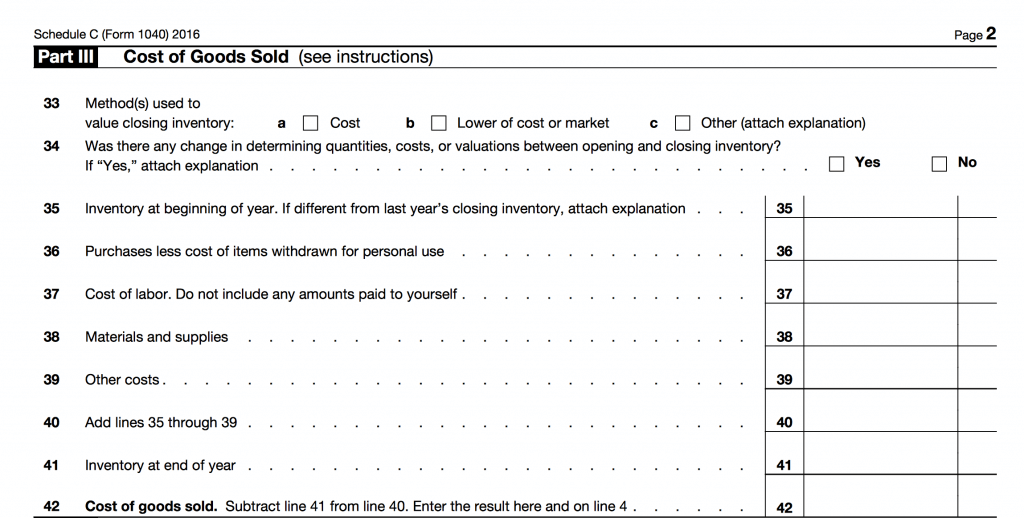

Part III – Cost of Goods Sold

Here’s where a lot of people get confused. First, you may wonder if you even have to fill out this section of the Schedule C. If you sell physical goods, then you likely do. This is true whether you’re crafting items from supplies (like a jewelry maker), making custom goods to order, buying finished goods at wholesale and simply reselling them, sourcing vintage goods and selling them at a markup, or anything in between.

You do not have to deal with inventory if you’re strictly a service provider, or if you sell only digital goods (lucky, lucky you!). In this case, you have no inventory and thus no cost of goods sold deduction.

Beginning inventory is either zero for your first year of business, or rolls over from what your ending inventory was on last year’s return.

Purchases are what you paid for items you intend resell, less the cost of anything you ended up keeping for personal (non-business use).

Materials and supplies are all the inventoriable raw materials and supplies that go into the goods you make.

Inventory at year end should be the cost of all finished goods AND inventoriable supplies still sitting on your shelf on the last day of your taxable year.

I talk more in-depth about inventory here:

- Inventory 101: What is inventory?

- Inventory 101: What is COGS?

- Surviving the year end inventory count

You do a fancy equation to basically then calculate your cost of goods sold. For tax purposes, cost of goods sold is basically a “plug number”, i.e., the answer to a math equation. Conceptually, you can think of cost of goods sold as the amount you spent on supplies that went into finished goods that sold this year.

Cost of goods sold then becomes a deduction back on page 1 of the Schedule C. That means it reduces your total net income, and can potentially lower your tax bill.

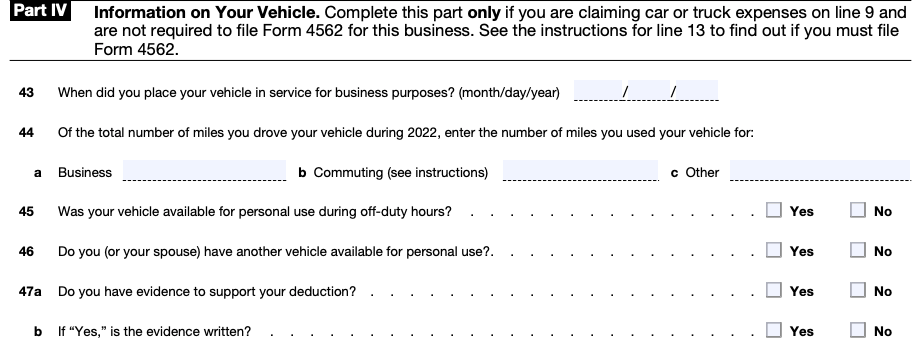

Part IV – Info on your vehicle

If you use your car for business purposes, this is where you can take the deduction for mileage. Consult the Schedule C form instructions for a step-by-step on how to fill out this section. If you’re tracking mileage for tax purposes, make sure you keep a detailed mileage log that includes date, beginning odometer reading, ending odometer reading, your destination, and your business purpose for documentation purposes.

Part V – Other Expenses

This section simply lists out the miscellaneous expenses you entered back on Page 1’s Line 27a “Other Expenses” in more detail.

Now what happens?

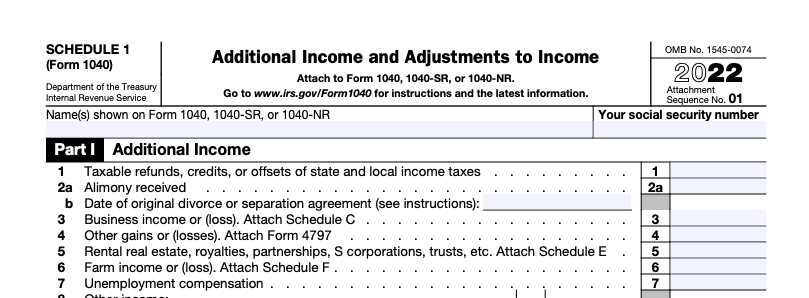

Your business net profit or loss, calculated on Line 31, will flow over to your personal 1040. That’s right – your business income or loss gets thrown in directly with your personal/family income.

So if your business has a loss, it can reduce your personal tax liability. If your business has positive income, it can increase the amount you may owe (or reduce your refund). This is why when so many people ask – “how much am I going to owe in taxes on my business net income?” it’s really hard to give an answer, because you have to take your personal situation into account as well. Everything is all taxed together – personal and business.

Thanks to tax changes in recent years, the Form 1040 (your personal tax return) now has several “Schedules” attached to it. Your business income or loss will flow to what is now line 3 on Form 1040 Schedule 1.

Wait a second. I don’t see the part where I report how much I paid myself.

Guess what? If you’re a sole prop, the IRS doesn’t care about what you paid yourself. There is no where to report owner withdrawals on the Schedule C, or any other tax form for a sole proprietorship. If your business has a net income of $20k, you are going to be taxed on that $20k. It doesn’t matter if you transferred $19k or $1k from your biz bank account to your personal bank account. Owner withdrawals have no effect. The same goes for owner contributions – personal money that you contribute to your business.

Wait another second. I thought there was a 20% deduction for businesses these days.

You’re correct you smart little cookie! There’s a new-ish deduction called “qualified business income deduction” that essentially means a 20% deduction of your business income before calculating how much taxes are due. The in’s and out’s of this somewhat complicated QBI deduction are outside the scope of this article (we’ll save that for another day), BUT I will tell you that this deduction is actually taken on your Form 1040 itself, not on your Schedule C. So it happens on the personal side of your return.

Are you wondering if you even have to deal with the Schedule C for your crafty shop?

Check out my free on-demand workshop all about this topic if you want to learn in VIDEO mode. In this 45-minute workshop, I review hobby vs business AND I dive into the financial to do’s and concepts you need to get familiar with as a legit business owner. Learn more here.

Super super helpful!! I just wish I had taken a class on this in high school! I had planned to launch my Etsy shop toward the end of last year but chickened out because the tax stuff made me so nervous. This makes me so much more at ease about next year. I think in my head I had it pictured that it was a very confusing process, but it actually sounds like really straightforward addition and subtraction and is just a matter of keeping track of things. Which your spreadsheets are helping with!

[…] will get it’s own form for taxes. For a lot of us creative business owners, that form will be the Schedule C (which is what a sole proprietorship files). If not the Schedule C, it will be a similar form. With […]

I have been reading other people’s schedule C’s for years, how strange and exciting to think about filling one out for myself.

So, so helpful! I have been wanting to start affiliate marketing and a blog for some time now and haven’t been able to start because I new I would have to do something with the taxes, finances, etc at some point. I’m not one of those that can just dive in. I need my facts up front. This really helped answer some of my questions and ones I didn’t realize I had! This article really picked up my confidence in getting started. Thanks again!

Excellent! So clear and more than ‘just’ an introduction. Thank you.

Glad you found it useful Katie!

Good thing you continue to be awesome and helpful with everything you do. Love your content! This stuff causes me legit anxiety and habing your materials to walk me though these intimidating topics is invaluable! Thank you!

wow this is such a well-written, friendly, easy-to-digest post Janet. You are the bomb! I have a tax accountant doing my returns this year but I am so glad I understand the schedule C better in case I choose to do my own in the future! thank you for creating this post I’m definitely going to share it.

Rebecca

As usual, very, very, very helpful.

The Seller Spreadsheet & Inventory Spreadsheets -and this article are literally a lifelong for taxes for my small business – thank YOU for being here and filling this need.

Line 32 on schedule C is not addressed here.

I have no idea what to do with line 32 and IRS instructions aren’t super clear here.