I recently talked about all those pesky hidden expenses (called “overhead expenses”) that your small biz encounters. I concluded that discussion by saying that it’s important to recover a little piece of your overhead expenses every time you sell a product or service, so you should be including these expenses in your pricing formula.

Today, we’ll get into the details of exactly how to do this! This process can get a little complicated and depends a lot on the specific products or services you provide. So feel free to ask for help in the comments!

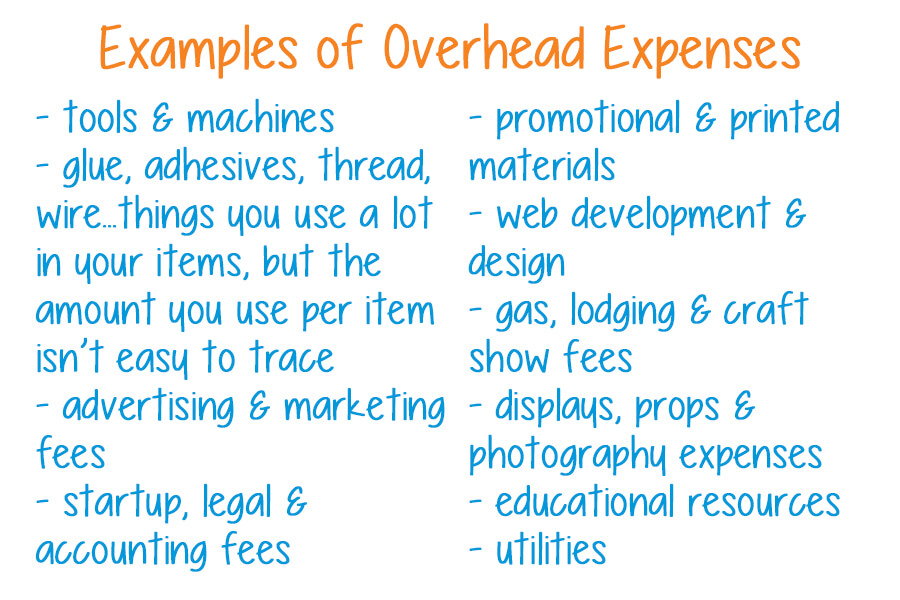

So let’s review from last time – overhead expenses are those indirect costs that go into creating my product. They are expenses that I cannot assign to an exact product. Things like glue, thread, the electricity I use to keep my sewing machine on, craft show fees, etc. I am spending real money on these things, but since I can’t allocate them to a specific product or line of products, I might forget to take them into consideration when I price my products. Remember, pricing is all about trying to recover all the expenses it cost to make that product, plus earn some profit.

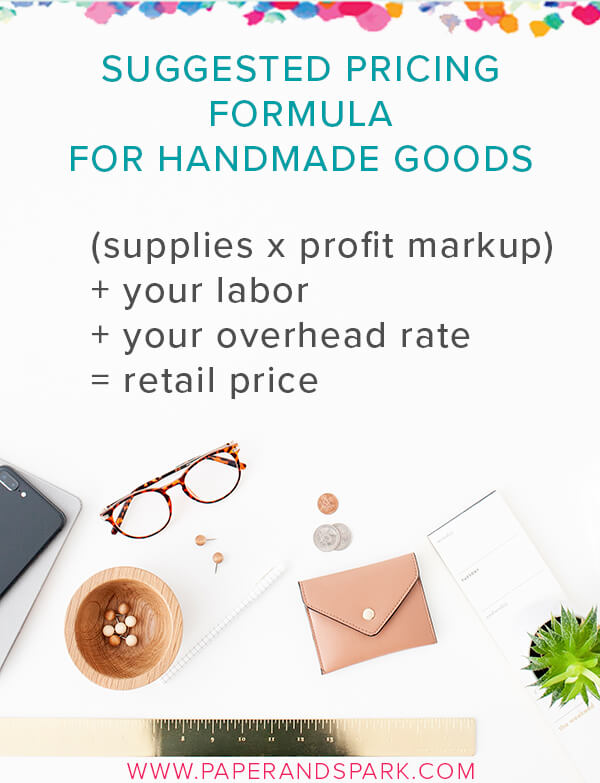

Here’s an example of a typical pricing formula:

The “overhead rate” piece is what we’re discussing today. How exactly do we come up with a number to put in this part of your pricing formula?

Let’s start by tallying your estimated overhead expenses, either on a monthly or annual basis, whatever is easiest for you. That includes the following types of expenses:

If you’re having trouble estimating your monthly or annual overhead expenses, it might help if you think of all the expenses you expect to pay for your business in one month or year. Then determine which of them are not directly allocable to your products. You’re left with an estimate of all your overhead expenses.

Once you have your estimate, you need to find a way to include a piece of this total sum in your pricing formula(s). This little piece is called your “overhead rate”. It can be either a dollar amount or a markup percentage.

There are lots of ways to calculate your overhead rate. Here are just a few possibilities:

- Based on estimated products created – Estimate how many products you will create this year. Take your total overhead expense number and divide it by the number of items. Add that number to the sales price of each item you list for sale. For example, $1000 in annual overhead divided by making 350 items this year means I need to increase the price of each item by $2.85 or so to recoup a chunk of overhead in every sale I make.

- Based on estimated products sold – Same method as above, but instead of estimating your total items produced, estimate the total number of items you hope to sell this year. That way you are getting closer to truly recouping that overhead expense back with each and every sale.

- Markup percentage – Instead of adding a flat “fixed” overhead dollar amount to each sale price, you can use a percentage markup instead. Once you know the cost of direct materials and labor that went into creating a specific product, you can multiply that amount by a specific overhead percentage (determined based on what feels sensible to you). For example, if these earrings cost me $6 to create and my overhead percentage is 20%, then I’m saying these earrings required about $1.20 of overhead expense to make, and really cost me $7.20 total to create.

Each overhead rate calculation method has its pros and cons. Experiment with the different methods and see what calculates a price that you feel most comfortable with.

To refine your formula further, you can even have multiple categories of overhead with their own rates. For example, your different product lines might have their own different overhead rates, and then you might have an overall “general business” overhead rate that you apply to all of your products.

Calculating your overhead rate and pricing formula depends on what makes most sense to you. My most important takeaway lesson is that you do something to include your overhead costs in your prices in some way, shape, or form. If you fail to include these costs in your price, then you are much less likely to ever recover them via your sales. At the end of the day, your business will make less real profit than you might think.

All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

[…] note, before you read this post, I suggest you read our posts on tracking expenses and accounting for overhead to better understand the concepts we’ll discuss […]

Love your blog! Seriously, I’m pinning and sharing EVERYTHING!

Very interesting, and easy to understand. I have a service Company, I bill to my customers per hour, My rent price was increased and I would like to know how to apply that percentage to my service price. Thank you

I would try to find a way to “divvy up” your rent expense in your hourly rate. Maybe take your monthly rent expense and the number of hours you charge your clients each month and divide it up. Assign that much rent to every hour you bill for, and increase your hourly rate by that amount.

Based on this formula, my crocheted blankets would cost $672 retail on Etsy. If my supplies are $60, and I charge the minimum of $10 an hour for my labor, and the blanket takes 8 hours to make. with 20% overhead charge….that is not even feasible as a price point. So, does this mean it’s an item I shouldn’t be selling?

(($60+$80) x2) + $56 = $336 x2 = $672.

This would mean everyone on Etsy charging $160 or less for their blankets is not making any money on them- in fact losing money? I’m so confused about this!

Hi Nicole! I get your frustration! First, remember that the formula is just as much an ART as a science. We can tweak it – the goal is to keep your overall purpose of ensuring you can cover ALL your costs of running a business AND be able to pay yourself on top of that in your pricing strategy. You could move the x2 multiplier in the equation and do ($60×2) +$80 labor +$56 overhead and get a drastically different price result. You can multiply just by 2 (or 3) instead of by 4 for your retail rate. You can find ways to lower your overhead rate, etc. You really just have to take time to look at the resulting suggested price and figure out if sales at that price will be able to cover your costs and allow you to pay yourself the amount you want to pay yourself!

Do you/should I include tax/gst into my costs or do you add this later?

I’m in Australia

I like the markup percentage method since I have a wide price of products. Can you show an example of how that fits into your formula? Is the overhead percentage calculated on ((supplies + labor) x 2) OR just (Supplies + Labor)?

Hello Janet! Thank you for this valuable information. I have a couple of questions:

1) What if my machines were personal use before and now are business use? Do I factor in the cost of the machine?

2) How do you calculate utilities if you are working out of your home? Do you do the total electric bill?

Hi Janet! Thank you so much for this educational blog post. I’d like to ask though if I can factor in my Shopify monthly plan into the overhead cost? Should I then multiply it by 12 to represent a whole year’s worth of subscription? It does kind of work like rent right for those who have physical stores? Thank you!

The overhead rate concept is for you to use however you see fit – I think it’s totally fine to incorporate your Shopify fees into that equation to make sure you’re covering ALL the costs of running your business when setting your prices!

Thanks for all of the helpful information. I’m considering selling some items through a retail business. They take 35% of the retail price for each item. Is this something that can be added as an overhead expense or should it be calculated elsewhere? TIA

Hey Janet,

Just reading through my Inventory Spreadsheet Instructions and trying to set up my sheets as I’m doing it. I’m planning on opening my jewelry shop on Etsy after the new year. Would supplies for packaging and shipping items (boxes, tissue paper, bubble mailers, labels, etc.) be considered an overhead cost? I know it would go on the Seller Spreadsheet as a non-inventory expense but would that be something I’d put on the overhead sheet (in the right-hand column)?

Thanks so much.

So I have used the formula to figure out my price, including overhead, and it seems like it is coming out to way too much. The product I want to sell is time consuming depending on the size, but I still feel like its coming out to an outrageous amount. Any suggestion?

How do you take into account for these companies that don’t send a packing list, so you know what you paid for in the order, but don’t have a breakdown of each specific item?

You usually can get an itemized account from the original order receipt or invoice

[…] note, before you read this post, I suggest you read our posts on tracking expenses and accounting for overhead to better understand the concepts we’ll discuss […]

Love your blog! Seriously, I’m pinning and sharing EVERYTHING!

Very interesting, and easy to understand. I have a service Company, I bill to my customers per hour, My rent price was increased and I would like to know how to apply that percentage to my service price. Thank you

I would try to find a way to “divvy up” your rent expense in your hourly rate. Maybe take your monthly rent expense and the number of hours you charge your clients each month and divide it up. Assign that much rent to every hour you bill for, and increase your hourly rate by that amount.

Based on this formula, my crocheted blankets would cost $672 retail on Etsy. If my supplies are $60, and I charge the minimum of $10 an hour for my labor, and the blanket takes 8 hours to make. with 20% overhead charge….that is not even feasible as a price point. So, does this mean it’s an item I shouldn’t be selling?

(($60+$80) x2) + $56 = $336 x2 = $672.

This would mean everyone on Etsy charging $160 or less for their blankets is not making any money on them- in fact losing money? I’m so confused about this!

Hi Nicole! I get your frustration! First, remember that the formula is just as much an ART as a science. We can tweak it – the goal is to keep your overall purpose of ensuring you can cover ALL your costs of running a business AND be able to pay yourself on top of that in your pricing strategy. You could move the x2 multiplier in the equation and do ($60×2) +$80 labor +$56 overhead and get a drastically different price result. You can multiply just by 2 (or 3) instead of by 4 for your retail rate. You can find ways to lower your overhead rate, etc. You really just have to take time to look at the resulting suggested price and figure out if sales at that price will be able to cover your costs and allow you to pay yourself the amount you want to pay yourself!

Do you/should I include tax/gst into my costs or do you add this later?

I’m in Australia

I like the markup percentage method since I have a wide price of products. Can you show an example of how that fits into your formula? Is the overhead percentage calculated on ((supplies + labor) x 2) OR just (Supplies + Labor)?

Hello Janet! Thank you for this valuable information. I have a couple of questions:

1) What if my machines were personal use before and now are business use? Do I factor in the cost of the machine?

2) How do you calculate utilities if you are working out of your home? Do you do the total electric bill?

Hi Janet! Thank you so much for this educational blog post. I’d like to ask though if I can factor in my Shopify monthly plan into the overhead cost? Should I then multiply it by 12 to represent a whole year’s worth of subscription? It does kind of work like rent right for those who have physical stores? Thank you!

The overhead rate concept is for you to use however you see fit – I think it’s totally fine to incorporate your Shopify fees into that equation to make sure you’re covering ALL the costs of running your business when setting your prices!

Thanks for all of the helpful information. I’m considering selling some items through a retail business. They take 35% of the retail price for each item. Is this something that can be added as an overhead expense or should it be calculated elsewhere? TIA

Hey Janet,

Just reading through my Inventory Spreadsheet Instructions and trying to set up my sheets as I’m doing it. I’m planning on opening my jewelry shop on Etsy after the new year. Would supplies for packaging and shipping items (boxes, tissue paper, bubble mailers, labels, etc.) be considered an overhead cost? I know it would go on the Seller Spreadsheet as a non-inventory expense but would that be something I’d put on the overhead sheet (in the right-hand column)?

Thanks so much.

So I have used the formula to figure out my price, including overhead, and it seems like it is coming out to way too much. The product I want to sell is time consuming depending on the size, but I still feel like its coming out to an outrageous amount. Any suggestion?

How do you take into account for these companies that don’t send a packing list, so you know what you paid for in the order, but don’t have a breakdown of each specific item?

You usually can get an itemized account from the original order receipt or invoice