If you’re running a creative business, ESPECIALLY if you’re a maker, it can be easy to spend a lot of money on the latest shiny object, piece of software, newest gadget, or (perhaps most of all) beautiful craft supplies!

That’s why today we’re chatting about how to make a budget for your business. Now I’ll be honest, I have always had a negative inner-reaction to the word “budget”.

Instead, I prefer to think of my biz budget as *boundaries*. Instead of a cut and dry, boring and bland budget, we’re setting boundaries around our spending, especially focusing on the problem areas where we tend to overspend.

So let’s figure out how to make a budget for your business!

WHY YOU SHOULD BOTHER WITH A BUDGET

If you’re reading this, I’m gonna guess your goal is to make more money with your business. By make more money, I specifically mean – pay yourself more from your business profits.

The easiest, yet most overlooked way to increase your business profits (sales minus expenses) is to spend less. Decrease your expenses. No matter how much (or how little) you make in sales, if you spend less of the money you make, you have more left over from which to pay yourself. Can’t beat that logic.

So no matter what sales level you’re at, it’s useful to learn how to make a budget for your business and set boundaries for how you’ll spend your money, so you can have more money left over at the end of the day!

1. DETERMINE YOUR OVERALL FINANCIAL GOALS.

The first step in how to make a budget for your business is to start the budgeting process with some overall financial goals for the time period in mind. Instead of shooting in the dark, we need to get some ballpark figures.

I suggest you come up with a revenue goal (total sales) and a net income goal (total sales minus total expenses) for whatever time period you want to set a budget for.

If you’re stumped on what these goals should be, you likely need to spend some time getting to know your numbers and pondering what you want out of your business a bit more. (That’s a topic for another day….or inside the Goal Getting Guidebook!). You can begin this process by thinking about how much you want to pay yourself for the time period.

Your net income goal must be equal to, if not a bit greater than, what you want to pay yourself (at least if you’re a sole proprietor).

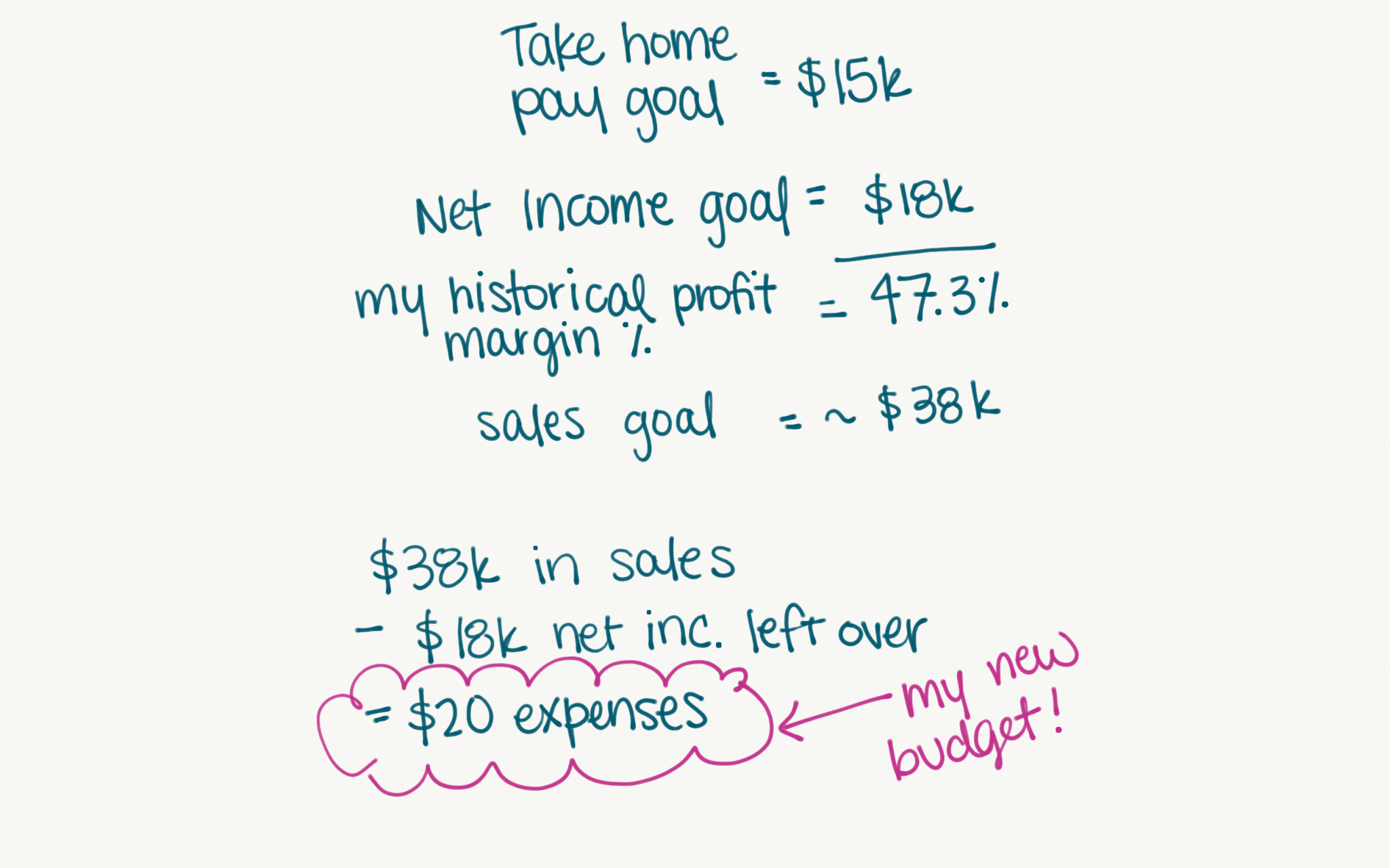

If you apply your usual/historical/average profit margin percentage to your net income goal, you can work backwards to figure out your revenue goal. Your revenue goal minus your net income goal equals your expense goal.

And voila, that process leaves you with your total budget – your spending goal!

Here’s an example we’ll use for the rest of this exercise. This business set her sales goal based on her net income goal and her historic profit margin percentage. Working backwards, she can set a budget of $20k.

Knowing your revenue & net income goal allows you to work backwards to get your expenses goal. This is better (and more realistic) than pulling a budget goal number out of the sky.

Remember, your expenses goal is the total amount you will try to spend on your business during your determined time period. We’ll take that goal number and refine it further, based on your past spending habits.

2. ANALYZE HOW YOU’VE SPENT YOUR MONEY IN THE PAST.

Pull up your books for the past month/quarter/year – whatever prior time period data you have easy access to. Let’s check out how you spent your money in the past.

You likely already have your expenses sorted by category. If you don’t, now’s a good time to categorize them! You can use whatever spending categories make sense to you – supplies, software, contract help, tools & equipment, shipping, credit card processing fees, advertising, education & training, etc.

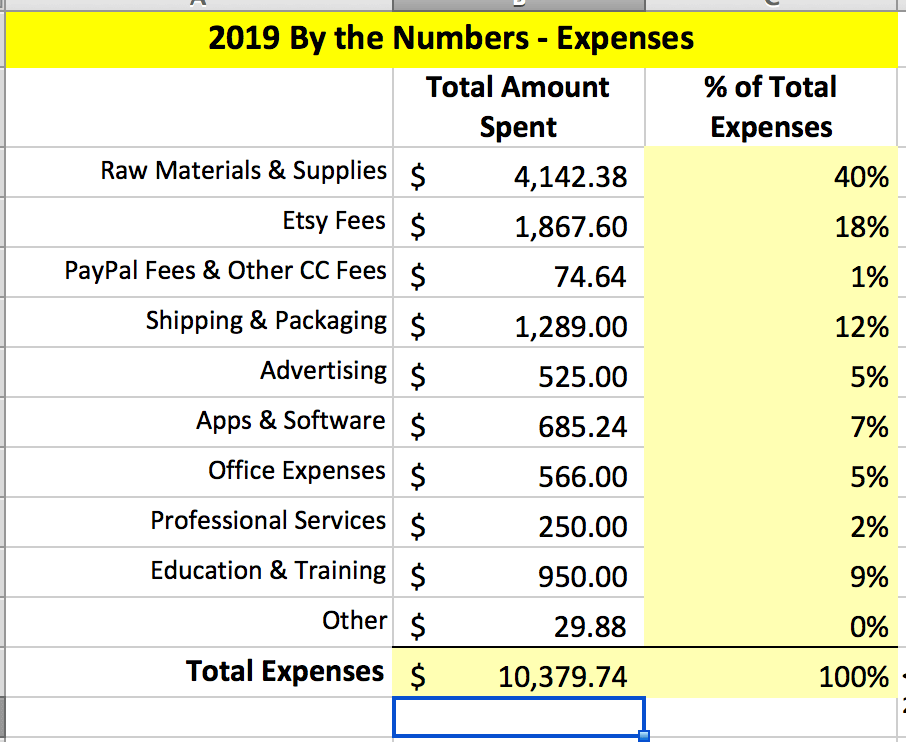

I want you to determine the percentage of money you spent on each of these categories. Here’s an example below ⤵️ for a business that spent just over $10k in 2019.

We’re looking to generate the percentage of total spending each of your categories represented in the past. We’ll apply those percentages to your future budget allowance!

3. APPLY THOSE PERCENTAGES TO YOUR CURRENT BUDGET GOAL & TWEAK.

We’re going to keep refining, but as a starting point, looking at last period’s spending percentages, either use those numbers or tweak them to your preference for setting your budget.

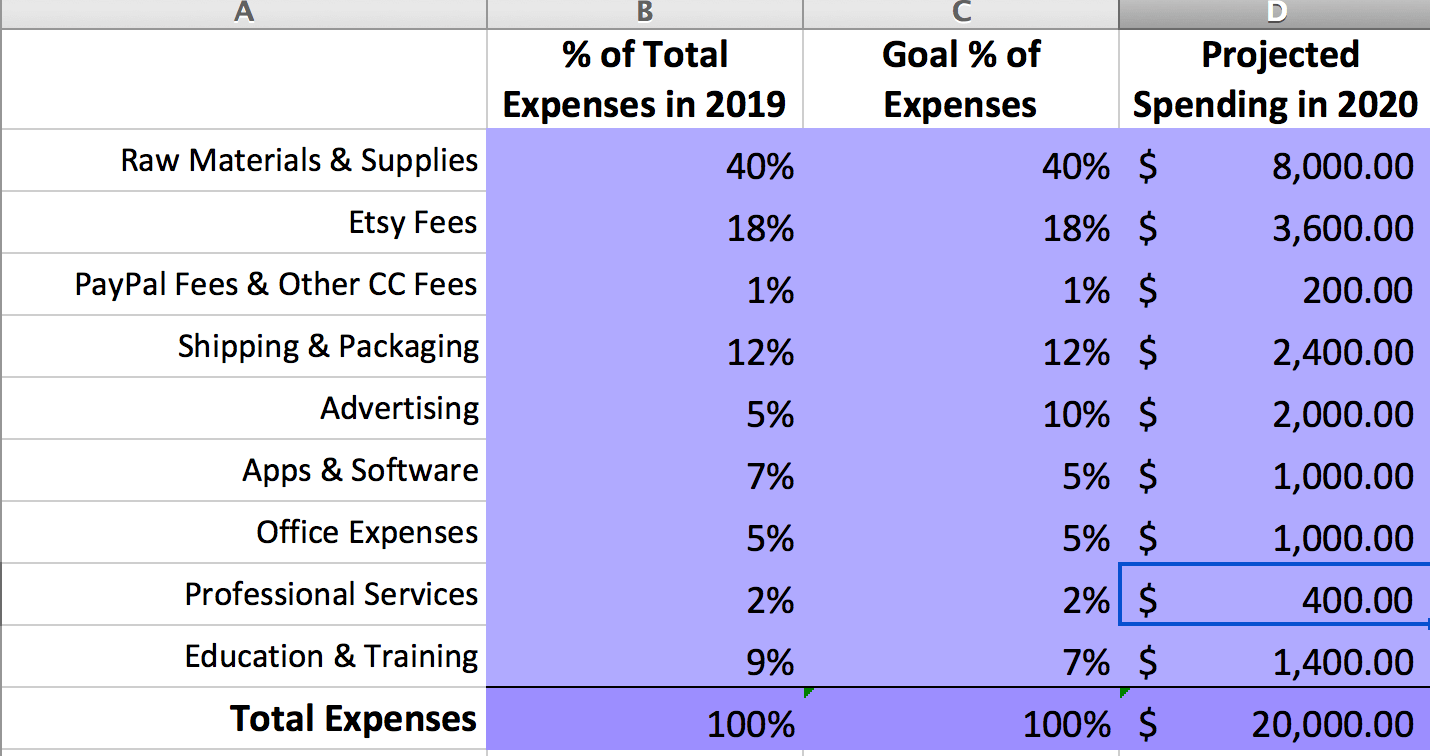

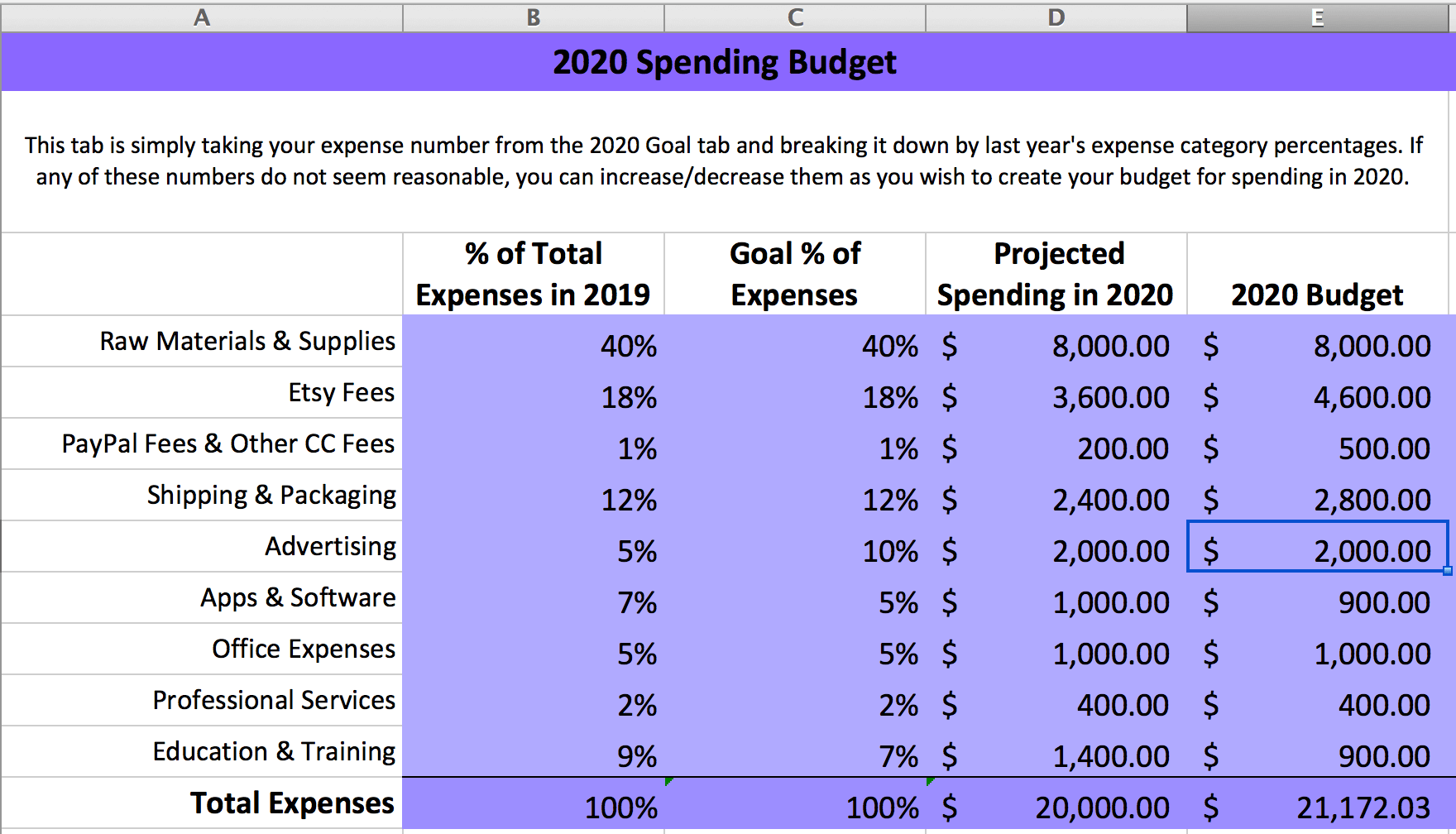

Our example business has an overall expense budget of $20k. Their historical spending percentages (taken from the yellow table above) are below in column B below.

Our example gal starts out thinking her spending will be about the same distribution as last year, but she knows she wants to up her advertising budget, so she increases it from 5% to 10%. She also wants to spend a bit less on new software & new online courses, so she decreases those accordingly.

Keep in mind since her expense budget (in dollars) is 2x last year, she still has a lot of money to spend on each category. The percentage of spending might go down, but actual dollars goes up!

Multiply your tweaked percentage per category by your total expense budget and you’ll get your projected budget per category (what you see in column D above). You can play with your goal percentages and see the different outcomes for actual dollars allotted to that category.

This is a good starting point for each category, but we can refine these goals even more.

4. THINK OF YOUR PROJECTED SPENDING CATEGORIES IN RELATION TO YOUR PROJECTED SALES GOAL.

Some of your expense categories aren’t so much a function of overall spending, they are a function of your total sales.

What the heck am I saying? You have some expenses that will rise or fall in direct correlation to your sales numbers. Credit card processing fees, Etsy fees, shipping expenses, and product costs are all examples.

At this point, I invite you to pause and analyze any expense categories that correlate to your sales volume. How reasonable do they look in light of your sales goal?

In my example, if I’m selling 100% on Etsy and my sales goal was $38,000, I would probably want to allocate about 12-15% of my total Etsy sales to Etsy fees (it’s hard to give an exact number but Etsy fees are generally 10-18% of sales depending on various factors). So if my budget didn’t have at least $4560 allocated to Etsy fees (12% x $38k), I need to tweak that number for sure.

Take a look at what percentage of sales those expenses were for you in the past, and make sure that correlates to your future sales goal. Tweak any expense budget categories that are too big or too small to get a more accurate budget.

In column E (“2020 Budget”) of the example below, I’ve tweaked what the goal percentages (based on last year’s spending) spit out and changed a few of the categories that correlate to my sales level, like Etsy fees, PayPal fees, and shipping.

You’ll notice that I’m now about $1k above my budget, but I don’t feel like I have anywhere I can cut back so I am leaving it as is. The goal is to end up with a realistic budget that will support my sales goal.

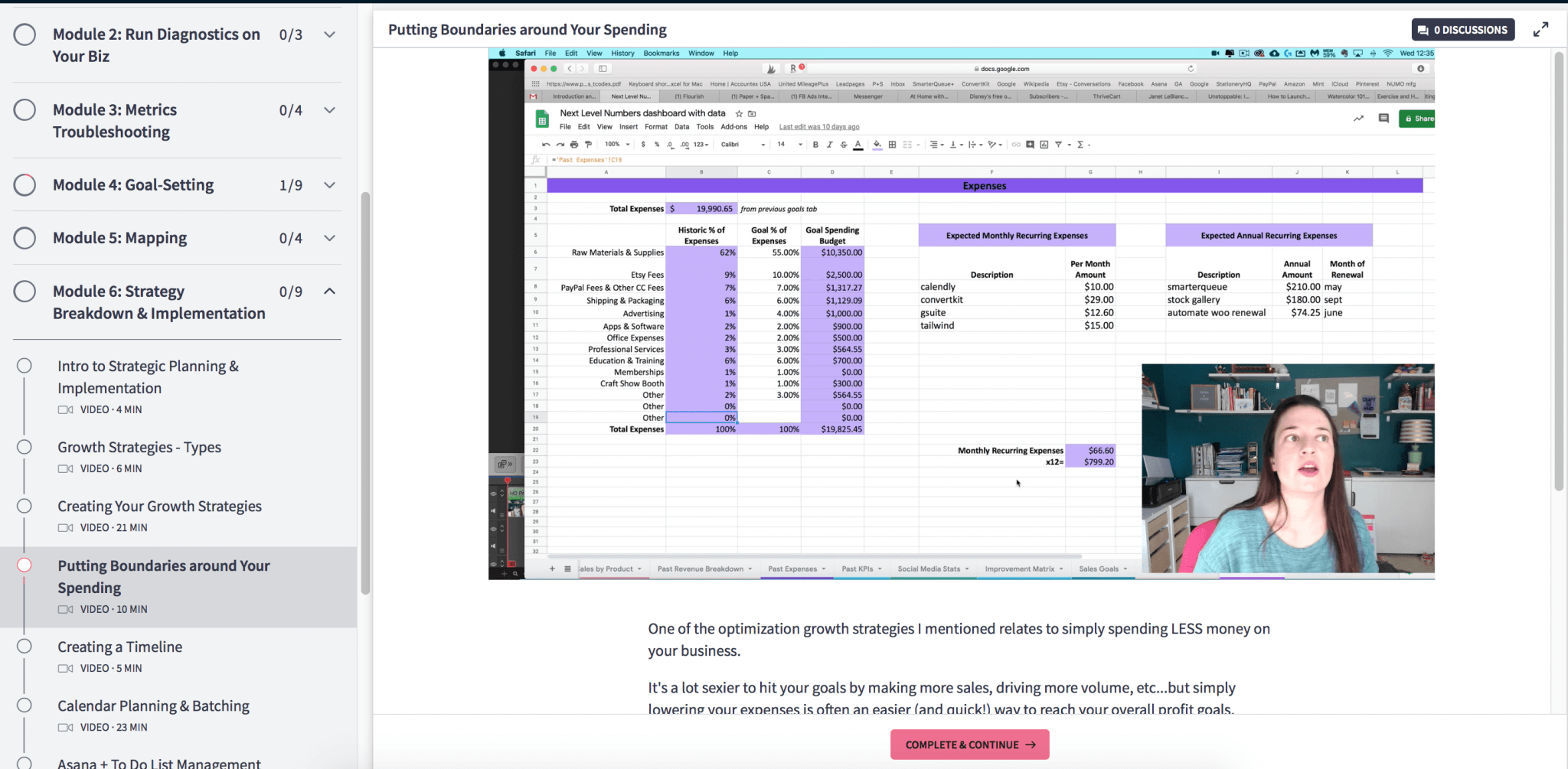

5. ACCOUNT FOR RECURRING MONTHLY OR ANNUAL COSTS.

While a lot regarding your business spending is unknown, you likely do have some fixed expenses that ARE known.

Take a beat and jot down all your recurring fixed expenses that you pay each month, quarter, or year. It helps to go through last year’s books to find them. Good examples are Etsy Plus or Pattern, Tailwind or other social media apps or schedulers, plug ins, website domains, email marketing services, course payment plans, etc.

Total up all these recurring expenses and check them against the applicable expense category. Does your annual (or whatever time period you’ve selected) budget jive with the amount you’re projected to spend on those recurring expenses? If you have any budgets that are smaller than the sum of your recurring charges, you can tweak those now. (Or consider if now is the time to downgrade or cancel your subscription and save some $$!)

YOU SHOULD NOW HAVE AN EXPENSE BUDGET FOR EVERY CATEGORY OF YOUR BUSINESS THAT SUPPORTS YOUR NET INCOME & SALES GOALS.

Coming up with these budgets by spending category is only half the battle! You’ve got some static numbers for the year (or whatever time period you’re working with), so now what?!

This is where your *boundaries* come into play. Determine if you want to take these expense goals and break them down into monthly goals (weekly or quarterly goals are fine too).

6. CREATE A SHOPPING LIST FOR YOUR PROBLEM AREAS.

We all have certain areas within our business where we tend to overspend. I suggest creating a “growth shopping list” for what you know you need to spend money on within that category.

For example, if you tend to overspend on education or training, make a list right now of whatever topics you know you need to learn more about during this time period.

Maybe I know I want to get better at Facebook ads, product photography, or SEO this year. So those topics are on my “growth shopping list”. If I come across a course or a training or a workshop on my approved topic list and it’s in my budget, I can invest. If I get an email about a new shiny course on selling digital products, I am mightily tempted but it’s (slightly) easier to say no, because I have already determined that’s NOT one of the topics I’m dedicating my education budget to.

The same concept applies to any other problem area for you, like supplies. Make a list of what you know you need this year. Anything else that comes up during the year has to be justified – is this another shiny object or is this truly something you need for your biz?

7. SET A PERCENTAGE OF SALES BOUNDARY AROUND YOUR PROBLEM AREAS.

For extra enforcement, besides just making your shopping wish list, I suggest setting a percentage of sales “boundary” for your problem areas.

What the heck does that mean? Here’s an example. If you tend to overspend on fabric, give yourself a percentage of sales amount each month (or quarter or whatever period) that you’re “allowed” to spend on fabric.

If you make $2k in July and you’re fabric boundary is 20%, then in August you can spend $400 on fabric. For certain personality types, this can be a fun way to “gamify” your biz spending. The more money you make, the more you can spend on your category!

To determine your boundary percentage, consider your sales goal for the time period and the budget you’ve already set for that category.

Basing your spending on what you make can be a more motivating way to work towards your budget then thinking of it as a “limited” bucket of money, WHILE still keeping your money in line. It also works well if you fall SHORT of your sales goal, because you’re still limiting your spending. You can’t spend more than you make if you have a constraint based on your actual sales.

A bonus effect of using this boundary method is that you need to keep up with your books to know how much you’re making each month to set your budget!

so just to review how to make a budget for your business:

- Set your overall sales & net income goal in order to get your overall expense goal.

- Determine your historic percentage of spending by category.

- Apply those percentages to your new expense goal & tweak if necessary.

- Tweak expense budgets that correlate to your projected sales.

- Make sure your expense budgets make sense with your expected recurring costs.

- Create a wish list for your problem areas.

- Set percentage of sales “boundaries” around your problem areas.

I hope you found this process helpful for how to make a budget for your business. If you want to dive deeper into knowing your numbers and thinking like a CFO, check out my course Next Level Numbers.

Janet, I feel like we are going to have some fun for the remainder of the year. New company, consolidated operations and a New Management team. I’m including you as well… Tim

Thanks for the article1 Budgeting is essential for any business.