If you’ve fallen behind on bookkeeping, let me say this right out of the gate: You’re not bad at business. You’re not irresponsible or lazy.

You’re probably just a real life human being biz owner who has been busy doing… literally everything else.

Shipping. Inventory. Customer messages. Product photography. Market prep. Website updates. A million tiny decisions every day.

Bookkeeping usually gets pushed to the bottom until one day you wake up and realize, “Oh no, I haven’t done my books since January.” Or something like that.

The good news? You can catch up now! (Honestly, you gotta get caught up for tax purposes regardless right??) Annnnd it doesn’t have to be an all-weekend panic session.

This guide will walk you through the fastest way to get caught up on your bookkeeping in 2025, whether you sell on Etsy, Shopify, Amazon, or anywhere else. We’re doing it in a way that’s tax-friendly and as low-stress as possible.

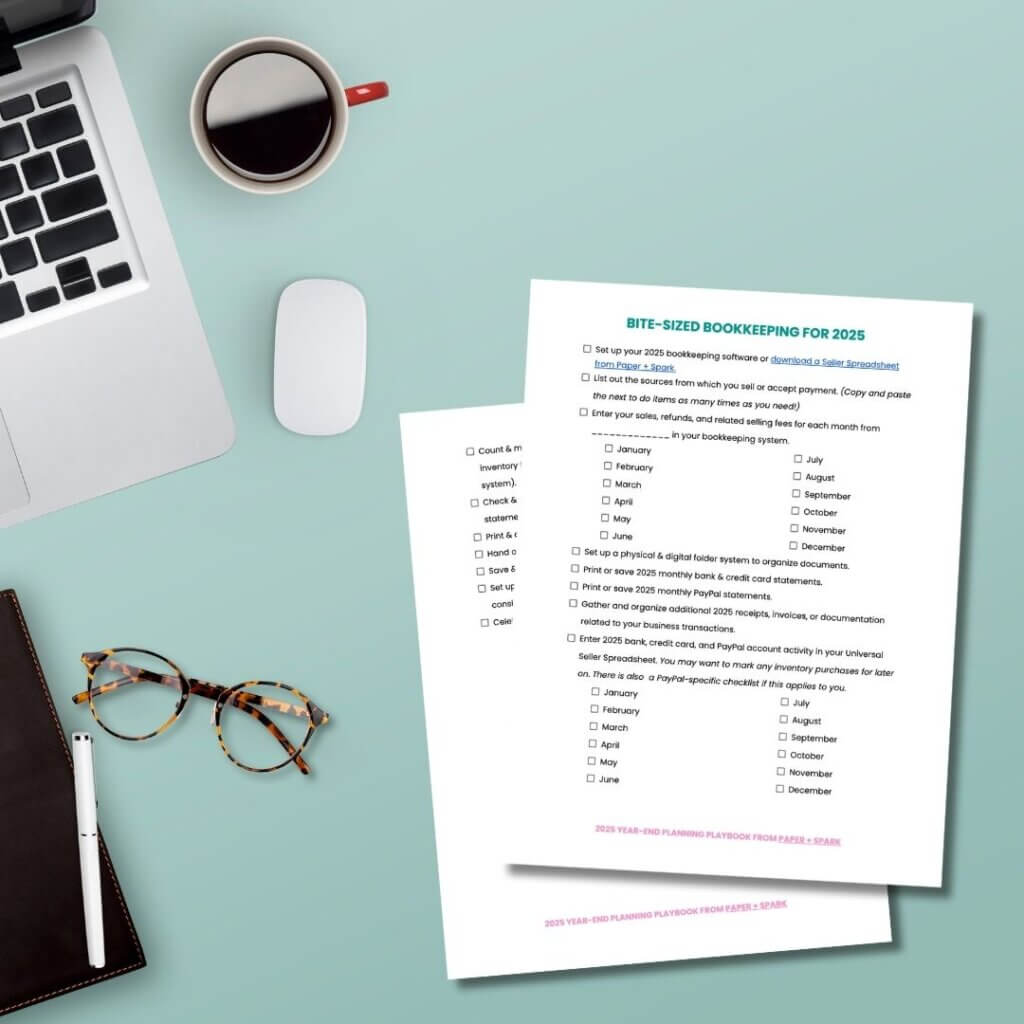

→ You can download my free step-by-step catch up to do list right here too.

First: What “Caught Up” Actually Means

Before you open a spreadsheet or download 47 reports, let’s define the goal.

For most U.S. online sellers, being “caught up on bookkeeping” means:

✅ You have accurate totals for:

- income

- expenses

- profit

- (and if you sell physical products) inventory / cost of goods sold

✅ Your numbers are organized into tax categories

✅ You can confidently hand your totals to your tax pro (or file your own taxes), and in time for the tax deadline of April 15th (assuming you’re a sole proprietor or a single member LLC taxed as a sole proprietor). That’s it.

You do not need:

- a fancy bookkeeping system

- a full range of financial statements (like a balance sheet, cash flow statement, etc.)

- expensive software

- an accounting degree

- every receipt from the past year labeled and alphabetized

Your goal is clean, tax-ready numbers.

✅ Step-by-Step: How to Catch Up on Bookkeeping

Step 1: Do a Quick Data Sweep First

Before you do anything else, consider all your income & expense sources. As e-comm sellers and creative brains, we tend to have a LOT of different miscellaneous revenue streams to manage, which can make bookkeeping complicated and more time-consuming.

Let’s take stock of where all your money is coming from (and also where it’s going). This saves you from starting, stopping, and spiraling because you realize halfway through that you’re missing information.

✅ Income Sources (common for online sellers)

- Etsy

- Shopify

- Amazon

- PayPal

- Stripe

- Square

- Wholesale invoices that hit your bank account directly

- Venmo

- Cash & checks that hit your bank account directly

✅ Expense Sources

- Your business bank account (hopefully not your personal one!)

- Business credit card

- PayPal account

- Venmo account

- Many fees come straight out of your sales funds, like on Etsy & Shopify. We’ll need to be careful to find & enter these the right way.

📌 If you use more than one platform, write them down now. Missing a platform = missing income = not a fun time at tax season.

Step 2: Make a List! (Or Download Mine.)

Write out everything you need to do in order to have totally caught up books for 2025. We can’t schedule it out or figure out how much to do each day until you’re clear on how much you really need to do!

Based on where you sell & spend (as determined in Step 1) you should have a basic idea of what you need to do. If you want to start with my catch up as an example and build off that, grab my customizable Google Doc catch up template + playbook to get an idea of what all you may need to catch up on (oftentimes just knowing what work actually needs to be done is half the battle!). I made it a Google Doc, so you can easily make a copy of it and customize it to better suit your needs, if necessary.

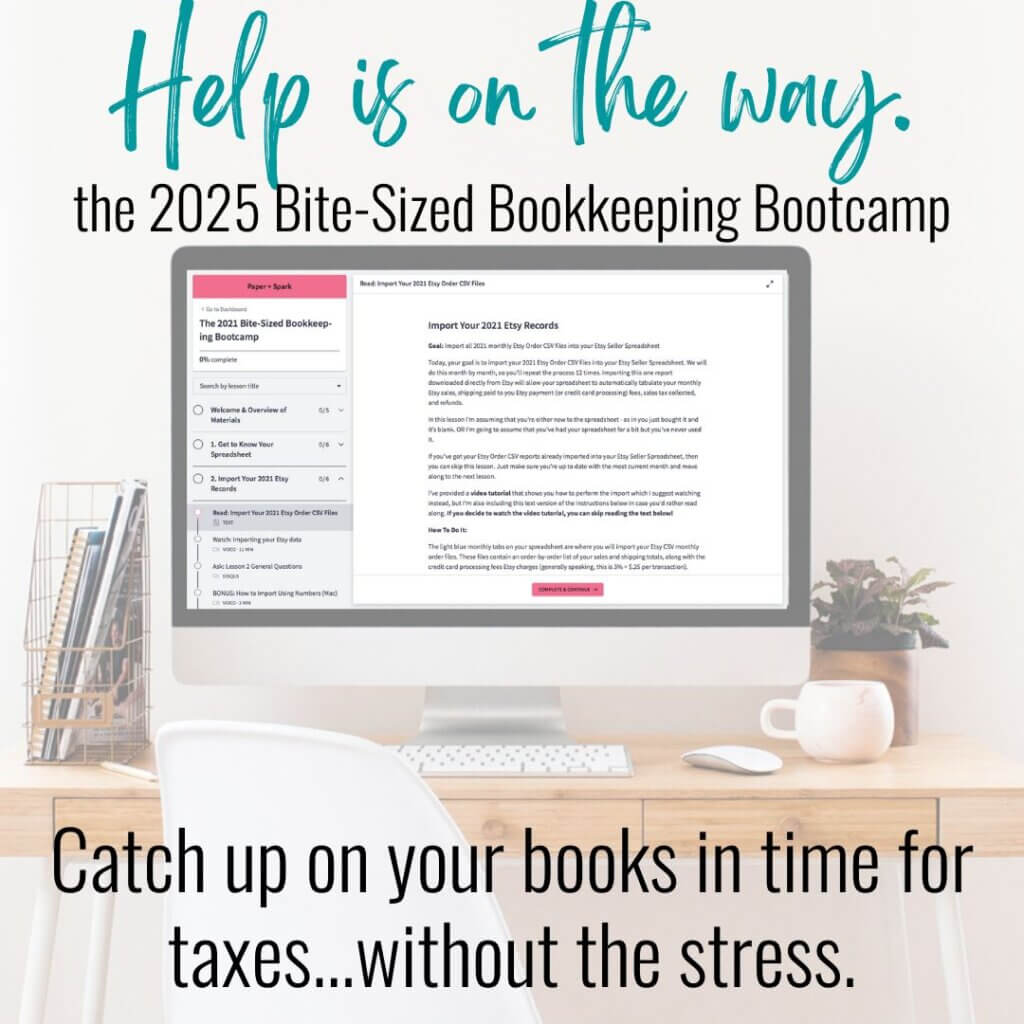

The goal is to have one giant to do list of every single step you need to do over the next (hopefully 2 or so) months to get from blank to done. Remember, if you want to do this with some help, I recommend the 2025 Bite-Sized Bookkeeping Bootcamp!

→ Bonus step: Get a Bookkeeping System!

I’m kinda assuming you already have something you’re using, or planned to use. But obviously you can’t catch up on your books if you don’t have a system in which to do your bookkeeping! Biased pitch for a Paper + Spark bookkeeping system right here!

Step 3: Choose Your Catch-Up Style

There are two good ways to catch up — pick the one that feels easiest for your brain.

Option A: Catch Up by Month (Best for Most Sellers)

January → February → March → etc.

You finish cleanly and you’re less likely to miss things.

Option B: Catch Up by Platform (Best if You Sell Everywhere)

- Week 1: Etsy

- Week 2: Shopify

- Week 3: PayPal / Stripe

- Week 4: Business bank + credit card

There’s no “right” way. Just choose the one that feels easiest. Either way, you’re gonna do it.

Step 4: Time Block It (Because It Won’t “Just Happen”)

This is where many people get stuck in full blown panic procrastination. They assume catching up requires a full weekend, and they’re afraid to get started. It doesn’t have to be like that!

We can break up the work in doable chunks. If you get started early enough, we can even break it up into bite-sized doable chunks. (Spoiler alert — I’ve got a resource for helping you with that right here.)

Here are some realistic options that may work for you:

- 30–45 minutes, 3x per week

- 1–2 hours every Saturday

- one “power session” weekly

- 15 minutes per day

If you’re behind multiple months, you’re not trying to do everything in one sitting — you’re just trying to build momentum.

Once you figure out what is easiest for you, line that up with your printed or digital calendar each week so you know exactly what is going to get done when. The planning playbook also includes blank calendar pages to give you space to break out & schedule things if you want. ChatGPT can be a great resource to help you with thinking of all the things and coming up with a rough timeline! Basically — know what work you need to do, list it all out, and then plot it out over your calendar.

If you write out your schedule in advance, you’re more likely to stick to it. This allows you to think out your plan of attack and make sure it fits within your actual life & schedule.

Plus, you’ll have a visual reminder of when you’ve fallen behind. Besides a list of the actual tasks you likely need to do, my printable planning playbook includes two more tools to help you schedule out your bookkeeping work — a tiny steps daily checklist and blank monthly calendars for January through April 2026.

If you are more of a digital person, I love using Asana to schedule out tasks like this over time. Brain dump your entire list of bookkeeping to do’s and enter it as an Asana to do list. Then, schedule dates for each and every action item.

Step 5: Don’t Forget about Inventory (This Is the Sneaky One)

As a maker, dealing with your inventory is likely to be the biggest component of your catch up process. Yet it’s a concept a lot of us totally ignore!

First, brush up on how inventory and cost of goods sold work for tax purposes. You might need to catch up on entering all your inventoriable supplies for the year, then do an end of year count to determine your ending inventory amount. If you are behind, make sure you set aside enough time to count, measure, and do a whole lot of data entry.

I’ve got a free 20-minute video all about year-end inventory work here.

It helps to know what to expect on the Schedule C.

It’s hard to know what you’re really doing here if you don’t understand where all these numbers are going. Take just an hour or two to review the Schedule C, the tax form where a lot of this info is likely going. I have a handy breakdown of the Schedule C here as well. Understanding this tax form will give you more confidence that you’re catching up on the necessary info and not wasting your time worrying about other things.

If you’re freaking out, I’ve got something to help you.

If you’re the kind of person who reads this post and thinks, “Okay, this makes sense… but I want someone to tell me exactly what to do in order.”

You’re not alone. Most of us do way better with some structure! And sometimes…someone telling us what to do!

My course, the 2025 Bite-Sized Bookkeeping Bootcamp, is designed to help you catch up on your 2025 finances in the least stressful way possible. I’ve broken down everything you need to do to update your books for the entire year in tiny, itty bitty, doable steps that are actually manageable.

✅ FAQ: Catching Up on Bookkeeping (U.S. Sellers)

How long does it take to catch up on bookkeeping?

Most online sellers catch up in 8–20 hours total, depending on how many months they’re behind and how many platforms they sell on. Splitting it into small sessions is usually the fastest approach.

Do I need QuickBooks to catch up?

No. QB is often too many unnecessary bells & whistles for many “micro” ecomm shops. Not to mention it’s a hefty recurring monthly subscription!

Plenty of online sellers catch up using Paper + Spark spreadsheets — especially if you’re mainly focused on clean Schedule C totals for taxes.

Can I catch up using only bank statements?

I don’t recommend it. Your bank statements often only include net deposits from the platforms on which you sell, and for tax purposes, you usually need your gross sales totals. You need to go into your Etsy/Shopify/Amazon/etc. reports and find & record your gross sales and then separately enter and deduct things like fees, refunds, shipping purchases, ad expenses, etc. All P+S spreadsheets help you through that process.

Do I really need to track inventory for taxes?

If you sell physical products and keep inventory or raw materials & supplies on hand, yes. Inventory affects your Cost of Goods Sold (COGS) and can change your taxable profit significantly.