Let’s talk about SHIPPING! Shipping can be a complicated topic for a creative biz owner because there are many facets to the “shipping” question. This comprehensive guide to shipping will address all the different “types” of shipping your business probably deals with:

- Shipping expense you pay on supplies for your business or for the goods you create (inventoriable supplies)

- Shipping expense you pay for non-inventoriable supplies for your biz

- Shipping expense you pay to ship your finished goods to your end customer

- Shipping expense the customer pays YOU when purchasing one of your goods (this one is really shipping income for your biz)

We’ll discuss how to account for shipping for both bookkeeping and tax purposes. We’ll also cover how to deal with shipping when it comes to your income taxes and your state sales taxes.

So let’s just dive right into it, shall we?

How to handle the shipping expense you pay for supplies & business goods

When you buy a raw material, supply, or good for your business, you may also pay a fee to ship the order to you. This is a shipping expense for your business. The biggest question is just how to record this expense.

First, we need to distinguish what you’re buying – an inventoriable supply or item, or something that is not inventoriable.

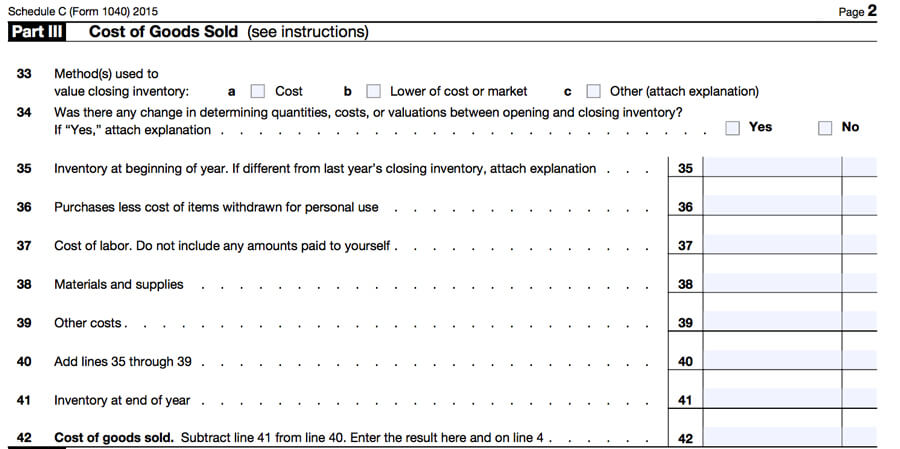

Inventoriable items are raw materials or supplies that will go into the finished goods you create and sell, assuming you’re crafting your finished product from other materials. If you’re reselling finished goods, then the wholesale good you’re buying would also be considered inventoriable. So for tax purposes, the cost of these supplies or items will basically go into your inventory (asset) account, and you don’t necessarily deduct that cost in the year you paid it.

The cost of these supplies will sit in your “inventory bucket” until you sell the finished good created with them, and then you can deduct the cost (including their shipping cost) as part of your cost of goods sold deduction. Hopefully I haven’t lost you, since I know inventory and cost of goods sold should be an entire post on its own!

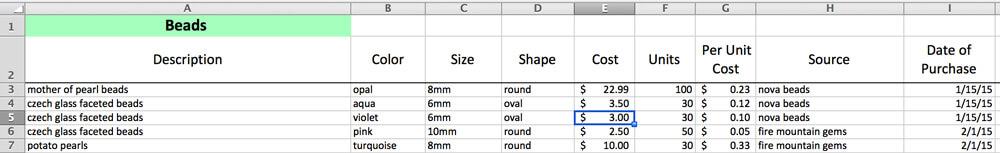

Following that train of thought, you should be recording your raw materials & supplies in a system that allows you to determine the cost per unit (i.e, this bead cost me $.02, this yard of fabric cost me $2.25, etc.). You might make 100 bracelets with all those beads you bought in 2016, and then sell some bracelets in 2016, some in 2017, and some never. Thus, you can only deduct the cost of some of those beads each year.

The same logic applies to the shipping expense for getting those beads. Your shipping expense paid for these supplies becomes a part of the cost for that item, and thus is divided into the per unit cost. So, bottom line, if we’re talking about shipping expense paid for inventoriable supplies or goods, then you will need to take the total shipping you paid and assign a portion of it to each unit you purchased.

An example of how you would enter your inventory supply costs. The shipping you paid for the item would be included in the “cost” column here.

An example of how to deal with shipping expense for supplies –

I ordered 20 yards of fabric at $4/yd, and paid $10 for shipping – so I paid $80 + $10 = $90. Thus, my cost per yard is $90/20 = $4.50 if I include shipping.

Things get more tricky if you have a big supply order of all sorts of different items. In this case, you will need to take the total shipping paid and divide it up amongst all the different supply items.

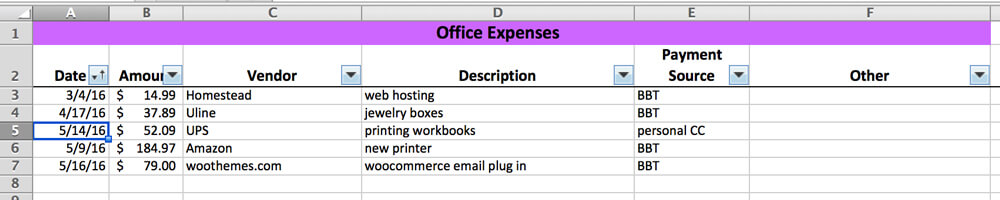

On the other hand, if you are buying business supplies that aren’t inventoriable, then you don’t need to get this detailed. For tax purposes, the shipping expenses paid by your business for all your non-inventoriable supplies can simply be deducted in the year paid. So, if you pay shipping for a new printer or a ream of paper, just lump that into the total cost of the item.

An example of how to simply combine your shipping paid + item cost for non-inventory supplies

How to handle the shipping expense you pay to ship goods to your customers

Another type of shipping expense for your biz is the cost you pay to actually ship orders to your customers. This obviously is also considered a shipping expense for your biz, and deductible for tax purposes in the year paid.

For both record-keeping and tax purposes, dealing with this category of shipping expense is pretty straight forward. You will want to keep track of this type of shipping expense in its very own category. You can deduct it under the “office expense” line or the “other expense” line on your Schedule C each year.

How to handle the shipping amount your customer pays you when purchasing an item

As I mentioned before, if a customer pays you an amount for shipping, it’s considered revenue (or income) for your biz. It does not matter whether the shipping amount is stated separately at checkout in your listing or lumped in with your total price. It’s still revenue.

For bookkeeping purposes, I’d suggest recording your shipping revenue on a separate line or in its own category, just so you can monitor your total shipping revenue vs. the amount you actually spend on shipping (you want to make sure you’re not losing money on shipping your goods). For tax purposes, let’s consider both income tax and sales tax repercussions.

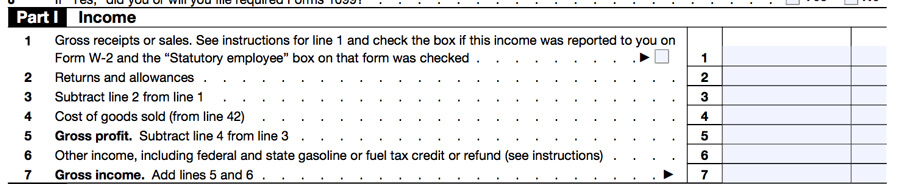

The federal government wants to know ALL your taxable revenue. That means you need to include your shipping amounts received as income on your federal income tax return for your biz (likely on your Schedule C). You would include your total shipping received as part of your “Gross receipts or sales” total on Line 1 of your Schedule C.

In general, if a form ever asks you for your “gross” sales, you can anticipate that that means your total sales + total shipping received (but I always recommend you check the form instructions to confirm!).

Now as for sales taxes, you need to know whether or not to charge sales tax to your in-state customers on just your sales total, or on your sales total plus shipping. This will vary by state, so make sure to search your state’s comptroller site for whether or not your state charges sales tax on shipping. A simple Google search of “Does XX charge sales tax on shipping?” or “Is shipping taxable in XX?” will probably guide you in the right direction.

While on that note, you want to make sure your shop is setup to charge sales tax correctly. If you’re selling on Shopify, WooCommerce, or another online venue, there is a setting (sometimes difficult to find) where you can simply check off whether or not to include shipping received as part of the amount subject to sales tax.

Note that when it comes to your orders, you will have both a shipping expense (paying to get it to your customer), and a shipping revenue (the amount the customer pays you for shipping). These two amounts really have nothing to do with each other. It doesn’t matter if they’re equal, or if your customer pays you more or less than what you actually end up paying UPS/USPS/FedEx, etc. Each is treated separately, and you will never “net” them together and use that amount for anything, anywhere. The only time you would actually want to do that is if, strictly for analyzation purposes, you want to know if you’re coming out ahead or behind on your shipping prices.

Want to know more about your biz finances?

If this post got the money-side of your brain in gear, you might enjoy honing your skills even more with our free e-book all about setting up a biz bank account and bookkeeping system for your shop. You can also check out our bestselling financial templates & spreadsheets here.

What do you do if some of the beads you ordered arrived damaged or they broke while you were crafting with them? Then you can’t use those beads in your work to sell. What happens then? Thank you!

I am learning so much! Thank you for sharing your expertise.

This is great information that helps me use your inventory spreadsheet.

When you have a shipping expense to a customer (I.E. a USPS label was purchased to ship someone their purchased item), where does that expense go on the Schedule C? I don’t see a specific category for it and it definitely doesn’t go into COGS. Does shipping expenses to a customer go under “other expenses” (line 27a for 2018)?

Incredibly helpful–all the simple things two different CPA/tax preparers have never bothered to tell me! I’ve been doing it all wrong & was always befuddled about whether/where to include the inbound shipping component (I’ve been including it in pricing, but didn’t know how to account for it for tax purposes–kept them separate & have probably lost out as a result.

Would shipping supplies, such as mailers, tissue paper/wrap, labels, etc. for shipping handmade goods to customers from an exclusively online shop be considered an expense, and all get lumped together in shipping expenses, or is there more to it (COGS- Shipping, Freight, Delivery or COGS – Supplies & Materials, etc.)? Thank you. =)

I usually would consider them a regular supply expense, not part of inventory.

So does sales tax you paid for a supply order get calculated the same way? For example, you said to take the shipping expense and divided it evenly amongst all the supply items in your order. Do you take the total sales tax you paid for a big supply order and divide it evenly amongst all the different supply items or do you have to do it proportionately based on the cost of each supply item? Hopefully that makes sense. I’m just trying to calculate things correctly for my inventory.

Either way is fine. I think the easiest method would be to take the sales tax rate and apply it to your items, but sometimes that can be complicated if you have sales tax on shipping or discounts applied.