All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. Please read my full disclaimer regarding this topic.

Alright friends. Today I’m going to talk about something serious. Something that keeps rearing its ugly head around the internet, basically since the dawn of time.

I started Paper + Spark to help creative entrepreneurs feel less confused and more confident about the financial side of running their biz. My goal is to educate and to explain these sometimes confusing issues in simple plain English. So, here we go.

(PS – a great place to start is with this free checklist to help you get your financial ducks in a row!)

There’s this myth that likes to flit around the internet that if you sell online (via Etsy or elsewhere), you’re considered a hobby and you don’t need to report your sales on your taxes. You have likely seen variations of this myth. It might start with something like, “I’m just doing this as a hobby so…”. Or it might not even involve the trigger word, “hobby”. It might be something along the lines of – “I heard I don’t need to report this money for taxes until I make $X.”

I hate to rain on your parade, but it’s not true.

First, if you are indeed actually a “hobby” (which the IRS, fun crew that they are, has a formal definition for), you would still need to report your “hobby” sales for tax purposes. There’s no way around reporting that money, regardless.

Second, and most importantly, your business is probably not a “hobby”. Do you have the intent of making a profit with your shop? If the answer is yes, then you are the proud new owner of a business, my dear! It doesn’t matter if you’re not making a profit (yet). It doesn’t matter if you only made $300 in sales. It doesn’t matter if you haven’t “registered as a business” yet. You’re a business.

In the words of the IRS, “Generally, an activity qualifies as a business if it is carried on with the reasonable expectation of earning a profit.” So really, whether you’re a hobby or a business really boils down to intent. Are you just selling things to fund the cost of your craft stash? Maybe you’re a hobby. But most of us who set up shop at least have the intent or goal of making some money (whether we actually do is another story!).

So back to my myth. Business or hobby, there is NOT a minimum sale amount your business must meet before you need to claim those sales on your tax return. You have to claim that money regardless. The only distinctions between business vs. hobby are: 1) where you claim those sales (like on which tax form), and 2) whether you can reduce those sales by any related expenses.

How to report hobby income

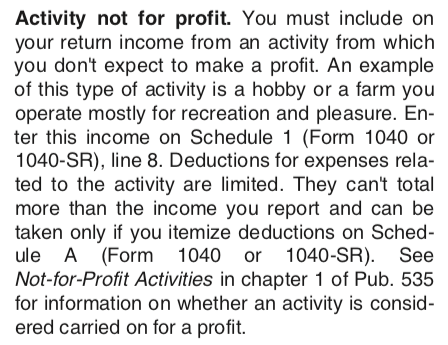

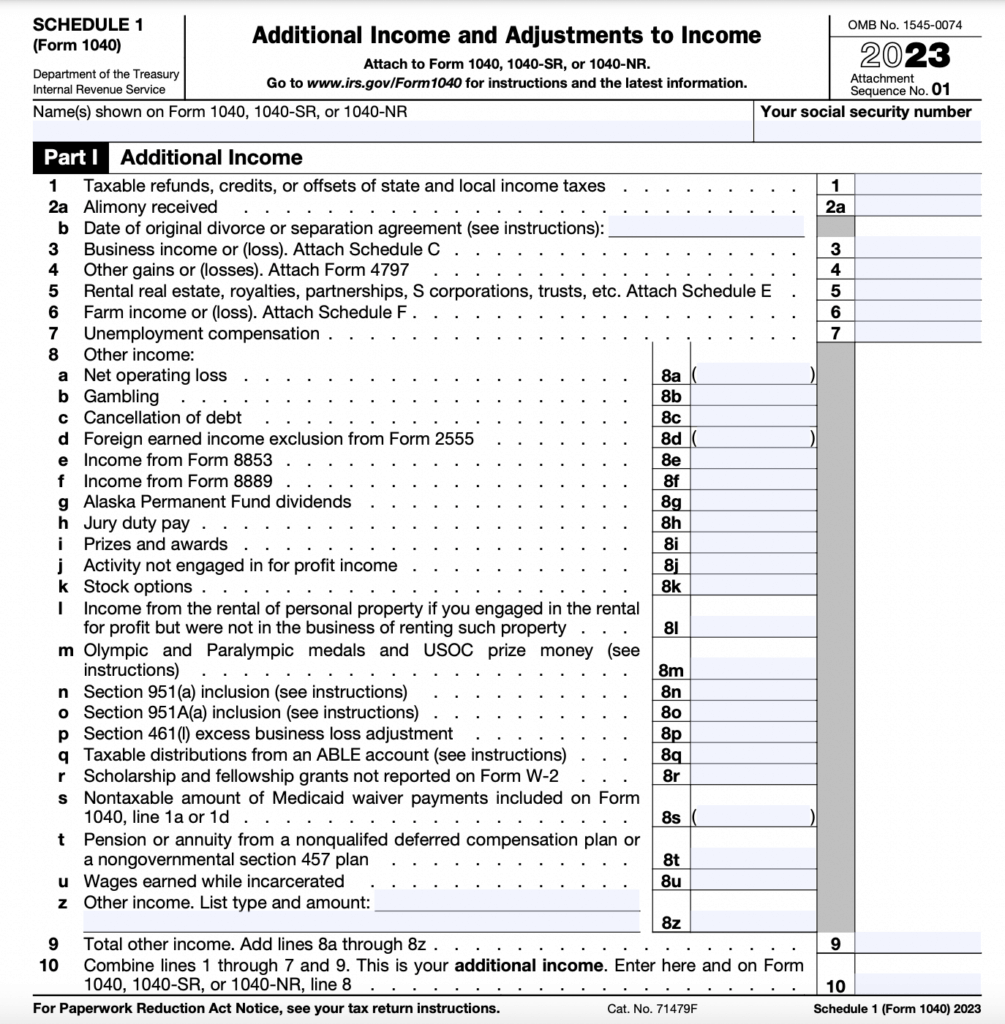

Where it goes: If you’re indeed a hobby (which the IRS also calls a “not-for-profit activity”), then you should report your total hobby sales (no matter how small) on line 8 of the Schedule 1 that goes with your personal Form 1040, as “other income”. Those sales just get lumped in with your personal wages and any other family income.

Taken from IRS publication 525 on Miscellaneous Income

Your hobby sales would go on Line z of your Schedule 1, which is filed with your Form 1040, whereas business net income will flow from a Schedule C to line 3 of this form.

How hobby deductions work: Thanks to tax reform in 2018, hobbyists can generally no longer claim any of their hobby-related expenses, meaning you’re taxed on the full amount of your hobby revenue. You can read all the details about not-for-profit activities in IRS Publication 535.

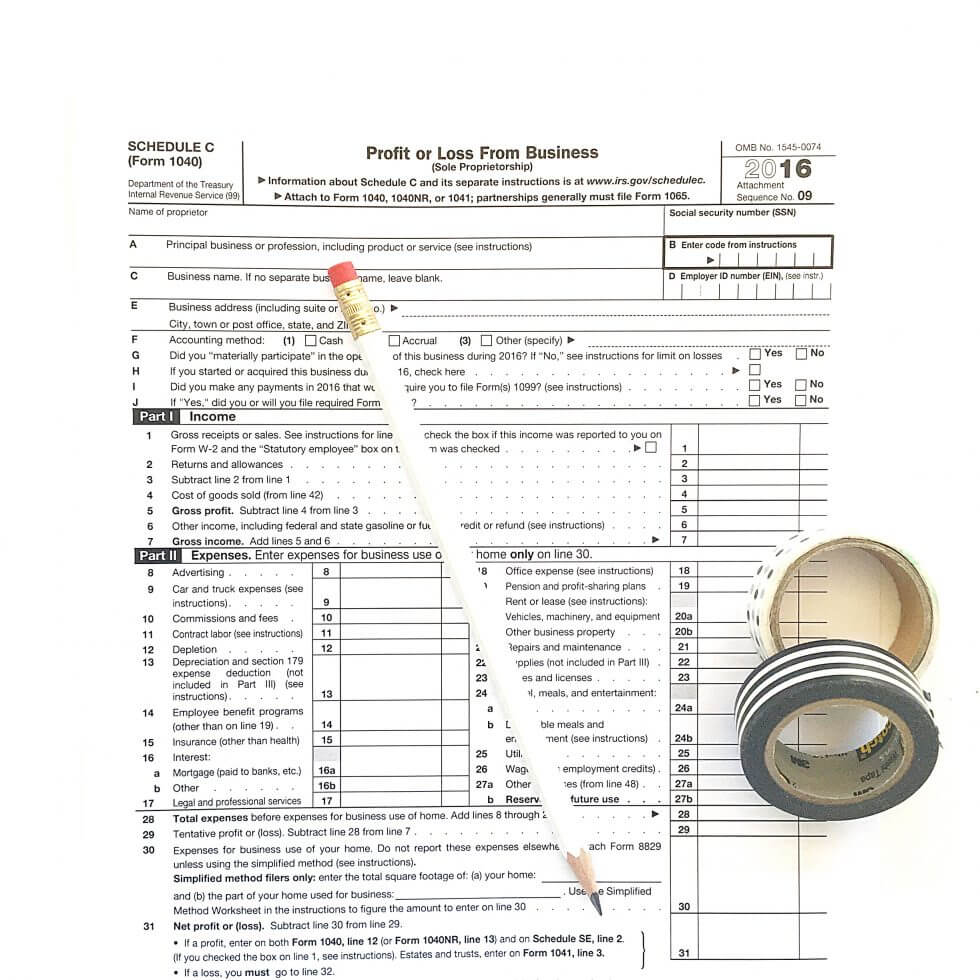

How to report business income

Where it goes: Your business will get it’s own form for taxes. For a lot of us creative business owners, that form will be the Schedule C (which is what a sole proprietorship files). If not the Schedule C, it will be a similar form. With the Schedule C, you’ll report all your business revenue and expenses to calculate your net profit or loss. Your net profit or loss travels back over to your Schedule 1, line 3. Then it too travels to your personal Form 1040, where it’s lumped in with your personal wages and family income and taxed accordingly. I delve into the Schedule C here.

How business deductions work: Unlike with hobbies, you can deduct any expenses that are considered ordinary and necessary to operate your business. Your business is taxed on it’s net income. You can even have a loss, and your loss can reduce your personal income on your Form 1040, lowering your tax bill.

It’s worth mentioning here that there is a minimum threshold for self-employment tax, which applies to businesses (reported on Schedule SE), and that’s a net income of $400 or more. So that’s why a lot of times you’ll hear the rumor that you don’t have to claim your sales until you “net $400”. That’s still not correct, since it only applies to self-employment tax specifically, not federal income tax.

If you’re just figuring out your a business, don’t get anxious! Check out this free checklist to help you get everything set up correctly.

federal and state are different animals.

Everything I’m discussing here is for federal income tax purposes. Sometimes these rumors get started or the confusion stems from states having different income thresholds and requirements for reporting. So always remember that your state may have it’s own requirements regarding state income tax, state sales tax, property tax, franchise tax, etc.

so, what’s the point?

My first point in the “hobby vs business” debate is that you’ve got tax responsibilities regardless of what you are. You have to record that income and get taxed on it no matter what. Don’t fall into the trap of thinking you don’t need to claim income until X happens. Once you set up shop and make that first sale, you’ve got tax responsibilities. Most likely on both the federal level and state level too.

My second point is that it’s really more beneficial for you to treat your business as a business and file accordingly. If you’re trying to avoid having to deal with paperwork, you might try to classify your business as a hobby, incorrectly thinking that means you don’t have to report anything. In reality, the downside of being a hobby is that you will be taxed on your full income. So it’s usually in your best interests to operate your business in a businesslike manner (like you’re intending to make a profit!), keep up with your bookkeeping, and report your business revenue and expenses.

need some help getting started?

I also have a free on-demand workshop all about this topic if you want to learn in VIDEO mode. In this 45-minute workshop, I review hobby vs business AND I dive into the financial to do’s and concepts you need to get familiar with as a legit business owner. Learn more here.

Great article, Janet! I’m sure this topic is making many Etsy sellers anxious and you’ve helped alleviate that by providing detailed info and links. I am opening my Etsy store very soon and I’m so glad I came across your website. There are not many that specifically focus on the financial end of a creative business, but you’ve chosen a great niche and I’ll be signing up for your newsletter. Can’t wait to see what else you have to share!

Thank you for the kind words Leslie! I am happy to hear you found this article helpful!

Excellent, simple easy to understand information! Thank you, great article!

You are very welcome Christine!

This is very interesting. I have been doing my own taxes forever, filling out a schedule C for my photography business for over 10 years. In all those years I have never shown a profit, and recently an accountant told me that unless I want to risk an audit, I should show a profit at least once every 3 years. Is this true?

Hi Patricia! it is true that the IRS looks at certain things regarding your business potentially getting audited. One of those (out of NINE) is showing a loss for the past 3 out of 5 years. If you consistently have a loss, it is more likely you could get audited. However, it is just one factor and does not mean you would get your “business status” thrown out and then be considered a hobby. If you are still running your activity like a business, even though you have a loss, it’s not necessarily the end of the world. I would definitely make it a priority to turn a profit though!

Thanks so much! I will try. 😉

Hi! I was just sent this article from a friend and I have a question, does this apply to Canadians as well??

Isn’t this article a little outdated? I heard that tax laws changed for 2018? There is no longer a line 21 on Form 1040 (to report hobby income), it’s now on Schedule 1. Schedule A no longer exists and none of the new Schedules 1-6 allow for hobby deductions. Schedule C looks pretty much the same. But isn’t there a new 20% pass-through (profit) deduction for qualified businesses?

I realize it’s difficult to keep everything updated, but still……..

Hi Nancy, great question. There are new tax rules for 2018 returns, but none of them affect any of the concepts I discuss in this post. The Schedule C looks nearly exactly the same, and while the format of the Form 1040 has changed, the way your business income flows from the Schedule C to your personal tax form is essentially the same, just different line numbers on a different page. Hobby deductions are now even more difficult to take than in prior years. I will definitely be updating the post with pictures of the new 2018 form as soon as I can.

Hi Amanda! I am a CPA in the US so I can only speak to US rules. Unfortunately, I have no idea how this converts to Canadian tax law.

what if my sales were $12.00 total for the year?

So if I’m “selling” my items as a fundraiser and I don’t keep any of the profits, is this something I’d still need to report? A close family member is battling cancer and I’ve been contemplating the idea to help raise money for the hospital bill.

Hi Janet, I new seller at Etsy, I want to do tax return joint with my husband, what is file form tax return that I should be use for file Tax return for my sale. I just know such as :

1. Form 1040

2. Schedule C

that is correct ?

What another form Tax return that I should be use it ?

Thank you

I’ve been purchasing materials for years and last year is the first year I got serious about starting an actual, licensed business. I purchased your inventory spreadsheets and have been counting, pricing, and cataloging as much as I can but I’ve run into 2 questions.

1) If it is simply not possible to identify a material (a string of beads, for example) on the receipt, can I count it as an untraceable cost, and enter it into the Indirect Costs box? Since I bought it, and will use it (whatever it is) eventually, but I can’t trace it?

2) If I have quite a bit of supplies I purchased prior to 2018, and only some of the coinciding receipts, how do I account for these in my inventory? Should I just leave them off of my official tax records, since I can’t deduct the costs for the supplies without receipts anyway? Or should I still count and catalogue everything… because when I do end up selling, for example a greeting card I printed in 2017, I will have sold a “Good” that is not in my inventory. When I filed my taxes last year, I took the standard deduction, and my sales tax return for California was for zero sales, since I didn’t sell anything in 2017.

I would say it depends. Do you have expenses you want to claim? Do you plan to build your sales and business in 2019? I would consider what you will likely be doing for sales & taxes in 2019 and file accordingly.

What if I made under $15O on 3 sales the entire year, and my expenses were over $800, so I definitely didn’t profit. do I really have to claim this? I deleted my “shop” by the way because it’s just not for me.

I found this article to be to the point but, as a bookkeeper, there is one point you made that I have to disagree with. In your article you wrote ” the downside of being a hobby is that you will be taxed on your full income”. This is not quite accurate. As a hobby, you can deduct the expenses associated with that hobby on Schedule A of you personal federal income tax return. However, there are other itemized deductions that are also assigned to Schedule A such as certain medical and dental expenses, mortgage interest, and charitable contributions among others.. If the total of the items on Schedule A are 2% or more of your adjusted gross income (AGI), then you have the option of choosing that amount rather than the standard deductions. The tax law allows you the greater of the two. Although this seems like IRS gibberish, the bottom line is that you can only deduct the expenses from your hobby income up to the amount you made (income) from you hobby and ONLY if the TOTAL amount on the Schedule A is 2% or more of your AGI. If not, you still have to declare (and pay income tax on) your hobby income. If that is the case, maybe it’s time to consider getting an EIN (federal ID number) and reporting your income and expenses on a Schedule C – Profit and Loss from a Business. That’s a whole other story and set of rules.

There are advantages and disadvantages to either situation but, as a bookkeeper, I would recommend always keeping good records either way.

Hi Linda! This is a good point for pre-2018 taxes, but Congress did away with the 2% limitation and all miscellaneous deductions subject to them with tax reform last year. Thus in 2018 and all years going forward, hobby expenses are not allowed even as an itemized deduction. The only “other” itemized deductions that are allowable (line 16 of the Sci A) are those listed in the instructions here: https://www.irs.gov/pub/irs-pdf/i1040sca.pdf

Do you claim net amount you make at Etsy on taxes, as etsy takes lots of fees off etc….

How would a single stay at home mom go about this if I wouldn’t be receiving any tax forms or otherwise filing for the year?

Start by checking out the Schedule C. You would potentially need to file that along with beginning to file a Form 1040 each year.

Hey! This is probably a really stupid question but do we just pay the taxes on items at the end of the tax paying year? Or do we pay it throughout the year based off of the income? Also is it true that we basically pay all of what we’ve made in profit back in taxes?

Do you need to get a business license to declare yourself a business?

Should I do amendment on my tax return? I believed I made an error when on-field. It was a hobby instead of business. I didn’t see the line 21 so it was reported on Schedule C line 3 instead.

Hi Cherry, the decision to amend is really up to you and your tax preparer, and dependent on your risk tolerance.

Generally just the act of selling makes you a business – even if you don’t file any official paperwork you default to being considered a sole proprietor. A lot of us think we need to “register” or fill out some piece of paper to officially become a business, but that’s generally not the case. You likely DO need to fill out some paperwork but you can still be considered a business even if you don’t follow those steps as you should. You’re then just a business that hasn’t filled out all the paperwork/gotten the licenses yet.

Hi Julia, this depends. Many businesses will owe income tax at year end and file it annually with their tax return (generally due April 15). Other businesses may also may estimated quarterly tax payments, where they are guesstimating how much they will owe April 15th and basically pre-paying that bill in quarterly amounts throughout the year. The best way to figure out if you need to pay estimated quarterly tax payments for your business is to take a look at the Form 1040ES.

If you don’t know your numbers and you don’t price for profit, you can totally end up in a situation where you pay a huge chunk of your profit in taxes. But this shouldn’t be the case for most business owners who are on top of their numbers, pricing, and profits. And I always suggest saving for taxes throughout the year as well.

I wanted to see if you could help me, or direct me. I am currently starting a new business. I make homemade candles. I been doing it for awhile. I made it more for gifts. But a friend just ordered for her wedding in January. I wanna make sure I am doing this correct. I would read that it’s best to trademark and get insurance. I have been researching and I really get overwhelmed fast. So much packages to choose from and all different type of cost. If you could help me I would greatly appreciate it.

Hi Josh, as a candle seller it may be wise to look into business insurance. I would not think you need to trademark right away – that’s a big expense, unless your brand is quite unique and you’re worried about copycats right out of the gate or something like that. From a financial standpoint, you want to look into getting your DBA (doing business as) license, sales tax requirements in your state (you may need a sales tax permit), opening a business bank account, and setting up your books. If you download the checklist in this article, it’s a great place to start!

So if I were to report my sales as hobby income on 1040, I would report the full income AKA I cannot subtract any Etsy processing, listing, transaction fees and shipping? Since those would be expenses?

Thank you, this article has been super helpful! 🙂

I am in my 2nd year of selling my crafts and tee shirts. Just by word of mouth and a Facebook page. What do I need to do.

Get legit! Set up your books, start tracking your sales & expenses, get a sales tax permit and a business bank account. Download the checklist in this post and it gives you the step by step!

Thank you for this helpful info!

Great feedback/ thanks for making it approachable to read & understand. I’m in with your newsletter & workshop! Thank you

I have been trying to find out how to legally run my Etsy shop and I just have one question that can’t seem to be resolved. I am based in NY and I am just wondering if we are required to register our shop name as DBA? And since Etsy is remitting the taxes on behalf of us now, do we still need a sales tax permit? I apologize for my concerns but I would love some advice from you. Take care!

Thank you. This is helpful. I was recently getting into just playing around with resin for the fun of it and figured I would sell the things that I don’t want to keep on Etsy just so I’m not clogging up my apartment. But I do my taxes myself since normally I only have my W2 and I didn’t know if/how to report what will likely add up to $50 or less. So I’ll just toss it into the Other category and leave it at that. Since I’m crafting for fun and not with the intent to necessarily make profit. And with as little as I’m actually going to make, it’s not really gonna effect my return.

Very informative…the only thing I’m not seeing addressed is that in reporting as hobby (Sch A Line 8) you DO get to reduce gross receipts to gross income by the cost of goods sold (only) which are very specific costs and do not include things like site fees or postage or mileage on the sale, just mainly the cost of your materials if you are a maker of some sort, see IRS pub 535 for tax year 2020 page 3, 6, 7.

I’d like info

Thank you so much for all the helpful information! I do have a question that I didn’t see answered (or I missed) if you claim your shop as a business, do you need a business license? Or is there a point that you will need to get one? I’m in California if that matters at all.

Thank you,

You can be filing as a business at the federal level (like filling out a Schedule C at tax time) without a business license at the local level. But usually, you would need a business license as well. The state usually has no clue what’s going on at the federal level and vice versa.

Hi Teresa, Schedule A is only for taxpayers who itemize their deductions. Line 8 is now for home mortgage interest. Prior to tax reform changes, you could sometimes claim those expenses you mentioned for a hobby activity as a miscellaneous itemized deductions on your Schedule A. After the tax reform changes made in the past few years, there are no more miscellaneous itemized deductions. Plus, a large majority of taxpayers no longer qualify for itemizing anyway.

Every state is different, but generally if you’re running a shop under a name other than your own legal name – a DBA is required. If you are selling ONLY on Etsy, NY maaaay not require you to get a sales tax permit. Most states still are requiring one, even if you sell only on an online marketplace. When in doubt, call your state department of revenue! Even if you get a permit, if you are only selling on Etsy, you will file $0 sales tax forms since Etsy is handling it for you.

Super helpful post! Does this apply for a blogger the same way? I am always confused as to where to report on a tax form (which forms to use) any affiliate income or value of products given to a blogger to try and write a review. Please let me know if you have already written a post addressing g this!

Thanks so much for this information. I look forward to watching your video.

I’m a US Citizen living as a permanent resident in the EU, and I am considering selling products on Etsy. I’m only interested in shipping/selling within the EU. But as a US Citizen, do I still have to report my income to the IRS even if I am paid in Euros and not USD?

Thank you for this section. This is extremely helpful. If you fill out a Schedule C for a business, do you need a license or any kind of proof that you are a sole proprietorship?

What is meant by hobby revenue.? If I sell on Etsy, is it what Etsy returns to me or is it what Etsy sell it for plus tax. In the 2nd case I will be paying on income I never received and Etsy will also be paying corporate income tax

on the same amount, duplication of Tax.

If I sold something on ETSY which was sold for $100 plus $8 sales tax and Etsy gave $70, is my hobby income $108 or $70?

If Etsy bought the product from me for $70 and sold it for $100 plus tax, clearly my hobby income is $70.

Does that suggest something?

I would like to watch this information to help me understand what I need to keep track of. Thank you.

So, what about people who have yard/garage sales every year, as a hobby or craft shows and flea markets. Some of the items are marked up to make a “profit”?????

Do you need to file taxes quarterly as a sole proprietorship?

Filing “quarterly taxes” can mean a few different things – sales taxes? Sometimes they are due quarterly with your state. Estimated quarterly income taxes? That depends on how much income tax you think you will owe, as a sole prop or any other type of entity, at tax time.

If they’re marking up items and trying to make a profit, it wouldn’t be considered a hobby. If it’s a true destash/garage sale situation, it’d be other income and not a business.

I’m a CPA and it’s important to clarify the comment that you will pay tax on all hobby income. If you read the IRS publication on hobby income, you can subtract cost of goods sold from the gross income so you aren’t paying tax on all revenue – that wouldn’t be fair since it did cost you to make the item.

If you’re wanting to sell two different things for example: Digital Data and hair bows would an individual have to set up different platforms and obtain different types of permits and licenses or could these two products fall under on umbrella and tax requirements?

Thanks for offering the workshop. Trying to stay informed.

Excellent article! Thanks for clarifying the difference between hobby vs buisness.