Understanding how to start a new creative business can be a daunting task, especially if you don’t have a background in accounting or business. We have so many questions when we first set up shop – what do I need to take care of on the legal side of things? How do I file my taxes now? What expenses do I need to keep track of, and how exactly should I do that?

A lot of times you will hear people say that your best bet is to hire an attorney or an accountant to help you get everything set up correctly. And that’s great advice, but I feel like most times it’s a tad unrealistic. Unfortunately as a newbie biz owner, we generally don’t have the funds to seek one-on-one professional help with these questions right away.

If you aren’t ready to hire a lawyer, CPA, or accountant, you probably turn to your trusted best friend Mr. Google to search for guidance. There’s a lot of fluff and misinformation out there. And a lot of info geared for bigger “traditional” businesses, not online creative entrepreneurs or even more specifically, makers. So in an effort to save you some time & overwhelm, I put this list together so you can stop the search.

accounting resources for creatives

I feel like resources with the actual detailed info about accounting, taxes, and bookkeeping, especially geared toward handmade sellers, is harder to find, and that’s what you really need in your pocket to feel confident DIYing your finances. If you’re ready to soak up some money info like a sponge, then this list is for you!

Today, in an attempt to save you some time and stress, I’m going to round up my favorite and most trusted resources to help you, the creative biz owner, learn more about accounting, taxes, and all the money stuff that a creative entrepreneur needs to know.

Please note that this post contains affiliate links. All opinions are my own.

courses

CFO 101 SERIES BY PAPER + SPARK

Yeah, I gotta start out with myself. 🤣 If you’re looking for something (free!) to just dip your toes in the water, the CFO 101 series was designed to do exactly just that. Over the course of 5 days, I’ll gently ease you through an introduction to the must-know topics of being CFO of your shop. Each lesson is delivered straight to your inbox, easy peasy. Sign up here.

THE Get Legit Toolkit® BY PAPER + SPARK:

My Toolkit is the ultimate comprehensive resource for getting clear and confident on your financial responsibilities as a handmade seller. This course walks you through each action step to build your business’ financial foundation correctly AND in plain English. By the end of the course, not only will you be legit at a state, local and federal level, you’ll actually understand how to deal with your biz finances.

We cover topics like sales tax, licenses & permits, the Schedule C, inventory & cost of goods sold, business bank accounts, paying yourself, and saving for taxes. This is the only financial course out there made especially for makers that covers topics like taxes & inventory.

The Toolkit only opens for public enrollment twice a year. Click here to see if now’s the time. If not, you can get an exclusive private invite if you attend this on-demand free workshop.

WHEN TO WORRY ABOUT TAXES FOR YOUR HANDMADE SHOP WORKSHOP BY PAPER + SPARK:

This isn’t a true course, but a free on-demand 45-minute workshop that you can watch here. This workshop is a good place to start if you have ALL the questions. You may not even be sure if you’re truly a *business* yet or not. I review the definitions of hobby vs. business in this workshop, along with all the financial responsibilities that come along with that!

KNOW YOUR WORTH COURSE BY AMY NORTHARD

I’d be remiss if I didn’t mention this program by my fellow CPA Amy Northard. It covers issues like choosing the right entity type, setting up a bookkeeping system, payroll and salaries, and small biz deductions.

books

ETSY-PRENEURSHIP

The book Etsy-preneurship, written by Etsy powerhouse and CPA Jason Malinak, is a business bible for anyone hoping to succeed on Etsy. Etsy-preneurship covers all sorts of business & legal topics for makers, and it’s not limited to just the money stuff. You’ll read about business plans, bookkeeping, taxes, budgeting, business structures, and marketing plans.

MINDING YOUR BUSINESS – A GUIDE TO MONEY & TAXES FOR THE CREATIVE PROFESSIONAL

Minding Your Business is a straight-forward book written by CPA Martin Kamenski. It covers financial topics relevant to artists, photographers, and musicians. It’s probably more appropriate for creative professionals and less so for makers, but he covers all the important basics – how to deal with your expenses and income as a self-employed creative, different business entities, methods to track your expenses, and how to deal with the IRS.

PROFIT FIRST

Yep, I’m on the Profit First bandwagon. Although this book is really written more for your “traditional” small business, I love the basic concepts Mike Michalowicz teaches here. The profit first mindset is all about setting your business up to serve you – and pay yourself first. Too many makers do NOT pay themselves, so this is a concept I’m completely on board with and want you to get on board with too!

educational blogs & sites

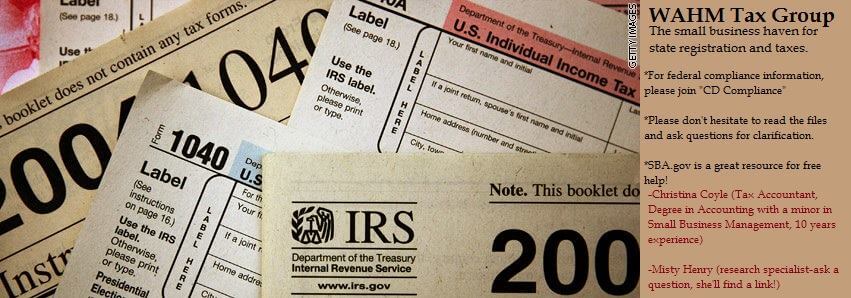

ACCOUNTING AND US TAX COMPLIANCE GROUP ON FACEBOOK

This is a great free forum to ask questions about your biz taxes, or better yet – search for other questions & answers. This forum, led by tax accountant Christina Coyle (and formerly called WAHM Tax), is a great resource. With over 24,000 members and counting, chances are whatever your question is – someone else out there has it too!

BLOGS

There are a handful of really great blogs out there that feature articles all about the money-side of creative entrepreneurship. I always encourage you to check out the P+S resource library (right here!). Here are a few more blogs I recommend:

government stuff

YOUR LOCAL SBA OFFICE

Now if you’re anything like me, you probably want to avoid going to any government-related office in person like the plague, especially if you have any tiny tots that would have to tag along. I personally have never called nor visited my local SBA office, but I do believe that it can be a great resource if you’d like to ask your questions to and get feedback from an actual live person! Depending on your city, SBA and SCORE will also host (free!) seminars to educate local biz owners on relevant topics, like income taxes or sales tax.

GOOD OL’ TRUSTY IRS PUBLICATION 334

So this isn’t the sexiest resource on my list, but this IRS publication, available online in PDF form, is basically your guide to all things small business tax. You can brush up on EINs, self-employment taxes, income tax, employment tax, the Schedule C, cost of goods sold, and all sorts of tax-related topics in this one 50-page guide. I definitely recommend reading it one evening (with a hefty glass of wine or coffee) when you begin your business to make sure you are aware in advance of what the federal tax requirements for you are going to be. Then, when you need someone or something to interpret all the IRS tax jargon into actual English, you can at least go from there.

If you’re looking for a list of recommended bookkeepers and accountants to work with, check out my post here.

If you’re interested in seeing my list of recommended non-financial tools & resources, go here.

What resource have you used to learn more about accounting and biz money?

Thank you for your efforts in putting all this information together. I’ll look into all of them.

I find that starting a small business is not only exciting, but very overwhelming. I have using shopify for my store. I am not understanding a lot, but you website has been a big help.

I’m glad it’s helping! Starting an online shop can have a big learning curve – keep going!