Hola! I hope you’ve read part one of my Inventory 101 series, which covers all the ins and outs of inventory. Click over here to see what should be included in inventory, how to properly track & record inventory, and whether you as a maker even need to deal with inventory as it is! Make sure to read that article before moving on to cost of goods sold, so you understand all the terminology.

I GET WHAT INVENTORY IS – NOW WHAT’S COST OF GOODS SOLD?

Remember how in my Inventory 101 post I discussed how you should treat the cost of your inventoriable supplies as an asset called “inventory”, rather than as an expense right away? Cost of goods sold (COGS) is basically what happens to your inventory when it sells. I like to think of this in terms of buckets…

You’re a maker. You buy a bunch of supplies and raw materials to make your goodies. Some of these supplies stay on your shelf (as I explained before, these supplies go into the inventory bucket). Some of these supplies go into some finished goods you make (these also go into the inventory bucket). All of these supplies and finished products are valued at cost, sitting in that inventory bucket. As soon as one of those finished goods sells, it (specifically, its cost) moves out of your inventory bucket, and into your COGS bucket.

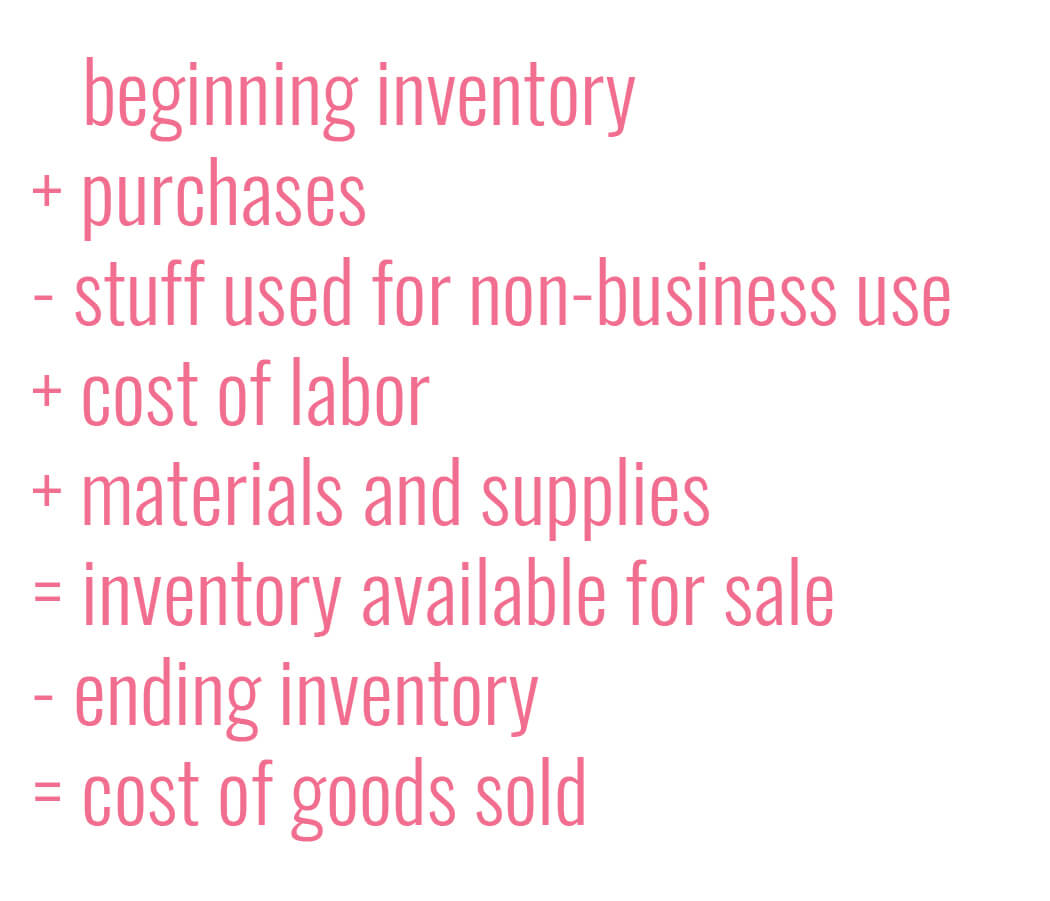

Now this is how I like to think about cost of goods sold, in the form of an equation:

Beginning inventory is zero in your first year of business. For each year after that, beginning inventory simply equals last year’s ending inventory. Remember I said inventory is perpetual.

Materials and supplies are all those inventoriable supplies I’ve been harping on and on about. This is the total amount you spent this year for inventoriable supplies. Add that to your beginning inventory, that leads you to…

Inventory available for sale, which represents all the finished goods, works in progress, and unused raw materials and supplies sitting on your shelf. This is basically everything you’ve got in your shop that’s sitting around. If you take this amount and subtract out your…

Cost of goods sold, which we now know is the cost of all your finished goods that sell this year, then you are left with…

Ending inventory. This is the cost of all the finished goods, works in progress, and raw materials & supplies left on your shelf at year end that you did not sell. For taxes, you should always verify your ending inventory by doing a physical count of all your supplies & finished goods, and tabulating the cost of everything still sitting on your shelf at year end.

How do I keep track of cost of goods sold?

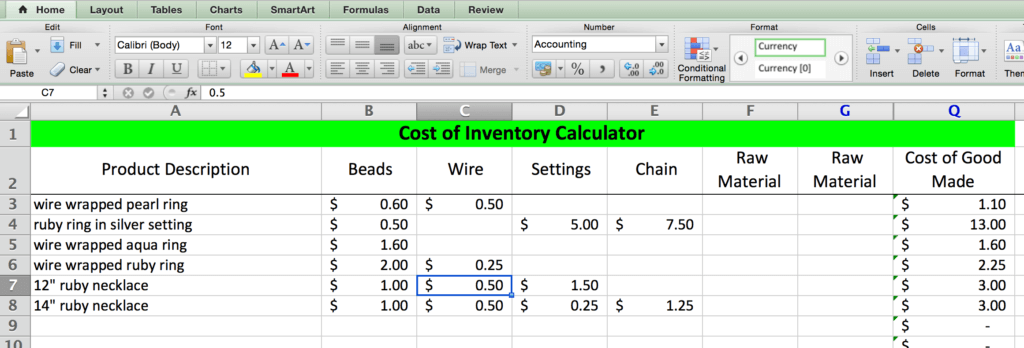

I personally believe that tracking COGS on a per product basis is the best way to handle a handmade biz. Why? Because it’s important to know how much your products cost you to make. If you know how much a product cost you to create, then you can price it more accurately. That means you can better ensure that your biz is actually covering costs and making a profit. For more about pricing for a profit, see my article here.

If you’re only calculating your COGS at year end and not tracking things as you go, then you don’t have this additional, super helpful data to make sure you’re pricing for profit.

If you enter your inventoriable supplies on a cost per unit basis (by recording both your purchase price and your total quantity purchased), then you’ve already got the data you need to keep track of your COGS. As you create a new item, you can simply add together the cost of all the supply units used in that good. The sum of these costs will get your “cost of goods made”, which I explained over in part 1. Keep a running log of the cost of goods made for everything you have for sale. When it sells, take that cost out of your inventory bucket, and add it into your COGS total for the year. Easy peasy. You should still verify this COGS total with a physical count before you do your tax return!

If this still sounds overwhelming to you, check out our Inventory for Handmade Sellers spreadsheet. This spreadsheet is already set up to help you through all the steps I just outlined. It will guide you through calculating your cost of goods made for everything you make on a per item basis, and then as you sell it, it automatically moves it to your COGS total bucket.

So, how do I deal with inventory and cost of goods sold on my tax return?

At the end of the tax year, you’ll be required to report your total “ending inventory” bucket on your tax return. Basically, all the tax man cares about are your year-end totals for inventory and COGS. In order to calculate these amounts, you’ll also need to know your total inventoriable supply purchases for the year.

It’s worth noting that as far as your tax return goes, COGS is simply a calculation you back into. That means that technically, for tax purposes, you do NOT need to keep track of COGS throughout the year…but as I argued earlier, I totally think you should to help you effectively price your goods and keep track of your taxable net profit or loss for the year.

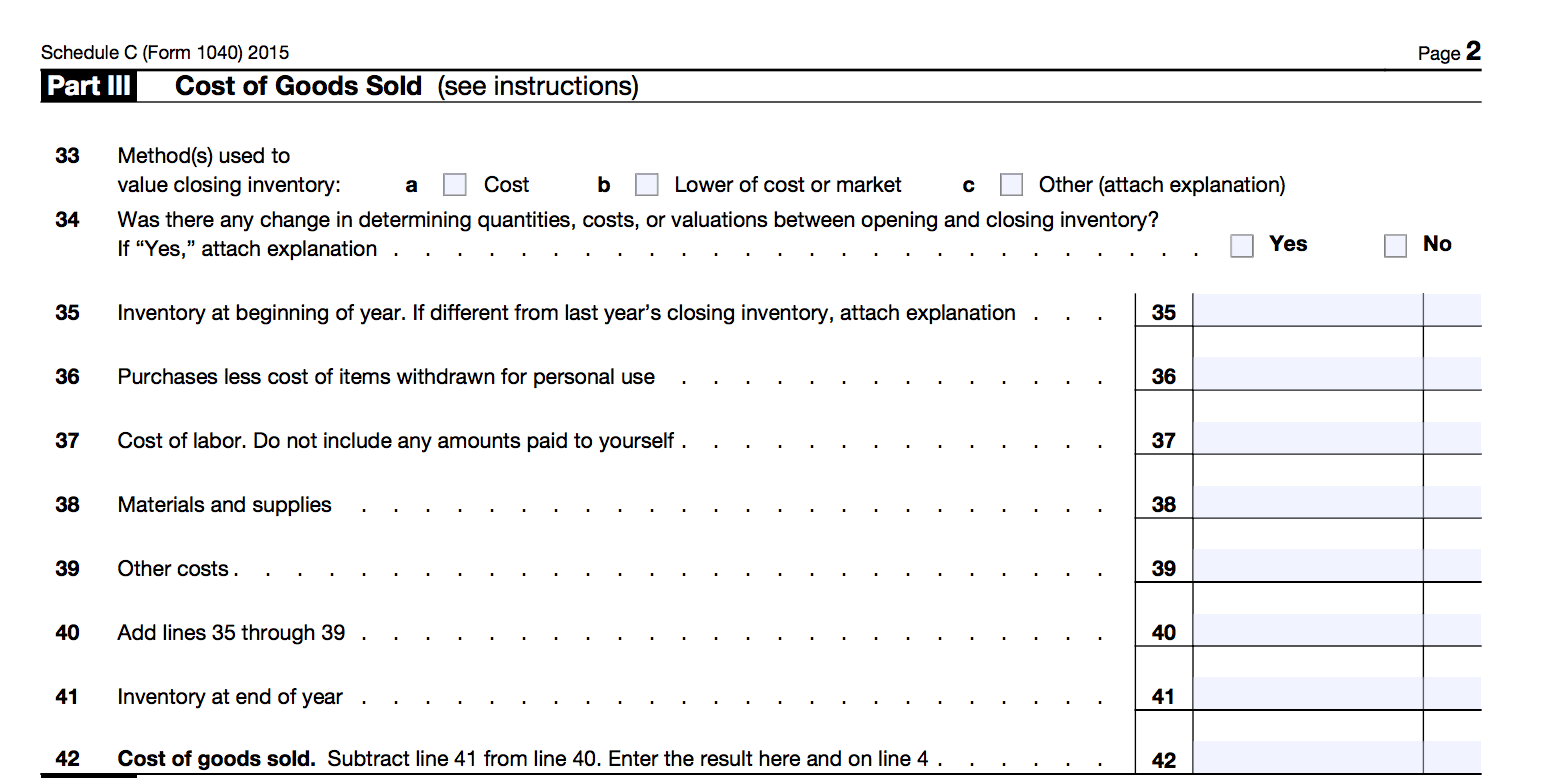

The inventory section of your tax return is going to look something like this:

Here’s my interpretation of this in plain English for you:

There are a few extra lines here, but this is pretty much the same equation that I explained earlier, just with some components switched around. Basically, instead of solving for “ending inventory”, your tax return asks you to solve for “cost of goods sold”. In the first case, ending inventory is your calculated amount. In the second case (on your tax return), COGS is your calculated amount.

So just know and understand that for tax purposes, COGS is a calculation. If you’re tracking your inventory and COGS as you go, you should already have a good idea of your ending inventory for Schedule C. You will just need to confirm this number with a physical count at year end (you may need to adjust for waste, scraps, trash, loss, etc.). You’d also already have a good idea of what your COGS total should be at year end.

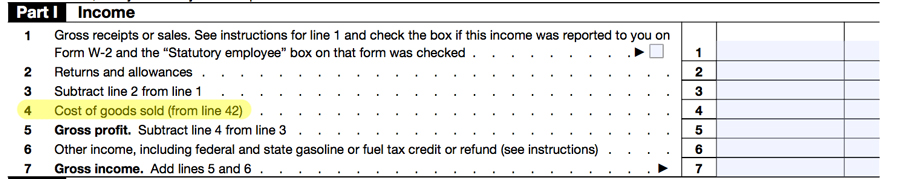

The amount you calculate on Line 42, your COGS, travels to page 1 of your Schedule C, on Line 4. Your COGS then gets deducted against your business’ profit, and lowers your tax bill. This is why it’s essential to correctly track and calculate COGS, because it’s a very important, and potentially beneficial, deduction for you.

Wait, what about those “supplies used for personal use”?

The government does not want you to get a cost of goods sold deduction for any supplies you may have originally bought for your biz and then ended up using for personal use. That means if you make baby clothes and end up making clothes for your neighbor’s new baby, you don’t get a business deduction for the cost of those clothes. You have to take them out of your inventory and COGS calculation.

What about cost of labor?

Unless you pay people to help create the stuff you sell, your cost of labor is blank. You do NOT include what you “pay” yourself here.

Where can I find out more about Schedule C and taxes?

Click here to download the official Schedule C instructions.

Click here to see what the Schedule C looks like.

Hold on, I heard from my accountant/crafty friend/mom’s uncle’s brother-in-law who does taxes that I don’t have to deal with inventory since i’m just a small biz.

Inventory, like many tax topics, can be a controversial topic amongst small biz owners. I am a CPA and I still get confused by how to interpret IRS tax rules & regs.

On one hand, I have heard of many other small biz owners, crafters, and Etsy-preneurs who have chosen not to keep track of inventory. Or, they simply don’t even know to do such a thing and claim ignorance. I have even heard of accountants who advise biz owners that they do not need to worry about inventory or cost of goods sold, based on their interpretation of the tax rules. On the other hand, I also know many accountants and tax preparers who strongly believe that the IRS does require us to keep track of our inventory. You’d think something so time-consuming would be a little more black and white, right?

Since it’s not the purpose or intent of this blog to give you tax advice, I simply must encourage you to delve into this issue on your own. Talk to your accountant or tax preparer (get one if you don’t have one). Ask them direct and specific questions about inventory. Make sure you’re talking to someone who is very familiar with not just small businesses, but crafty ones who make things. Read the rules yourself. Do the research.

I will tell you that as a biz owner I do believe that you are indeed required to keep track of your inventory and fill this out on your tax return. I do believe that if the IRS audits you, you will be on the hook for this. All IRS guidance tells us that you must handle inventory in a way that clearly reflects your income. Deducting all those unsold supplies in the year of purchase does not clearly reflect your income. It can greatly inflate a loss or drastically reduce your actual net income.

I totally admit – keeping track of your inventory and COGS can be quite time-consuming depending on how your biz works. That’s why I saw the need to create our inventory spreadsheet, which I encourage you to check out. The decision is ultimately up to you and you alone. But besides being tax compliant, keeping track of your inventory gives you the huge advantage of understanding your costs for price-setting purposes to make sure you’re actually running a profitable business.

Wanna learn about this topic in a video format? I cover inventory in-depth in my course, the Get Legit Toolkit, which you can learn all about at the end of this free tax training. In the Get Legit Toolkit, we dive into ALL the in’s and out’s of inventory, and I answer tons of questions about how to deal with tough items like fabric, vinyl, paint, thread, and more. We also discuss the best ways to get caught up on inventory if you’re behind. Plus the course covers many other useful topics for getting your financial ducks in a row!

All information on this site is provided for general education purposes only and may not reflect changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

[…] going to attempt an overview of some important inventory concepts in simple, plain English. In part 2, I’ll delve into dealing with cost of goods sold […]

[…] is likely to be the biggest beast of playing catch up. First, brush up on how inventory and cost of goods sold work for tax purposes. You might need to catch up on entering all your inventoriable supplies for […]

Hi!

I just started my business is Feb of 2017. I did not realize i needed to keep inventory. I am working on that know. My question is, how do I do ribbon. I use quite a lot and am not sure how to factor that in to COGS. I may only use a patterned ribbon for one product and never again. Do I subtract the whole rolls cost out, or guess on how much I used? Same goes for vinyl. I have never measured how much I used before. Thanks for your help!

Hi Jackie! You don’t necessarily need to know how much you used of ribbon or vinyl in each product you sell. You need to know the total amount you purchased and what is left at year end. So you would ideally measure the ribbon or vinyl remaining at the end of the year for tax purposes.

Hi! I was wondering what the difference between Purchases and Materials + Supplies is on the Cost of Goods tax form?

This is the best site I’ve found to learn about all of this! You break it down in such an easy to understand way even through all the complicated terms. Thank you so much for sharing the information because otherwise I’d probably be crying right now feeling like I would never understand it 🙂

Hi Nicole! I have seen different accountants use these two rows interchangeably. Some say that purchases should be where you put the cost of any finished goods you are buying and reselling, while materials & supplies are those raw materials & supplies that go into your handmade goods. Then I’ve seen some other accountants say the opposite! Do what makes sense for your business and be consistent year to year. Either way, they both increase your inventory amounts.

Hi! I’m in the research phase of setting up my Etsy shop and was so relieved to come across your website because I wanted to track inventory at least for pricing purposes, and now I have all this information and access to a tool that will work specifically for my situation. I do have a question though. As you mentioned, many makers who end up opening an Etsy shop take product from a stash they’ve been building for years. If we don’t have receipts for those purchases and/or haven’t tracked the price we paid, how do we account for the cost? If it were just for determining a reasonable retail price, I’d be satisfied with estimating, but is that adequate for IRS purposes or do they require receipts?

Hey Myndi! Great question. The bottom line is that for tax purposes, if you don’t have a receipt (or some sort of solid documentation to back up that expense), then you’d want to consider it as having a cost of $0 for tax & cost of goods sold purposes. It’s totally fine to guesstimate the cost for coming up with a proper & profitable price point, but for taxes & cost of goods sold, you’d want to take a zero dollar deduction (ie, NO deduction!) for the cost of that item.

Hi Janet,

I can’t get the Reply link to work to respond to your answer to my question, but I wanted to say thanks! I suspected that was the case, and it’s a good thing I throw most of my fabric receipts into a bag “in case I ever start an Etsy shop”. Now I just have to sort it all out! On that note, if I have receipts for purchases prior to the date I open my shop/and or obtain a Sales Tax License (resale license here in Maine) that I will use for the purpose of either running my business (such as your spreadsheets, when I make that purchase) or for the actual making process (rotary cutters, sewing machine, etc.), I can still count them as an overhead cost? Even if the purchase debt is prior to the “official” opening of my shop? I imagine they would have to be because every business has overhead/startup costs prior to opening their doors. How do you determine what the life of each non-inventory good is so that you can determine the cost per sellable item? You gave an example of 5 years for a sewing machine. Is that an arbitrary number or guesstimate? Or are the lifespan of such non-inventory goods predetermined on a list somewhere? Sorry to bother with so many questions. I want to make sure I start out on the right foot and you are so knowledgeable about the specifics of a maker-business. Thanks!

Hi. I am so confused because of my situation. I upholster furniture, and I spend thousands on fabric (which my customers pay for up front…including my markup), and I then turn around and order the fabric or sometimes custom cut foam specific for the job. I use up all of the fabric they pay for, as well as any custom cut foam. So, where I am confused is, where do these large expenses go on a tax return? They don’t seem to fit into supplies, and they aren’t inventory in my opinion, or am I wrong? I can see needing to list things such as staples or rolls of Dacron padding as inventory, because it does sometimes become a part of the finished furniture, but is that even necessary either? I may have on hand a few rolls of padding and staples, thread, maybe button molds, but not a lot. Any advice would be appreciated! Thank you!

Thank you for this and the inventory post. I have been reading articles and explanations all day but you finally put it in a way that makes sense.

Hi there! Thank you for this information. I’m confused as to where my labor in making items would be expensed or accounted for? In your etsy pricing formula there is a space for your labor but on this schedule C it does not seem like your labor is accounted. Am I missing something?

Thank you!

Hi Marlene, you don’t get a tax or cost of goods sold deduction for the labor you pay yourself actually – assuming you’re a sole prop filing a Schedule C like you noted. Those are basically owner draws, and you can’t expense them. If you pay for someone ELSE to do labor on your products, that is what you would get to deduct.

How do you determine the cost of goods sold for digital products? Let’s say I purchase a package of 10 digital scrapbook paper backgrounds for $2. I use one of the backgrounds to create 5 products that I would sell. Would I consider the entire cost of the 10 digital scrapbook paper backgrounds ($2) or only the cost of the one background I used in my products ($2/10=20cents)? What do you do with the cost of the paper backgrounds you had to purchase because they were included in the package but that haven’t been integrated into a final product yet?

Hi Janet, I also had the same question as Myndi. I have tracked down receipts of supplies that I purchased 5 years ago of beads that I am now using in my pieces. I am bit consfused and would like clarification. I can or cannot include these purchases in the starting year of my business but just label it as the previous years date? Or do I have to include it on beginning inventory even though I have started my business this year? Which is correct when you have receipts from the previous year’s supply and material purchases that you want to include in the business’s first year?

Hello! Thank you for the information – It has been very helpful. I am looking at starting my Etsy shop this year and have many supplies that I purchased in 2019 and 2020 (I do have receipts). Can I list those supplies under “materials and supplies” on my taxes even though they were purchased in years prior?

Also, is inventory deducted from taxable income?

If I start my business this year with $3,000 of materials (and don’t buy any more for simplicity), have a gross revenue of $4,000, and $1,000 of materials left over, will my taxable income be $2,000?

Thanks!

I make and sell jewelry on Etsy. A majority of the supplies I purchase throughout the year are precious metals, which are priced at the daily closing market value. These prices change from day to day and this is what’s tripping me up. In example: I purchase 5 feet of 16 gauge sterling wire on January 15, 2020. I purchase the same length and gauge of silver wire on August 4, 2020, but the cost of silver has risen per troy ounce, so I pay more for the exact same supply. For all intents and purposes, how would this be a factor (or wouldn’t it?) regarding inventory, materials and supplies, COGS, etc? TIA!

You would still record your inventory for tax purposes at what you actually paid that day for that item. Each purchase of the same item would be entered separately to keep track of those difference cost of goods and cost per units. You’d use a method like FIFO or LIFO to keep track of what supply you use up and when (I have more on that in my spreadsheet instructions and in my Knowledge Base if you’re like – what the heck is FIFO and LIFO?!).

You definitely want to consider the market value when you set a price point for your items though!

Hi Sam, for your first question, check out this article in my Knowledge Base: https://paperandspark.stonly.com/kb/guide/en/inventory-spreadsheet-faqs-troubleshooting-zzNn06VuBb/Steps/196338,196360,238158

The inventory you sell in a given year is deducted from your taxable income as cost of goods sold. Any inventory you still have sitting on the shelf at year end is not deducted yet. In your example, you’d have $4k minus $2k COGS which equals taxable income of $2k, yes.

Hi there! I have more info on this question right here that should help: https://paperandspark.stonly.com/kb/guide/en/inventory-spreadsheet-faqs-troubleshooting-zzNn06VuBb/Steps/196338,196360,238158

How does this work for items such as printer ink. i sell stickers which need paper and ink. I can count the amount of pages left over, but how do I track the amount of ink left?

Printer ink you usually can just deduct as used when the cartridge is empty.

Hi Janet,

How can I fix my Inventory at Beginning of year to reflect the same as last years Closing inventory number? There is now $75ish more to report on Line 35 this year from my ending inventory last year. I know I “fixed” some inventory problems. The Sched C says to attach explanation – I only kept track near the end what changes I made. I don’t know what to do here! Thank you!