This article is my attempt at rounding up ALL the issues & changes & questions surrounding online sales tax lately. There have been a lot of changes within the past few years. I will do my best to answer your questions and address your concerns in plain English. Even as a Certified Public Accountant, it’s difficult for little ol’ me to stay on top of these continuously changing state regulations.

Also, keep in mind that I have simplified these concepts for you without diving in to all the overwhelming details and exceptions to exceptions. As always, my goal is that you get some clarity on the general workings of what’s going on – rather than having that fear of the unknown or thinking this is all totally unmanageable.

This post has been updated for the latest & greatest with sales taxes in March 2025.

SO LET’S SHINE A LIGHT AND MAKE IT KNOWN!

That being said, here is my friendly disclaimer:

All information on this site is provided for general education purposes only and may not reflect recent changes in federal or state laws. It is not intended to be relied upon as legal, accounting, or tax advice. We strongly encourage you to always consult with a tax or accounting professional about your specific situation before taking any action. Please read our full disclaimer regarding this topic.

With that out of the way, let’s dive in.

What are Sales Taxes?

Sales taxes are regulated by your state and sometimes also local government (ie, NOT the IRS or the federal government). It’s a tax that is usually levied upon the end user or final consumer of a product.

So, as business owners selling handmade physical products, if we’re doing it right, sales tax is something we charge our customers. They pay it to us, and we hand it over to our state when the time comes. It shouldn’t really be money out of YOUR pocket as a business owner since it’s something your customer pays.

If you really need a primer on the basics of sales tax, go here. I’m going to assume you’re relatively familiar with the concept of sales tax from this point forward – so don’t forget to read my primer first if you need to, then come back to me here.

Also, the important thing about sales tax is that you only have to charge sales tax to customers in states in which your business has nexus. Nexus is going to be our key operating word here – because that’s what’s changed a lot in recent years.

So what that means is that you do not necessarily need to charge ALL customers sales tax….until recently that is, and maybe. Let’s continue…

A brief history of how sales tax worked

Before we discuss changes, it’s helpful to understand a bit about how sales tax previously worked prior to 2018. Although you may have to force your eyeballs to stay open, bear with me here.

As I explained in a prior article here, sales tax is governed by your state. Each state has its own rules & requirements. However, all states had a relatively uniform definition of nexus. Usually nexus was defined as any state in which your business had some sort of physical presence.

nexus (used to) = physical presence

For most of us operating online shops, that simply meant we have nexus in the state in which we lived & operated. Usually you just had to deal with your own state. I run my business out of my home in Texas; I have nexus in Texas (that’s my new accounting rap song BTW).

If you had employees or a warehouse elsewhere, or maybe if you crossed state lines to do a craft show, you may end up with nexus in that other state as well.

Although online sales tax was still complicated (just dealing with your OWN state’s rules is often complex enough by itself!), dealing with your state sales tax responsibility was relatively straight forward. You had to get a sales tax permit with your state, set up your shop to properly charge your in-state customers sales tax, and stay on top of your filing deadlines, again, with your own state.

the definition of “nexus” has now evolved

For a while now, brick & mortar shops have been rallying for an online sales tax, so that internet shops don’t have an advantage in this regard. Fast forward to June 2018 – the Supreme Court overturned a prior ruling which basically said “physical location” meant nexus was legit.

In South Dakota vs Wayfair, the Supreme Court held that states may charge sales tax on purchases from out-of-state sellers…even if they have NO physical presence in that state.

This ruling basically means that physical presence is NOT necessary anymore for nexus, and ADDS another way to have nexus with this new concept of economic nexus. Some states may also call this click-through nexus, remote seller nexus, or something else, but I’ll just refer to is as “economic nexus” from here on out.

Now before we panic, the Supreme Court ruling did not instantly change anything. All it did was say to the states that they can now make (and actually enforce) new rules regarding online sales. It is now up to each individual state to figure out what they want their rules to be.

This leaves us with the super fun responsibility of staying on top of each state and figuring out whether their new rules apply to us.

so what does economic nexus mean?

Well like I said, it depends on each state, because each state defines it differently. South Dakota had a specific requirement saying they wanted to charge sales tax on out-of-state sellers who had either over $100,000 in sales to South Dakotans OR more than 200 transactions a year to South Dakotans. This became THEIR definition of “economic nexus”.

Thus, a lot of states have just modeled what South Dakota defined as economic nexus, since they’re the amazing state that won the court ruling. So, you will see a lot of states are set up very similarly, if not identically.

You can think of “economic nexus” in general to mean any state in which your business has a big financial impact (that’s my totally unofficial terminology here) – meaning you make a lot of sales to people in those states.

new nexus = economic presence = make a significant number/amount of sales to a specific state

So to be clear, a lot of states define economic nexus as surpassing a gross sales threshold and/or a specific number of transactions to customers in that state.

For example, like I mentioned, our favorite state South Dakota defines economic nexus as sales of $100,000 (IN South Dakota) or more than 200 transactions (IN South Dakota) in a calendar year.

So if during the calendar year of 2019, you made more than $100k from buyers in South Dakotans OR if you had more than 200 orders from South Dakotans, ding ding ding – you are now the lucky recipient of economic nexus in the state of South Dakota.

Me, cackling evilly whilst writing this blog post….just kidding. This is my smiling face of encouragement for you.

and how the heck do i deal with that for each state?

Each state has its own definition of economic nexus. I really like this handy chart from the Sales Tax Institute. They keep it updated as rules change & thresholds evolve. Keep in mind this area of sales tax is changing rapidly.

Back when these changes first began, most states thresholds are around $100k in sales. Some states are even higher. It’s been a couple of years now since this began, and many states are dropped their singular number of transactions thresholds to make it easier for “micro” online businesses (like most of us) to comply (ie, harder for us to hit the threshold, which is a good thing!).

Check this chart for specific up-to-date info per state.

That being said, don’t forget about the handful of states that do have transaction thresholds. Most states have either just gross sales thresholds (dollar amounts) or gross sales AND number of transaction requirements, but a handful of states have an “either/or” rule. Meaning you could make well below the gross sales threshold, but if you have 200 or more transactions in that state, you still hit the economic nexus threshold! This number of transactions threshold, NOT the gross sales threshold, is much more likely to apply to creative online businesses like ours!

Don’t get too panicked yet. A lot of us are not even going to get close to these thresholds, so there is no need to freak out. But let me keep talking because there’s MORE!

well janet, i am freaking out. what am i supposed to be doing here?

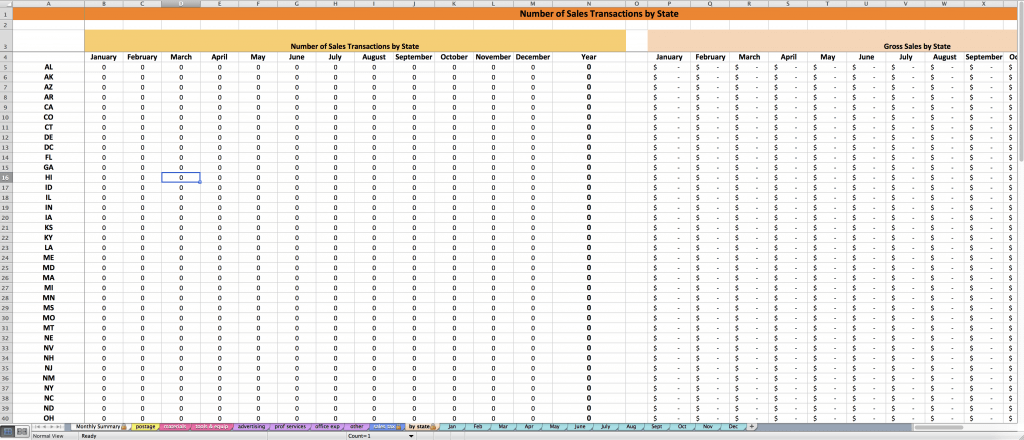

The best thing we can do right now is just start tracking our sales by state. Like I said, I really think most of us will NOT meet those economic nexus thresholds for most states.

👉 The only way you will know is if you are keeping track.

If you see that you aren’t even getting close, then you can just continue to breathe easy and not worry about this stuff! If you see that you have a lot of sales to a specific state, you can check that state’s rules and see if you are nearing their threshold or you can reach out to an accountant to help you.

I really think that a few minutes worth of tracking each month is going to allow you to not stress about this!

so then…is there an easy way to track that?

Yes! I have added that capability to as many of my Paper + Spark Seller Spreadsheet & import add ons as possible. When you copy & paste in your sales CSV each month, my spreadsheets have a tab that automagically totals up your sales transactions and gross sales amount per state.

it ain’t pretty but it’ll get the job done, and automatically too!

This capability is available for:

- The Etsy Seller Spreadsheet and the Etsy import add on

- The Shopify Seller Spreadsheet and the Shopify import add on

- The Amazon Seller Spreadsheet and the Amazon import add on

- The eBay Seller Spreadsheet and the eBay import add on

If you purchase the above files, you will get the ability to track your sales by state (along with everything else the spreadsheet will do for you!) so you can keep track of when/if you near those thresholds.

Remember that I suspect most of us will not need to worry about those sales thresholds; keeping your eye on your number of transactions to a state will be the most helpful stat to track.

I am happy to create tools that make these easier for you to track, but I will add that it is up to YOU to compare your stats to each state’s threshold. Remember you can reference each state’s rules here or here.

what do i do if i’m getting close to meeting a state’s economic nexus threshold?

Like I said, if you’re tracking each month (definitely recommend that you keep track of these numbers on a MONTHLY basis!) and notice that you are nearing the threshold for a specific state, you should begin researching what that state requires. That may mean registering for a permit with that state, making a special disclosure to those customers, charging sales tax to buyers from that state, or any combo of those. It’d be a good idea at this point to make contact with a sales tax expert or an accountant who can advise you (I recommend Christina Coyle who is very knowledgable on all things state-related).

a few wrinkles regarding the timing of all this…

States vary on how they want you to treat the thresholds as far as timing goes. If the threshold is $100k in gross sales, that could mean $100k in the past 12 months, $100k in this calendar year, $100k last calendar year, etc. Make sure you are clear on which state wants what.

These things are really only concerning if you see yourself getting close to the threshold of a particular state.

ok, i gotta keep track of my sales by state. i get it. so then what is this stuff where etsy is collecting sales tax on my behalf for certain states?

Great question! This is a different issue when it comes to sales tax. It’s confusing because both of these changes have happened right around the same time, but they are not really related.

In addition to everything I previously mentioned, many states that have also enacted sales tax rules for marketplaces. We can call this concept marketplace nexus or marketplace facilitator taxes. This is like a third kind of nexus and the second new sales tax we’re dealing with. 🤯

Again, each state is different, but these states are requiring online “marketplaces” to collect & remit sales taxes for sales to those states on behalf of the individual sellers. This applies to large online selling venues like Etsy, eBay, and Amazon. These marketplace rules are going to affect your shop even if YOU personally don’t meet the above-mentioned economic nexus or physical nexus rules we’ve already discussed.

Washington State was the first to enact this rule on January 1, 2018. Fast forward to 2024 and now Just about every state that has sales tax has followed suit.

This is sort of a double-edged sword for Etsy sellers. On one hand, having Etsy do all that for us is nice – it’s a legal burden we don’t have to deal with on our own, yay! Etsy sets up how much to charge, collects it automatically, AND pays it over to the applicable state ALL for you.

On the other hand, it means increased fees for us. (Yes, Etsy is applying their 6.5% fee to those sales taxes collected!). Plus, it’s been a drag getting this system in place. Certain goods are not subject to sales tax in certain states, and sometimes customers are getting charged when they shouldn’t. Which rate to charge which customer can also be confusing, and sometimes the wrong percentages are getting applied. Etsy is having a fun time ironing out those kinks. If you want to read the official statement from Etsy regarding all this, you can do so here.

It also becomes more complicated for reporting, because Etsy is not really providing any clear documentation that sums up what’s been collected or paid on a seller’s behalf. You can really only clearly see these amounts on an invoice-by-invoice basis.

what do i do if the marketplace is collecting on my behalf?

What if you have a physical presence nexus in a state that Etsy automatically collects for? As of 2025, all states with sales tax require marketplaces to collect & remit on the individual seller’s behalf. So on marketplaces like Etsy, you no longer have access to any specific sales tax settings for a specific location.

You likely still need a sales tax permit with your state. You will STILL file your sales tax forms with your state when due. Etsy is collecting and remitting on your behalf, but that doesn’t mean you can now just do nothing when it comes to your sales taxes. Your Etsy sales are now reported as nontaxable or exempt when you file your report. Each state has a different way of “asking” for that info on their form, but make sure you find it and report correctly.

You will still be responsible for collecting & remitting sales tax on all your non-Etsy in-state sales (like if you sell on Shopify or locally). Wanna compare how to deal with sales tax on Shopify? Go here.

what if i sell somewhere other than a marketplace…like my own site or shopify?

As of right now, marketplace sales tax only applies to marketplaces like Etsy, Amazon, eBay, WalMart. We are seeing more and more platforms treat sales tax this way, but if you are selling on your own site, you are generally NOT considered a marketplace. It’s just little ol’ you.

Shopify is not considering itself a marketplace, but rather a website hosting platform. So theoretically, they are not subject to these marketplace rules and not collecting & remitting any sales tax for those states. I have a whole other post on this topic here.

What that means is – don’t freak out about the marketplace rules if you sell on Shopify, WordPress, or your own site.

BUT

On the flip side – all of us, even individual Etsy sellers (selling in marketplaces) need to pay attention to the economic nexus rules for each state. From what I understand, we ALL still need to stay on top of tracking those transactions and sales by state for that purpose.

so just to wrap that up for you…

We’re currently dealing with three types of sales taxes:

- Physical presence nexus – you likely have to get compliant with the sales tax situation in the state in which you’re physically located, regardless of how much or how little you’re making in sales

- Economic nexus – if you make a high volume or dollar amount of sales to certain states you may also be responsible for dealing with sales taxes there

- Marketplace sales tax – Etsy will collect sales tax on your behalf for roughly half the USA (states with marketplace sales tax rules), but you’re still responsible for filling on time and collecting outside of Etsy for your own state and any other states you may have economic nexus in

This is a great article, Janet – thanks! One thing I have been wondering. What if you have Etsy and Shopify. Etsy is collecting in a state on our behalf and we meet the threshold on Etsy. Let’s say 300 transactions in South Carolina. Then I have 10 transactions that same year in Shopify. Do I total the two platforms for the 200 transaction test, or would they stand alone meaning I still don’t need to worry about Shopify until I get 190 more on there?

Thanks!

Hi Lindsay! You would want to total your sales by state across ALL platforms, not separately. So once your business as a whole crosses that threshold, you’d be responsible for dealing with the sales tax requirements (or whatever requirements) for that state.

I am in business in Colorado. However, I am moving home to WI next month. I love this state, I will miss everything about it, expect the damn sales taxes. I even told the dept that they were horrible.

HI Janet- Is there an update to include the sales by state for the PayPal Seller Spreadsheet? That is the spreadsheet I am currently using.

Hey Michelle! Unfortunately no. There are a few spreadsheets I am unable to add the new by state tab to, and PayPal is one of them. PayPal’s CSV doesn’t have a separate column for the state of the transaction, and without the state being separately stated I can’t build an accurate formula to sum the sales by state. So for now, no by state for PayPal spreadsheets.

This was great information! Does Amazon work the same way as Etsy for collecting and remitting?

Thank you again for this information! I will be following you!

Best,

Layne

Thank you Janet for explaining all this in plain English. Unless they change the thresholds I doubt I will ever meet them.

Maggie

Does this apply to International sellers selling to US customers?

This article was really helpful. I was really worried about the sales tax issue. You cleared up my concerns. Thank you

I am late to the party, but trying to figure out this sales tax thing. Thank you so much for this article and your website!! Just one clarifying question- Etsy is required to collect/remit sales tax to all those states listed regardless of my nexus, correct? So I don’t need to change any settings on Etsy to only collect tax in states I have nexus?

This is a fabulous article. When I read anything that has to do with numbers or taxes, my eyes glaze over and it all seems like gibberish. This article was informative, helpful, and even made me giggle! Gasp! An article on taxes, made me giggle!!

Etsy’s settings will override any settings you put in for any states that are on the marketplace list. The only settings you need to go in and add/change/check are for any NON marketplace states in which your business has nexus.

Great article! I’m new to the Etsy game. I have my Etsy shop out of my home in Florida, but my items get printed in a print shop in North Carolina. Do I then have a Physical Presence Nexus in both states? Do I have to get a sales tax permit in both then?

It is possible that using a printer in NC could create a physical presence nexus there – it depends on NC’s sales tax rules.

Thank you, this was very helpful. How does Etsy deal with those stores who sell downloadable digital art? There is no shipping address but maybe they use billing information?

Yup, This helps emmensely! So glad I signed up with Paper & Spark to get my financial house in order so I do not have to worry about getting myself into hot water by doing things incorrectly! Many thanks, Paper & Spark!

I’m a little late to her podcasts, but I just heard your interview with Lauren Keplinger of “Crickets to Cha-Chings.” When she introduced you, I just knew you had to be a Louisiana girl like me.

The sales tax thing has always been a big question mark in my brain–I sell online only (some thru Etsy, mostly thru my own website), and so I figured all I needed to collect was LA sales tax. This morphing nexus thing is kinda scary! Thanks for sharing with us 🙂

Heyyyyy my fellow Louisiana friend! Thanks for listening!

This is one of the best articles I’ve read on online sales tax. It’s kept me up at night, as a new seller on Etsy and now opening my own Shopify site. I’m glad the Etsy seller spreadsheet has the total state sales built-in, that is SO helpful – I was looking into a Taxjar subscription just for that!

Hello, This is one of the very best explanations of sales tax as it applies to online sales that I have read. You explained difficult definitions and concepts clearly, concisely, and logically.

I am a recently retired Sales Tax Auditor, with 18 years audit experience, from the State of Arizona. When those new nexus statutes went into place, it made even our heads spin and our eyes glaze over in confusion. 🙂

One thing that we do to help clarify the issue is to use different terminology. We use the term “marketplace seller” for people who sell through a third-party “marketplace facilitator”. We use the term “remote seller” for people who sell directly into Arizona. As you point out, a person can be both a “marketplace seller” and a “remote seller.”

It is very good advice that people research the tax laws of the State. For instance, once the threshold of $100,000 gross income from sales into AZ has been met, the seller must begin remitting tax to the state the following month for the remainder of the year AND for all of the following year.

Information can be found on the State Department of Revenue websites, but it isn’t always easy to find. So don’t hesitate to call the Tax Customer Support Help Line for information.

Again, I wish to compliment you on a very informative post on a very difficult subject. ~ Merry

Thanks for the additional info and the kind words, Merry!

I’m so glad you found it helpful, Samantha!

I want to start selling on Shopify, I live in NY do I need a permit to start selling or I can do it without up until I meet the nexus ?

Thank you so much for the info and sharing the nexus chart! It’s nice to be able to find all the thresholds in one place.