Let’s discuss how to price your handmade goods and my recommended “Etsy pricing formula”. Pricing your handcrafted products or designs can be one of the most challenging tasks for a creative entrepreneur or artist (that’s why I eventually created a spreadsheet and an entire free workshop that helps you do it!).

You can have an awesome product, a cohesive brand, a great webpage…you can even have amazing sales, but if your product isn’t priced right, you won’t make a profit. Without a healthy profit margin, it will be hard to keep running your creative biz.

{Please note, before you read this post, I suggest you read our posts on tracking expenses and accounting for overhead to better understand the concepts we’ll discuss here.}

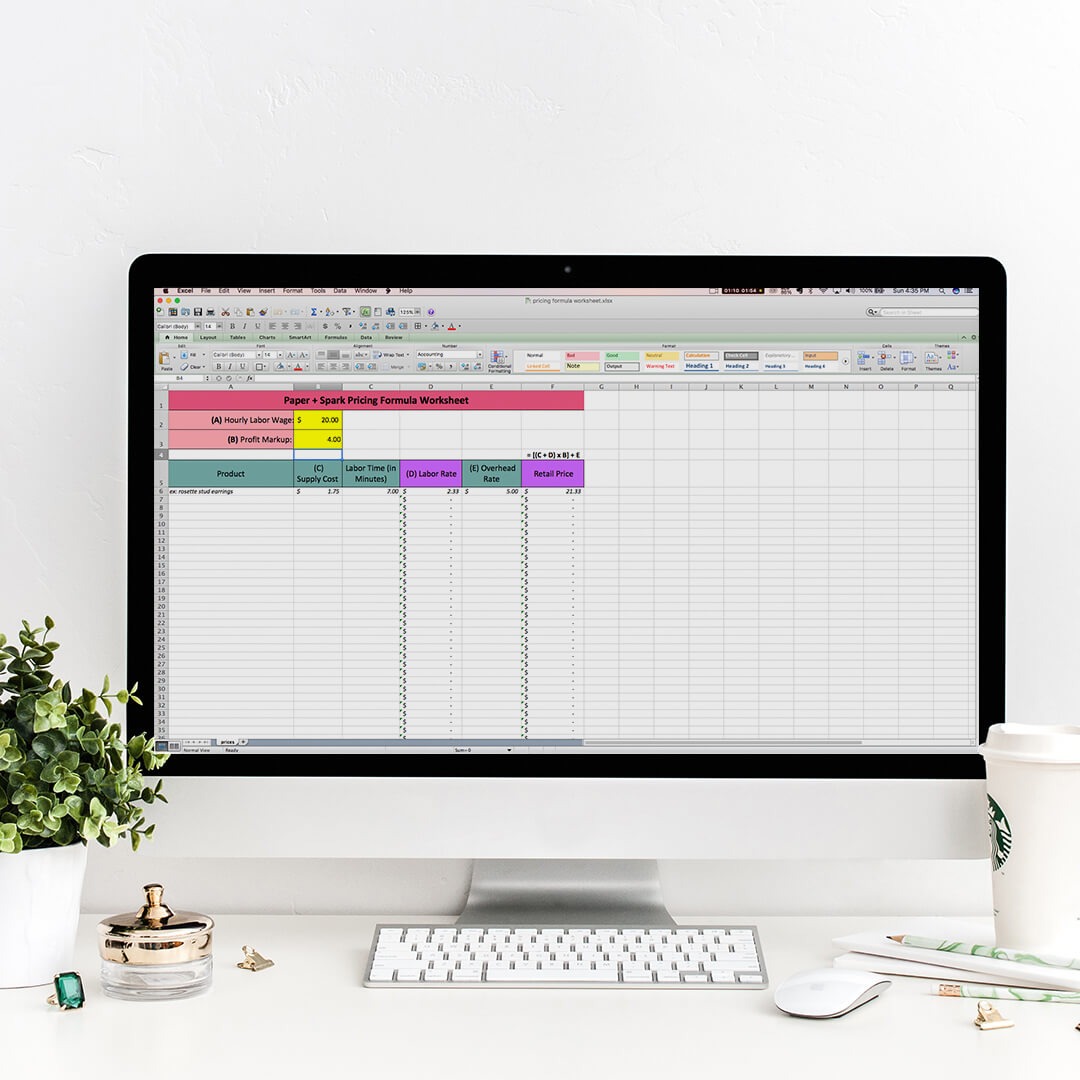

I could write a whole novel on this topic, and you’ll find several posts about pricing around here. This is a tricky but important concept that every serious business owner should take the time to research and understand. I’ve also created a free simple + flexible little pricing formula worksheet to help you determine profitable prices for your handmade goods.👇

TRYING TO PRICE DIGITAL PRODUCTS? I get asked often about how to price digital products…is there a formula for that?! I recorded a masterclass on this topic that includes a plug & play calculator here.

the unprofitable etsy pricing formula

Browsing the interwebs, you might see a pricing formula that looks a lot like this:

Supplies x 2 = Wholesale Price

Wholesale Price x 2 = Retail Price (or basically Supplies x 4)

I’m hesitant to even type that one on here because I don’t want you to just see it, use it, and then leave. A pricing formula like this might be simple, but it most likely will not get you a profit. Why? Because it leaves out a whole bunch of other fees and expenses that you’re probably incurring. Sure, the “x2″ or “x4″ multiplier is probably helping you cover part of that, but it’s better to come up with a more accurate measure of all your expenses and include them in your equation.

pricing for profit – a better formula

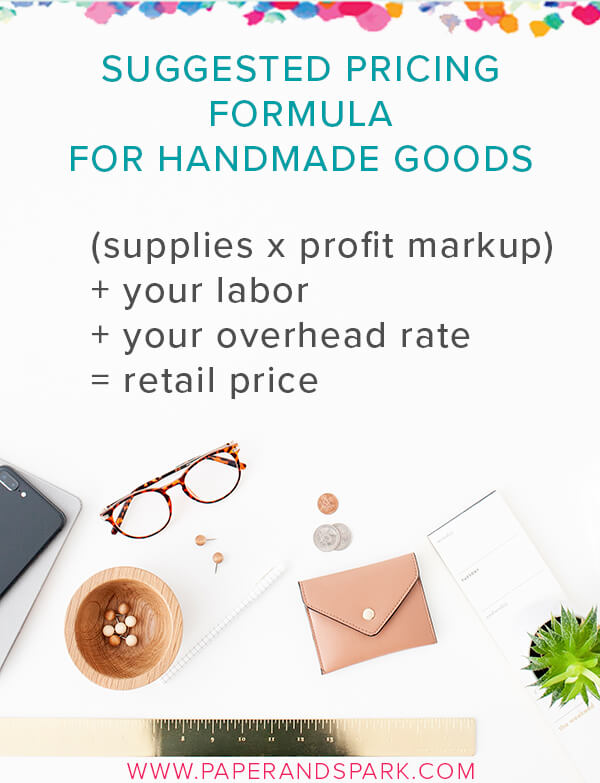

Here’s what I suggest:

My Etsy pricing formula also includes labor and what I’m calling an overhead rate. Yes, my formula is a little more complicated. But, it’s going to give you a price that more accurately reflects how much it really cost you to create your good.

Let me explain my reasoning by defining each piece of the formula. Then, I’ll give an example of pricing two hypothetical products, a wire-wrapped ring and a pair of stud earrings (I’m biased toward jewelry due to my original biz Lazy Owl Boutique!).

Supplies: As I explained in this post, your supplies expense is the cost of whatever materials went directly into your product. You should always have a record of what you pay for your materials (don’t forget to include what you paid for shipping too). You should generally be recording this at the per unit level. Per-unit means tracking what it cost you per bead, per piece of paper, per foot or yard of fabric, etc., rather than just the entire string of beads, ream of paper, bolt of fabric, etc. (If you aren’t keeping track of your supply expenses, I highly recommend you get started with my inventory, cost & pricing template here).

You might need to do some dividing to get to your per unit cost. For example, if you bought 100 beads, you should take the price and divide it by 100 to get the price per bead. If you bought a bunch of fabric, you’d calculate the price per square inch, foot or yard. This will help you determine how much a product you made with 1 bead or 1 yard of fabric cost you. Getting your supplies down to the unit helps you accurately calculate exactly how much one finished good cost you to make.

Profit Markup: This should be some number greater than 1. The gold standard is about a solid 4. This is a multiplier that ensures you’re not just covering your costs, but ALSO making a profit. The profit markup allows you to pay yourself and re-invest in your business. It gives you that cushion! A healthy profit markup also makes it possible to offer wholesale rates and discounts with EASE instead of with discomfort. And it also gives you some wiggle room if you need to adjust your pricing a bit. But stay as close to 4 as possible!

Labor: Just like with a “real” job, you must pay yourself an hourly rate. Decide what you want your hourly rate to be (please, at least pay yourself more than minimum wage!), and determine how long it took you to make the product. Labor cost should equal Time x Wage, so if you’re paying yourself $10 an hour and it took you half an hour to make it, pay yourself $5 for that product. You aren’t necessarily taking $5 out of the bank account when you sell this item, but it’s important to build a salary for yourself into the prices of your items so you can afford to pay yourself.

Overhead Rate: Remember to refer to this article to get the full rundown on overhead. Basically, overhead is all the other expenses you have that 1) go into your product, but you can’t get the exact amount per product (the cost of the thread you used in your apron, the ink you used to write the calligraphy, etc.), plus 2) all of the other business expenses you pay that don’t have directly go into a product, but keep your business running (advertising costs, a web domain, your crafting tools, etc.).

These NON SUPPLY costs are the expenses that eat into your profit and drain your revenue. If you aren’t accounting for them somewhere in your pricing you aren’t recovering them. This is why you can end up with tons of sales but NO MONEY IN YOUR BANK ACCOUNT!

The best way to include these expenses in your pricing formula is to come up with an average rate. You are basically putting a little chunk of these expenses into the price of everything you sell. Please refer to our overhead article for specific ways to calculate your overhead rate. I suggest calculating your rate based on your estimated products sold in a year.

WANNA SEE THIS IN ACTION?

Want to see this formula in action and try it out with YOUR products? Grab this free pricing formula worksheet.

NOW LET’S WORK SOME HYPOTHETICAL EXAMPLES.

wire-wrapped druzy ring

- Supplies – That’s the cost of the wire and the druzy stone. The druzy stone cost me $3. I buy the wire in 30 feet spools. One spool costs me $8. So, I can either measure exactly how much wire I used for this ring, or I can make an estimated cost based on an average for each ring. Let’s say I use an average of 2.5 feet for each ring, so that gets me about 67 cents of wire in 1 ring ($8 per spool / 30 feet = $.267 per foot x 2.5 feet = $.67). Am I confusing you yet? (If this math confuses you, check out the template spreadsheet that will do it for you!) So, my supplies expense for this one ring is $3.67.

- Labor – This ring takes me 15 minutes to make, and I want to earn $20 an hour. So 1/4th of an hour x $20 = $5 in labor for this ring.

- Overhead Rate – In my hypothetical situation, let’s say these are my estimated overhead expenses for the year:

$800 – Etsy fees

$250 – Paypal fees

$250 – Advertising & printing expenses

$300 – Craft show fees

$50 – Photo props

$100 – Editing software

$75 – Tools

$275 – Indirect product costs

$15 – Website costs

= $2,115

Wow! That’s a lot of overhead! These costs add up, that’s why it’s important to include them in your pricing strategy somehow.

I’m going to calculate my overhead rate based on an estimated annual number of products sold. Last year, let’s say I sold 400 items. This year, I’m estimating that I will sell 500 pieces. $2,115 / 500 = $4.23 per item for overhead. So, my formula would look like this:

(Supplies x 4) + Labor + Overhead Rate = Retail Price

($3.67 x 4) + $5 + $4.23 = $23.91 for my retail price. I’d probably round up and sell it for $24 even.

The great thing about this formula – especially if you use that profit multiplier or markup of 4 (don’t cut it short, y’all!) – is that it leaves room for wholesale discounting or other promotional offers.

If I want to offer a typical wholesale discount (50% of my retail price), that gives me a wholesale price of $12, which still more than covers my costs and my overhead rate. Too often we set out retail prices so low that we are not financially able to even offer wholesale.

rosette stud earrings

- Supplies – Let’s say the rosettes cost me 20 cents a pair, 20 cents for the studs, and 5 cents for the earnuts. That means my supply expense is $.45.

- Labor – I make a bunch of earrings at once, so each pair doesn’t take me too long. Let’s say I pay myself $2 for each pair.

- Overhead rate – $4.23 as I calculated it in the above example, and you can use that same overhead rate across the board for all your products.

So, my formula would look like this:

(Supplies x 4) + Labor + Overhead Rate = Retail Price

($.45 x 4) + $2 + $4.23 = $8.03 for my retail price, so I’d likely charge $8 or $8.50 depending on how the wind is blowing that day.

HANDMADE PRICING – THE BIG PICTURE

Does it seem crazy that a ring that cost you less than $4 to make should be priced at $24? Or a pair of earrings that cost you less than $1 could sell for 8 times that amount? That is why soooo many artisans underprice their goods, or make awesome sales but never turn a healthy profit. It all boils down to two things when coming up with a pricing formula that works:

- Covering all of your costs – find a reasonable, doable way to include all your business costs in your pricing formula, not just the obvious ones, whether this is by using an overhead rate, a percentage markup, or something else that works for you.

- Making a profit – here’s the kicker. If all your business expenses are represented somewhere in your pricing formula, that little “x4″ profit multiplier is what will allow you to be profitable. To pay yourself. To leave money in your business to invest in stuff & grow. Too many entrepreneurs forget to include all their true costs in their formula, and profit multiplier that should be giving them a profit is really just covering all those forgotten expenses instead.

Trust me, it’s a lot easier to price your product for a profit now, even if it feels too high, and lower your price later for whatever reason, than to be in business for a while with prices that are too low, realize you aren’t going to have a sustainable business, and have to raise your prices later to stay open. Pricing high enough also allows you the flexibility to have seasonal sales and give out coupon codes. I delve more into the complexities of pricing in my other posts.

If this post gets your wheels turning about how you’ve been pricing your goods, check out this free handmade pricing formula worksheet. It’s got built-in formulas and comes with super simple video instructions to tell you exactly how to use it (even if you’ve got spreadsheet-phobia). Ready to master your pricing in order to grow a truly profitable, sustainable business? Don’t shirk off handling your pricing and grab your free worksheet here.

This is the best article on pricing handmade products I’ve read. Too many formulas have the multiplier on the labor and overhead which makes the end price of something that’s labor intensive unrealistic. If you make something that takes a few hours and multiply your $10 hourly wage by 2 hours worked and then again by 2 for wholesale and then 2 again for retail you’ve just paid yourself $80 an hour without adding in any other costs. When you’re also multiplying all the other overhead costs you’ be just priced yourself out of most markets.

Thank you so much for all of the wonderfully helpful information, I can not even begin to explain how long it has taken me to find the proper pricing formula and I’m so thankful for how much detail you put into each category! I’m excited to start pricing my handmade products properly! Thank you!

Very helpful article on Pricing especially for creatives. Thank you.

Thank you, I have scoured the web for decent info, found this finally making sense. I make stuffed animals that are not toys, more decorations, to be used as decor in a nursery. Using quality fabric, taking lots of stuffing, it is labor intensive, I sometimes from drawing the design to the last hand stitching hair or eyelashes, can take up to 3 or 4 days if it is a large one. Smaller ones can take one and a half day of about 9 hours per session. Trying to work according to all the other formulas, by the time I have multiplied and multiplied I have nothing left for labor, barely getting cost back. These items are individual, not the kind of toy you get over at a toy shop. I have made various items for friends, and grand children, and they are very popular. But costing me a small fortune to make, and getting nothing back. So I decided to start selling, and an art shop near me has asked me to display my items there, as they have seen it. So I am absolutely going to try your method now. I would rather sell slower, and get the proper value, than give it away for free, and taking a loss.

Question about your over head….. if you sell more product 400 one year and the next year 500 your over head goes down…. so with your formula your cost goes down. Is this what you want/is it a good thing?

I make hand-sewn felt dolls that take me between 4-6 hours each to make, depending on the level of detail on each one, and I have become completely frustrated with the pricing of these items. If I use the formula that you have laid out here, my retail price for each doll would be over $50, which is a lot higher than I believe anyone would want to pay for a felt toy. That’s paying myself $10/hour. Even if I drop that to $8/hour, my final price ends up around $45 – still too high.

I have priced them at $20-$25 in the past and everyone, mostly other artists, told me that I was not charging enough, so I increased the price to $30-$35, to which I was told (by the same artists) that I was charging too much. I don’t know what to do at this point. I am already undercutting myself at $30-$35, so maybe I just need to face the fact that my dolls are not financially viable and give up? Ugh.

I think i might have done something wrong in the formula, maybe you can help me out.

i purchased the ribbon(3 yards) for 3.99 and to make one bow i use 2 (8 inch). What is the cost per unit for one? When i calculated this it came out to $21.28.??

(3.99 roll of ribbonl /3 yards = 1.33 x 16 inches = 21.28)

Did i make a mistake here ? It seems pretty high for just one bow.

You are coming up with a cost per yard and then multiplying it back inches – that is your mistake. You have to be consistent with those units of measurement. So it should look like this:

$3.99 for a roll of ribbon / 3 yards = $1.33 per YARD

1 yard = 36 inches, so 3 yards x 36 inches = 108 inches

$3.99 for a roll of ribbon / 108 inches = $.037 per INCH x 16 inches used in your bow = $.59 of ribbon in that bow.

Who determines that the price is too high? Why listen to what these other artists are telling you? Your costs should determine your pricing – if you can’t price high enough to cover your costs AND pay yourself on top of that, then it’s not a financially viable product. However – I suggest pricing where you need to price it to BE financially viable and try selling it at that price. At that point, it’s all about marketing, positioning, and finding the RIGHT target audience & customer for your product at that price point. I guarantee there are people out there who pay $50+ for a handmade doll. Who is to say you can’t position your product to find & attract those people?

In this case I likely wouldn’t adjust down. I’d leave the price as is to cover the potential costs of increasing your output OR best case scenario – be able to pay yourself more!

So my shop has been open for about a year and I’ve always struggled with pricing my products. I sell digital downloads, so printable home decor, party invitations, cards, and templates, etc. Would this formula still apply to me? Do I need to tweak it?

I do three things.

Material cost + Hourly rate + Shipping = total cost for one item

total cost for one item x 35-40% profit margin = Etsy listed price

profit margin + hourly rate = Total profits

The formula is still a good starting point but digital products are a whole new ballgame. Obviously we don’t have the same type of product costs. With digital products it’s more about the intangible benefits & value you’re providing to your customer. From my experience selling digital products, it is definitely a work in progress!

I’ve always crafted in one way or another but I’ve recently been making greetings cards and a few people have said I should sell them but I wasn’t sure about pricing so this article/formula/spreadsheet has been really interesting.

Thank you for sharing your experience and information.

Hi! This helps a lot! My question is what if you dont sell a lot aka starter seller and your overhead per item currently is like almost $10… i cant charge over $10 for wax melts lol supplies x 4 is 8.50.. which alone is what i sell at to include shipping of 3.25… no labor either.. most cost to make 1 clamshell is 2.18

I really enjoyed your article and it is very concise and helpful. I am curious as to your thoughts on market pricing. For example your rosette stud earrings at $8.00 or $8.50 is a great price. However we owned a store in a Tehachapi, Cal and found that most quality handmade earrings could easily sell for at least $15.00 and most patrons felt that was a great deal. I agree with your pricing strategy but wonder if a quick reference to customary pricing of similar items would also be an important factor.

What an excellent article. I will definitely be watching the videos and will download your helpful tools.

Oh my I wish this was available for me when I started my craft business. Yes most artisans sell their items cheap because for one thing the overhead is almost always forgotten. Thank you for this. I will br sure to use it in my other craft items.

Sooooooo helpful. Thank you ☺️

I am always for increasing prices when you can make good sales at that price point – the higher the better! I think doing some research on what’s happening in your market can be helpful. I just think it’s MOST important to consider your costs & financial goals when setting your prices. Too often we let the market drive us DOWN in our pricing – that’s what I’m fighting against. There’s no ceiling on the upper end of the price though IMO.

One of the best articles on pricing handmade goods! Thank you!

You are a Godsend!

Hi, thank you so much, this is so informative!

I have a couple of questions. In your formula (Supplies x 4) + Labor + Overhead Rate = Retail Price, for the cost of labour do you calculate based of gross cost (before income tax)? So (for illustrative purposes) I should calculate based of 30$ an hour to make sure I account for taxes and actually end up with 20$ an hour after tax?

Or would income tax be paid from the “x4” multiplier?

I hope I explained properly.

Also, in the formula, isn’t the cost of labour suppose to actually pay the wage? At the end of the article you have written “Making a profit – here’s the kicker. If all your business expenses are represented somewhere in your pricing formula, that little “x4″ profit multiplier is what will allow you to be profitable. To pay yourself.”

I’m a bit confused. Thanks so much!

am I understanding correctly that if you offer “free shipping” or somehow include shipping in your product pricing, this should part of your “supplies” and not part of your “overhead rate”? I’m trying to determine how to price for Etsy to make sure I’m covered for the “free shipping over $35” for when they combine items that cost less than $35 individually.

Thank you. I majored in accounting in college, but that was 20 or so years ago.

We didn’t cover handmade goods .

This won’t work for crochet items. I make baby blankets. My current project, the yarn cost 38 bucks. 38X4=152 dollars. That’s only part 1 of your formula. No one is going to pay 152 for a baby blanket let alone the rest of the cost.

Hi Jenn, only you can decide how much or how little you’re willing to pay yourself for your hard work! There’s a market for nearly everything at every price point these days.

Hi there

This was such a great article !!

I am still struggling on understanding the whole sale

Do you have a bit of a breakdown or formula for this ?

Thank you

This is so informative and helpful, thank you!

Do you have any advice on pricing digital items? Some of my products are available as digital downloads, for example cross stitch patterns which I have designed. Initially the designing, trialing and redesigning is time consuming. But once I have the product right and it is available for my customers, there’s no limit to how many I can sell. I have some patterns which have sold several hundred copies of, I have well and truly covered all my costs and labour on these. Some however have only sold a small handful of times and are no where near breaking even.

In these cases, is pricing based on comparison to similar products/patterns the right way to go?

I can’t even begin to explain how much this article helped me. You’re a blessing. I was significantly under pricing my items, when! Thank you!!!

After reading this I realize I am really short changing myself. My problem is my sewing takes too long to make a true profit. I made some American girl doll clothes and was thinking about selling them for maybe $15 and thinking that was high…I think I need to find something quicker to make:)

How do you calculate something that is a pass through supply item – for example, the doormat I’m personalizing or the lighted base for an acrylic sign. I didn’t make any part of that product, but it’s essential to the product I’m making. It’s awfully expensive to include in the formula – a standard size doormat would be around $68! I’m tempted to exclude that number from the formula equation but include it in the final price.

What about overhead labor? If my hourly wage is 10 and a item takes 1 hour….where does tge money come from to pay the 10 per hour id spend on listing, product development, research, craft fair setup take down and hours of selling at fairs, marketing, shopping for supplies, cleaning up after creating, etc etc. Is that supposed to ALL be covered in the supplies markup?

Hi Melissa, the idea of adding another overhead rate in for all your non-production labor time is an interesting one. Otherwise, I usually *hope* to cover those hours with my markup rate, yes. The only way to really know that you are making enough of a profit and pricing in that sweet spot is if you look at your OVERALL business profit margin from time to time. Is that in a healthy range? Also consider how much you actually pay yourself over a year – divide that by an estimate of how many hours you worked. Are you happy with that number? If not, what needs to change?

Is that an item you’re paying for? Like you buy the doormat – the customer isn’t handing it to you to customize? Then yes, I’d definitely include that as a supply cost in your pricing formula.

That’s the constant battle! Your hard work and all that time is worth paying yourself for it.

I’m so glad you found it helpful!

I don’t have any hard and fast rules when it comes to pricing digital. It’s just so much less tangible. It honestly is more of a personal decision, taking your time and your business expenses into account. I started selling my spreadsheets 7 years ago for $23. They are now $97, and have gone through many iterations between those two prices! That’s based on my time, the costs of running Paper + Spark, the volume of customers served, and many other components. Keep an eye on your overall business profit margin and how much you’re truly paying yourself – those are two good benchmarks that will let you know if your pricing needs to be adjusted.

Thanks so much for this pricing info! I need advise please. My issue is I purchase supply retail using the x4 even w/o adding in what you advise seems to result in too high pricing cost? Do you have any suggestions?

This article certainly justifies my “should I raise my prices?” Thanks for the encouragement to do so in spelling it out in this article!

Thank you for sharing this. This is very helpful!

Hi! Thank you for this in-depth explanation! It was so helpful. I was wondering, when determining your overhead, what if you are just starting out and haven’t made any sales yet? How would you calculate without an estimated amount of products sold?

Really great article.

Thanks for this article. It really helps me get around the age-old question of “How Much Do I Charge?”

Great but in a small town, that would be considered (overpriced ) and I could be lucky if I sold one! Maybe if I sold them online but not on craft shows in the surrounding area. Too much competition and having to deal with others and their pricing.

Hey, Janet! Thanks for the website.

Its quite informative for the handmade products industry.

Regarding the matter of pricing my handmade products, how do i incorporate the wages to an extra hand into the formula?

Should it lie in the overheads or Under the labor i intend to pay myself

Hello, where do you put taxes ? In France we declare what we earn each month and we have around 22%+11% of taxes so you will lose a third of what you have earned … so the calculation for the price of earring initially at 24$ would become 36$ which is expensive…

Please tell me your advice

Laurence

What about the time you spend for making photos of your products and putting them online, what about the time you spend packing and shipping them. What about sent back items or repairing? Schouldn‘t that be counted in too?

There’s no right or wrong way to do it. You can certainly include all those hours in your pricing strategy. I try not to get too granular in the formula and instead monitor monthly/quarterly/annually my actual *overall* profit margin and then I’ll see how my hourly rate shakes out.

If you wanted to include that in your pricing you’d need to markup your items by that rate. Otherwise it will come out of your markup or profit margin some other way. I’m not sure how it works in France but I’m guessing/hoping you are actually only paying 22% + 11% on your profit (sales minus expenses), not your gross sales (before any expenses are taken out). So if that’s the case, you could increase your prices by some smaller percentage (say 10%) to try to cover that expense.

I think either way is fine. If you have labor that will solely be helping create inventory, maybe include that hourly rate directly in your formula. If your paid labor is helping with other business activities, maybe it’d be more appropriate in the overhead rate.

Great article on pricing strategy. I hadn’t heard about including overhead before! I found you by looking up articles on end of year inventory and have really enjoyed everything I’ve read so far. Will be buying your spreadsheets today. Thanks!

I’m glad you’re finding my resources helpful! Thank you!

I would like to thank you very much for your article. You gave me so many important details!! Good morning from sunshining Greece

This is so helpful. One must also consider things like traveling costs to buy materials, tax, accountant fees, insurance fees, etc. Thank you so much for this blog. It’s my first time here but I’m hooked.

Have 10 self designed /handmaesailing boats halfhull/full for sale.

This is so helpful! I’ve had many people tell me I should sell my handmade cards and albums but I feel like to make a profit, I’d have to price too high. But truly understanding my costs, makes it an easier pill to swallow when I think about selling a card for $10 or an album for $300. People who truly appreciate your craft will pay prices that accommodate you for your time and effort.

Honestly this is the best article I have found about pricing handmade goods. It has been a challenge before but this actually gives me the formulas and breakdowns to charge prices that will turn a profit! Thank you so much!

Wow, I am so inspired by this post!

I am a small shop owner in Australia designing and making mostly fabric bags plus some small items – lanyards and quilted keyrings, soon adding scrunchies as another small item.

Whenever I try to use a formula for my items, the prices end up being very high, so I have always taken the “averages” approach and compared my prices to other shop owners’ prices and placed myself somewhere between the average and higher prices.

The problem then with this method is that I know a fair few shop owners are not making their items themselves. And a lot of shop owners are making lower quality items with cheaper materials / inferior quality workmanship.

As was said in this article, many shop owners are greatly underpricing their products. (And don’t get me started on the “free shipping” thing! Everyone knows its just added onto the price. But how do you explain the ridiculously low priced items PLUS free shipping?!)

Anyway, I see now I haven’t been taking into account ALL of my expenses!

My question is – The items I make are all my own original designs, and so a LOT of my time is taken up by designing, drafting patterns, making cardboard patterns for ongoing use. Plus the first time I make a new design it always takes me longer to make.

I make a lot of bags in a few different designs and make a few at a time. Storage space is limited and many of my sales are custom orders.

I pride myself on my originality and quality of work. I use the best (most affordable) materials, thread, interfacing, hardware … Plus my designs are made to last – lots of topstitching, double stitching seams where needed… I think you get the picture.

Quality and attention to detail are very important to me. Many hours are spent on my items and I am greatful whenever I receive a review or message of appreciation for my work.

I guess what I’m trying to say is this:

How do I include ALL of my expenses where my labour costs and materials are higher than say, making a pair of earrings?

Sharon

(Ebony Red Creations) Australia

Hi Sharon, the struggle to price to include all your costs plus your time & energy & effort, and still make a profit, AND still make sales at that price – is tough! I would try to incorporate an overhead rate to represent the non supply costs of running your business, and an hourly rate to represent your time. Following the formula I suggest includes all those pieces of the puzzle.

I crochet and once long ago tried to sell on Esty with disastrous results, but with your help I would like to try again. I do have some inventory, but I want to get all my ducks in a row before I try again.